We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Capital One Venture X Rewards Credit Card

No one expected the Capital One Venture X Rewards Credit Card to be so disruptive. It’s simple, easy, and provides immense benefits and value in excess of the annual fee.

Capital One didn’t follow Chase or Amex down the rabbit hole of higher fees with more and more statement credits you have to track to justify paying those higher annual fees. Instead they debuted a card with the lowest annual fee ( $395 ) of any ultra premium card and the easiest roadmap for recouping those fees.

You’ll get unlimited 2x miles, travel bonus categories, a $300 annual travel credit, and 10k miles every year after your anniversary.

Long story short. It’s an absolute home-run of a credit card.

You can use the $300 annual credit on hotels like the Peninsula Bangkok which you can’t accrue elite nights or status.

Table of Contents

Capital One Venture X Rewards Credit Card offer and benefits:

- 2x miles on every single purchase without limit

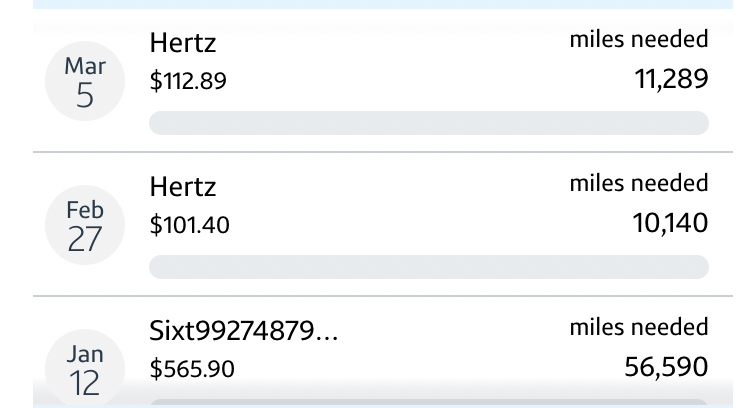

- 10x miles hotels and rentals cars in Capital One Travel Portal

- 5x miles flights and vacation rentals booked through Capital One Travel

- $300 Annual Credit within the Capital One Travel Portal

- 10k bonus miles after each anniversary

- Lounge access

- Capital One Lounge Access

- 1 location currently and 2 more scheduled for 2022

- 2 guests allowed and $45 for every guest after that

- Authorized Users get access as well

- Add 4 Authorized Users free of charge

- Priority Pass Select access

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Plaza Premium lounges

- Capital One Lounge Access

- 15+ Transfer partners

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Credit valid every 4 years

- Complimentary Cell Phone Insurance

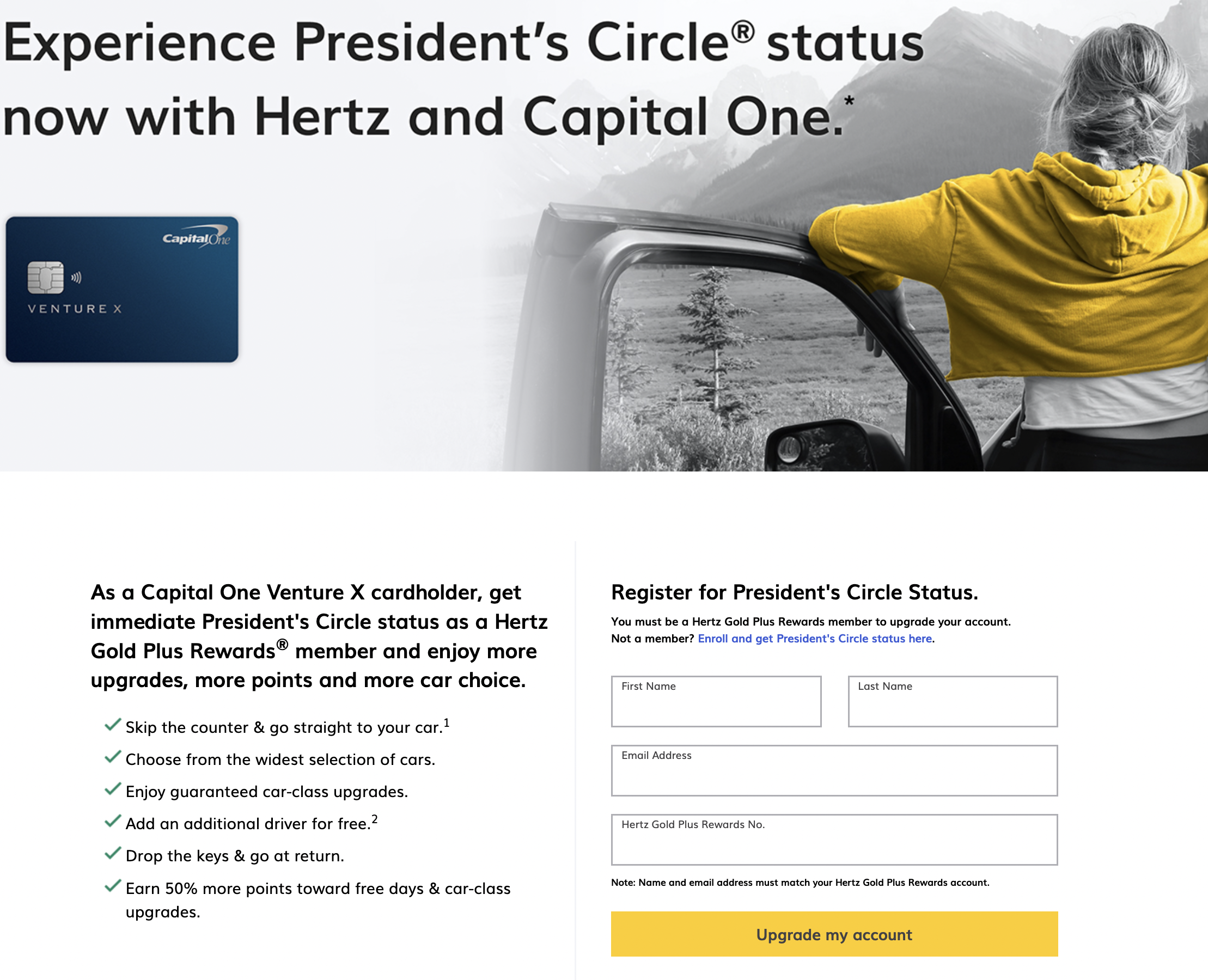

- Hertz President’s Circle Status

- Enjoy a $100 experience credit and other premium benefits with every hotel and vacation rental booked from the Premier Collection

- No fee for up to 4 authorized users

- $395 Annual

75k Miles after $4k spend in 3 months

How can you use 75k Miles?

- $750 within Capital One Travel

- Offset any travel purchase at 1 penny per point

- Transfer to 15+ partners

3 months is industry standard for spend requirements + you’re earning a minimum of 2x on every single purchase. At the very least you’ll walk away with 83k Capital One Miles which you could use in Cap1 travel for a minimum of $830. You know I’m a transfer freak, so this isn’t where I’d throw them, but that’s the bare minimum value.

You could transfer Cap1 Miles into the following partners to fly Swiss Business Class

