This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

In case you’re unfamiliar with Chase Freedom Flex 5x Category bonus:

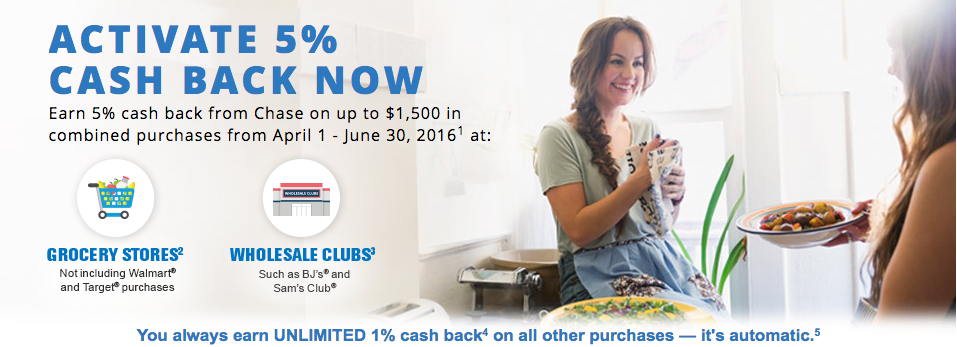

Every quarter the Chase Freedom or Freedom Flex Card gives a quarterly bonus on specific categories. The bonus applies to the first $1500 that you spend on those categories, each quarter, earning you $75 cash back or 7500 Ultimate reward points. It’s an absolutely fantastic way to earn bonus points on money that you would ordinarily spend. If you were to max out the categories each quarter you’d earn a total of 30,000 points on $6000 spend. A great way to earn more points and get you closer to some aspirational travel!

Technically the Chase Freedom Flex card is a cash back card, so if getting a statement credit is your top priority you can use the credit you earn to get cash back on your statement. But, if you hold a premium, Ultimate Rewards earning credit card ( Sapphire Preferred, Ink Business Preferred, Sapphire Reserve ) and you’re more interested in using the points on travel, then you can transfer your accrued ‘cash back’ to one of those other cards and redeem Chase Ultimate Reward points.

$100 of cash back = 10,000 Ultimate Rewards

You can then use those Ultimate Rewards to transfer 1:1 to their Air and Hotel partners

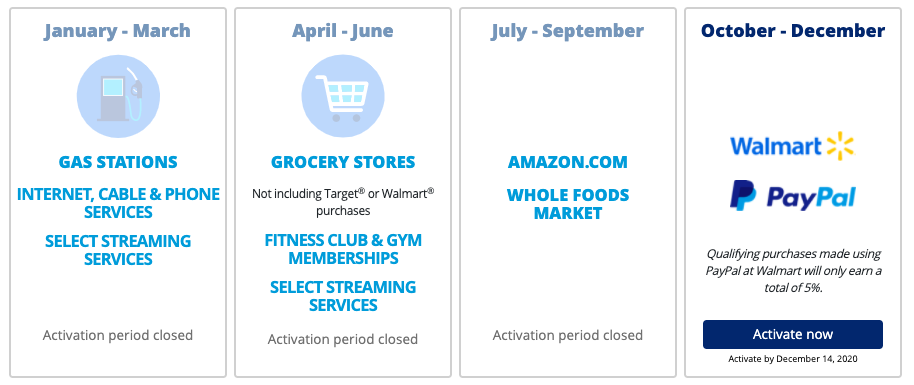

Here’s the current 2020 Calendar

How much have you spent on a Freedom 5x category so far this quarter?

