This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

ICYMI: Extend Hilton Diamond Status 1 Year.

I was reviewing the guaranteed benefits of Hilton Diamond status and ran across one that I had overlooked. It’s similar to what Alaska Airlines allows people to do…except Hilton’s Diamond extension doesn’t “pause” your status, but maintains and extends the status for an additional year if you meet the stated criteria. Let’s check it out.

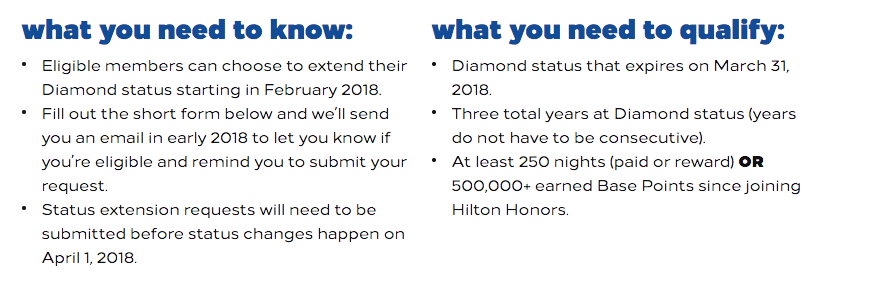

Hilton Honors Diamond Status Extension

Looking for the form to fill out? GO here:

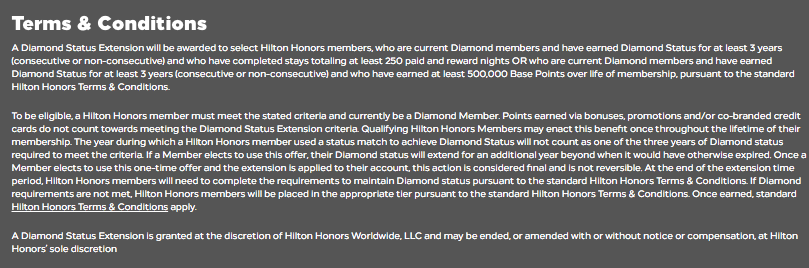

Full terms and conditions

Personally, I couldn’t qualify for this benefit even if I wanted to take advantage of it. I haven’t had 3 years at Diamond status, nor have I earned 500k + base points or spent 250 nights at Hilton Hotels. It’s clearly targeted to those members who have spent a lot of time and/or money with Hilton and I think that’s a great perk to add. If I knew I would be losing my status and could qualify for this promotion, I would probably take advantage of it, which in turn, means Hilton would grab more of my stays during the extension period than otherwise. Compare this to Hyatt who just made it far more difficult for their Top Tiers to maintain status, Hilton is creating value for those who have been loyal and potentially hit a rough patch.

My family took advantage of my Diamond status when we stayed at the Conrad Bali, featured in the main image.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.