- Avianca LifeMiles – 70k Miles

- Aeroplan – 70k Miles

- Singapore – 72k Miles

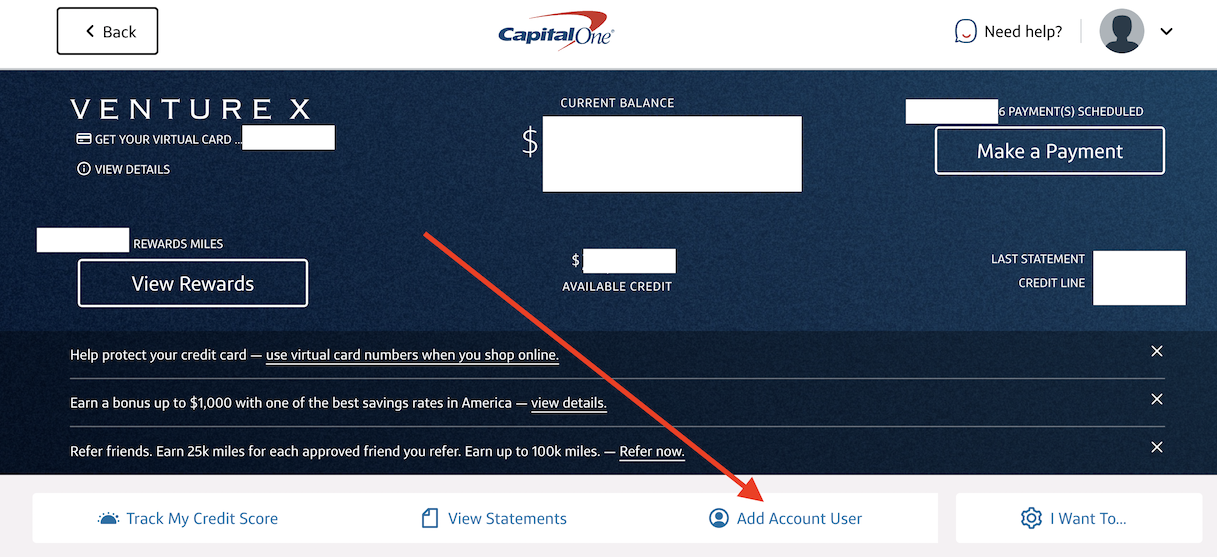

Add up to 4 Authorized Users without any additional fees

This is amazing especially when compared to Amex Platinum which charges $175 to add up to 3 additional users and Chase Sapphire Reserve which charges $75.

What do Capital One Venture X Rewards Credit Card Authorized Users get?