It’s getting towards the end of August and you’re probably wondering: how much do you have left to spend in a specific category and still get the 5x bonus? I haven’t shopped at Wholesale Clubs this quarter so I’ll show you how I checked my Grocery Spend

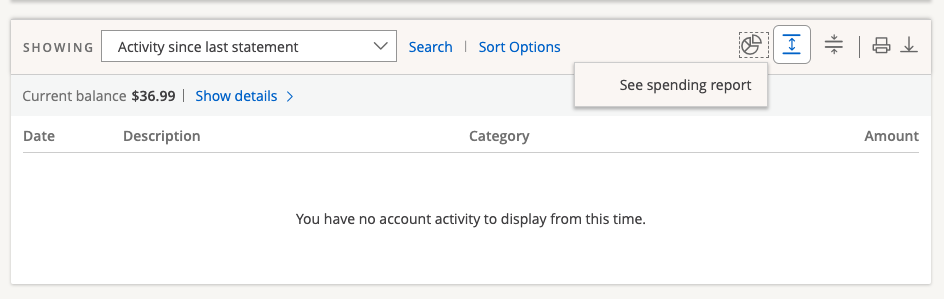

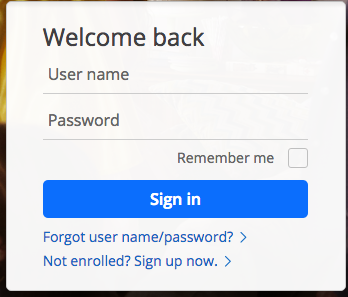

Step 1: Log in to your Chase account

Step 2: Find your Freedom Account:

Step 3: Click on details…and you’ll see

I’ve been horrible on maxing out this quarter’s bonuses

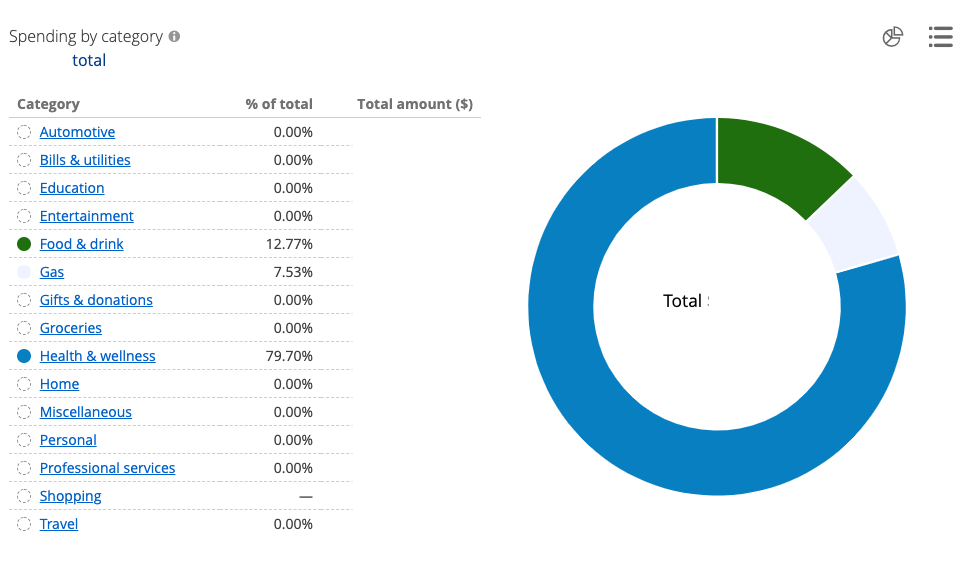

Step 4: Track your spending by category

Click on the Pie Chart

Step 5: Select the Category

Voila…you can see detailed information for each category.

Don’t forget that a great way to pick up extra Chase points is via referral

Feel free to leave your referrals below.

| Chase Sapphire Preferred | 100k after $4k spend 5x Chase Travel 3x dining + select streaming 3x groceries |

|---|---|---|

| Chase Ink Business Preferred | 100k after $15k spend 3x Travel/Internet/Cable Free Cell phone insurance $95 Annual Fee |

| Chase Freedom Flex | $200 after $500 spend 5x rotating categories No Annual Fee |

| Chase Ink Business Unlimited | Earn $750 after $7500 spend in 3 months. Earn 1.5x on every purchase |

| Chase Freedom Unlimited | Earn $200 after $500 spend in 3 months |

Referrals help us a lot. In fact, it’s how we can keep flying and reviewing.

Leave your links, questions, comments. We love to hear from you!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.