- Hertz President’s Circle Status

- Primary Rental Car Coverage

- Priority Pass Select Membership

- Can bring in unlimited guests to lounges

- Capital One Lounge Access

- Can bring in 2 guests

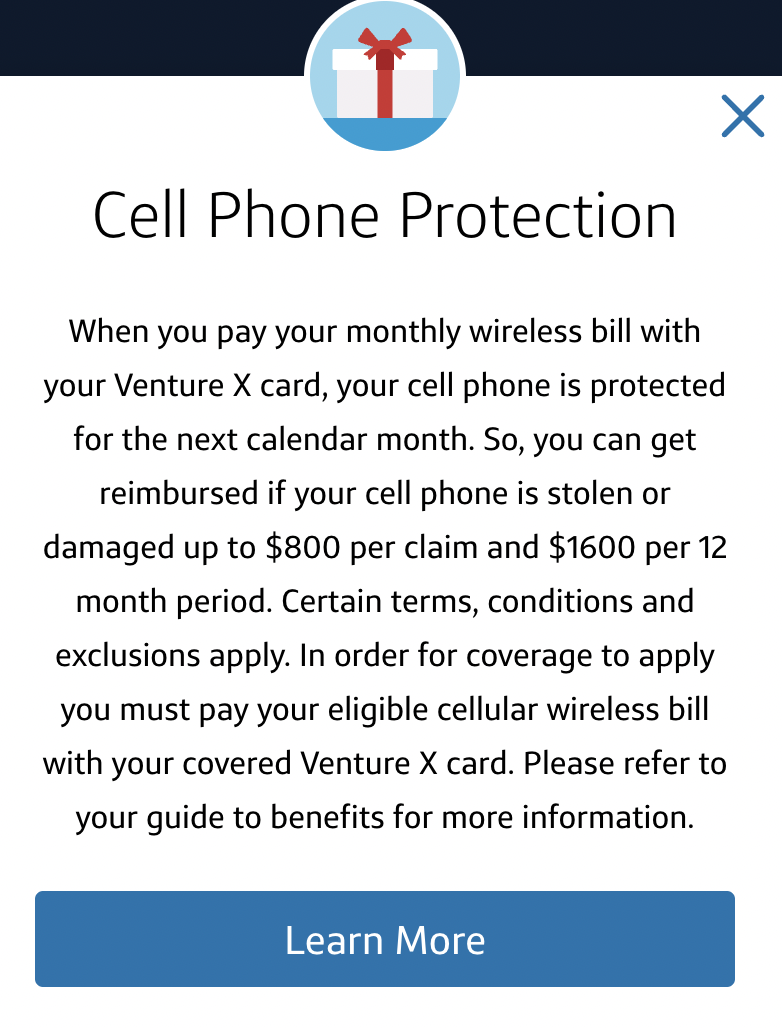

- Cell Phone Protection

- up to $800 per claim, 2x per year

- $50 deductible

- Return Protection

- up to $300 per year

- Purchase Protection

- up to $10k per claim, $50k per year

- Extended Warranty

- For warranties under 3 years, add a year to it

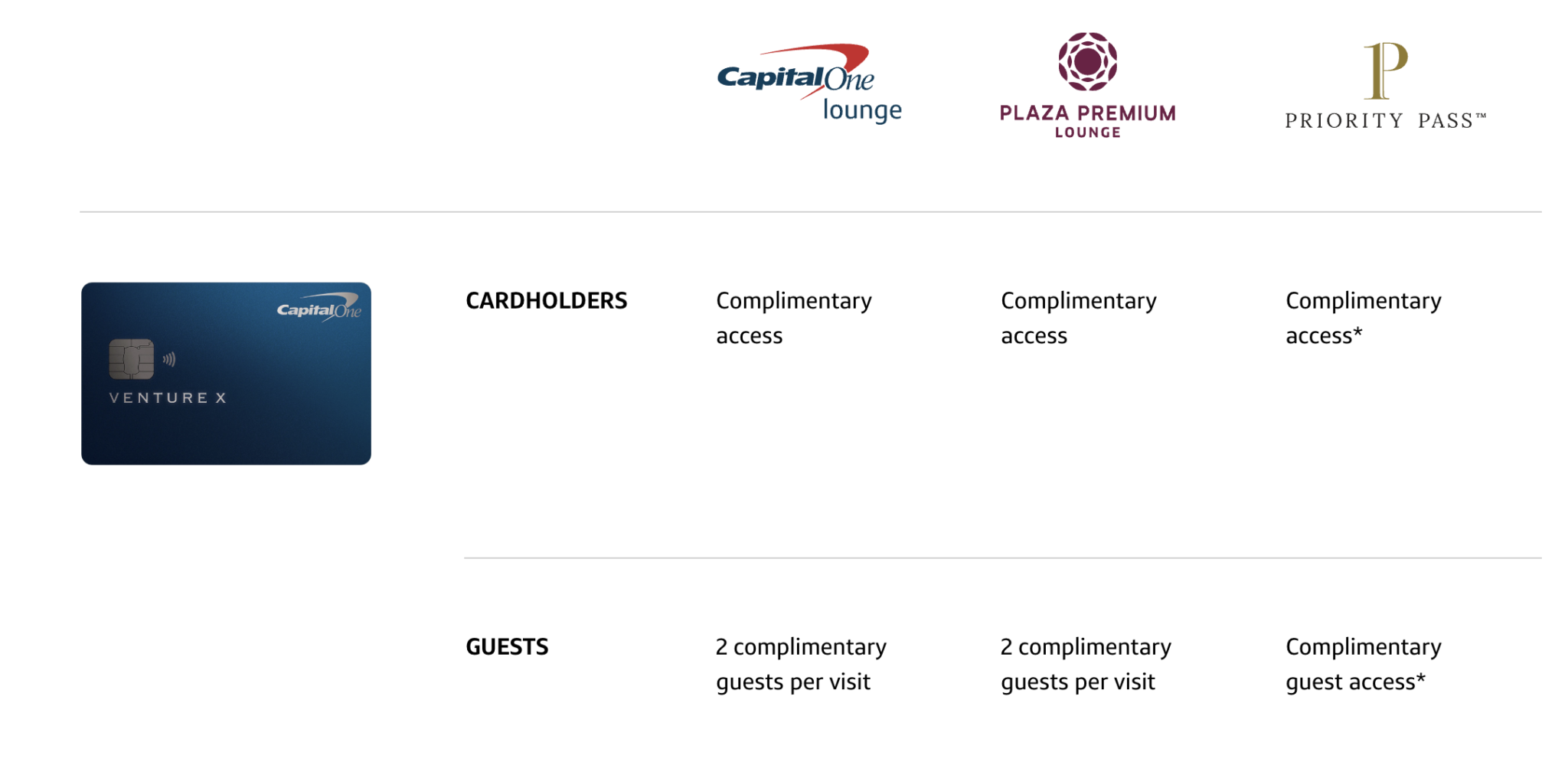

Capital One lounge Access

Not only do you get lounge access at the brand spanking new Capital One lounge network ( currently at DFW and in 2022 Washington D.C. Dulles and Denver ) but you can bring in 2 guests AND add 4 Authorized Users who all get the access as well.

You can read our full review here, but if you’re in Dallas, it’s fantastic.

Priority Pass + Plaza Premium Access

- Cardholder or Authorized User + 2 guests

Unlimited 2x on every single purchase you make

This is where Capital One X really stands out in comparison to other premium cards. You will earn 2x points, without limit, on every single purchase you make.

Global Entry or TSAPre credit

You can receive up to a $120 credit, every 4 years, to put towards membership in either program. Quick tip, membership in Global Entry gets you TSAPre as a part of the program, so you’re better off going that route since its a 2 for 1.

$300 Travel Credit + up to 10x miles with Capital One Travel Portal Bonus Categories

As long as you book your travel through the Cap1 travel portal, you’ll earn a $300 annual credit every year you keep the card. You’ll also get big time bonuses on the following categories

- 10x miles on hotels + rental cars

- 5x miles on airlines

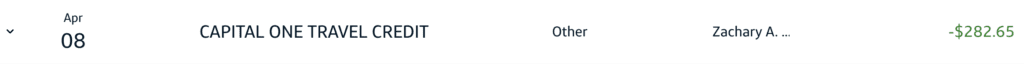

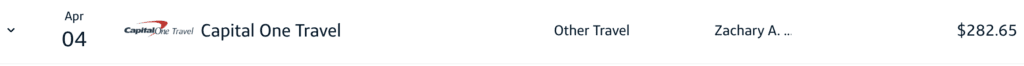

How long does it take for the credit to clear?

It took my account about 4 days. You can see below, charge hit my account on the 4th and was removed on the 8th

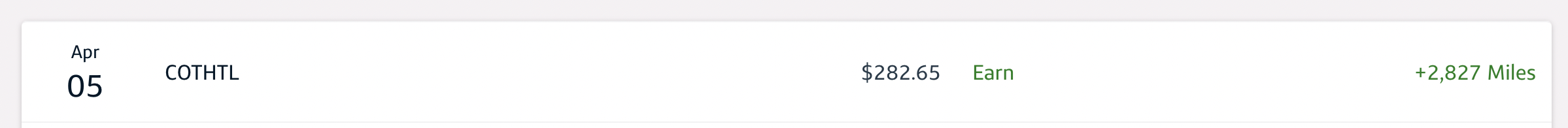

Do you earn points on the travel credit purchase?

Yep!

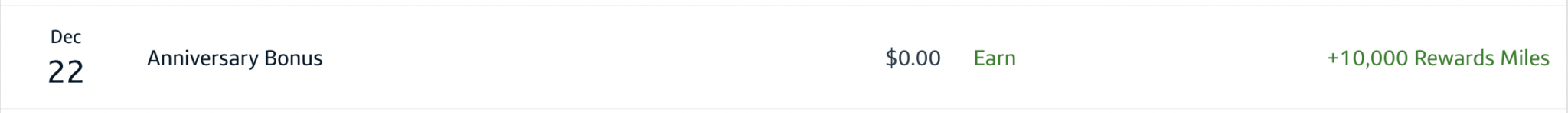

10k Miles every year

Starting in year two, you’ll get an 10k Venture Miles each year you keep the card as an anniversary bonus. Those 10k miles can be redeemed for $100 towards travel or transfer into partners…which is how I’d go about using them.

Cover Travel Purchases at a penny a point

You’ll see an option to use points to eliminate travel charges from your account after you’ve already spent them.

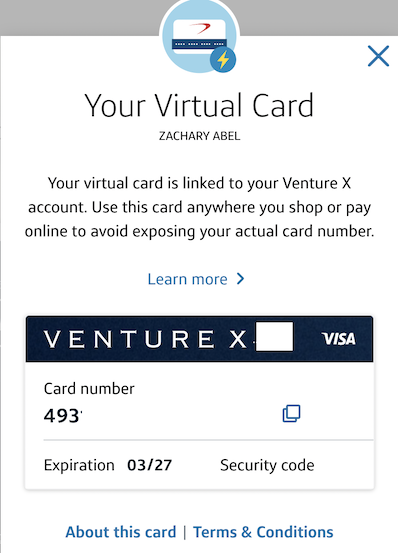

Create Virtual Cards for online purchase and deter fraud

It’s very simple and prompted on both the app and online when you login.

Capital One Transfer Partners are very valuable

Here’s a pretty chart referencing Capital One transfer partners. I’m really impressed with how far Capital One has come in just a few years regarding their push to establish themselves in the travel rewards ecosystem. This is an impressive list of 15+ partners and all but two are 1:1

- The following partners are now 1:1

- Aeromexico Club Premier

- Air Canada Aeroplan

- Avianca LifeMiles

- Air France Flying Blue

- British Airways Executive Club

- Cathay Pacific Asia Miles

- Choice Privileges

- Etihad Guest

- Emirates

- Finnair Plus

- Qantas Frequent Flyer

- Singapore Airlines

- TAP Air Portugal Miles&Go

- Turkish Airlines Miles and Smiles

- Virgin Red

- Wyndham Rewards

- Accor transfer 2:1

- EVA transfers 2:1.5

Read this article to see the 50 best ways to use Capital One Miles

Hertz President’s Circle Status

Just be being a Capital One Venture X Rewards Credit Card cardholder you get top tier Hertz President’s Circle Status. One of the benefits that I have enjoyed is being able to select the car you want out of exclusive President’s Circle lanes at the rental car lot. You can enroll your card via this link.

Rental Car Coverage + Cell Phone Protection + Return Protection

The Capital One Venture X Rewards Credit Card comes with primary rental car coverage, Cell phone protection, and Return Protection all via Visa Infinite.

- Primary Coverage, up to $75k vehicle

- Guaranteed Collision Damage Waiver

- See link for exclusions

Auto Rental Collision Damage Waiver reimburses You for damages caused by theft or collision — up to the Actual Cash Value of rental vehicles with an original manufacturer’s suggested retail price of up to seventy-five thousand dollars ($75,000.00) when new. Auto Rental Collision Damage Waiver covers no other type of loss. For example, in the event of a collision involving Your rented vehicle, damage to any other driver’s car or the injury of anyone or anything is not covered. Rental periods of fifteen (15) consecutive days within Your country of residence, and thirty-one (31) consecutive days outside it, are both covered. (Longer rental periods, however, are not covered).

- Up to $800 per claim, $50 deductible

- $1600 max per 12 month rolling period

- Up to $300 per item, $1000 max per year, see the link for exclusions

If You are disappointed with an item, within ninety (90) days from the date of purchase, and the retailer will not accept a return, You can be reimbursed for the purchase price, up to three hundred dollars ($300.00) per item of personal property, and an annual maximum of one thousand dollars ($1,000.00), per Account.

How does the $395 annual fee compare to other premium cards?

Let’s just quickly compare the face value on Annual Fees to other bank’s premium cards and the credits that they offer. What you’ll see is that the Capital One $300 annual travel credit is very straight forward. Spend $300 in the Capital One travel portal and you’ll get credit for it. While Amex has the most credits to offset the fee, its also the most complicated and specific on the fees. Chase Sapphire Reserve and Citi Thank You Prestige offer straight forward travel credits, but leave you paying a higher annual fee as well.

- $695 American Express Platinum (Rates and Fees).

- Up to $200 Airline Incidental Credit

- annual statement credit

- Up to $200 Hotel Credit ( Pre-paid Fine Hotels and Resorts or The Hotel Collection )

- annual statement credit

- Up to $200 Uber Credit

- annual statement credit broken into monthly credits ( up to $15 every month aside from December which is up to $35 ).

- Up to $189 Clear Plus Credit

- Other credits – Up to $300 Soul Cycle, up to $200 Equinox, Up to $240 Digital entertainment credit

- Up to $200 Airline Incidental Credit

- $550 Chase Sapphire Reserve

- Up to $300 Travel Credit

- $495 Citi Thank You Prestige

- Up to $250 Travel Credit

- $395 Capital One Venture X Rewards Credit Card

- Up to $300 Travel Credit to be used in Capital One Travel Portal

- 10k miles anniversary bonus starting in year 2, worth $100 in Capital One Travel or transferred out

Approval tips

- Capital One will only process one credit card per 6 months…so if you’ve already applied for one in that time frame, you’re going to have to wait.

- This means both business and personal.

- For instance, if you recently picked up their Spark Miles for Business card – you’ll need to wait until it’s been more than 6 months.

- Current Venture Cardholders are eligible

Can you combine your miles with other Capital One accounts? This is incredible.

Yes, you can combine your points into one account. This applies to accounts under your name, and also to ANYONE else that has a Venture or Spark account. Pretty awesome.

Earn points from referrals? You betcha, up to 100k every year.

Capital One will allow you to earn up to 100k points per year referring the card, 25k per referral. As soon as this becomes possible I will create a referral page where you can leave your links. I gotchuuuuuuu

- 100k miles Max

- 25k miles per referral

Overall: It’s plain and simple to see how you can earn your $395 annual fee back every single year.

I think Capital One absolutely NAILED the drop of their new premium card. This is a card I have in my wallet and use on every non-bonus purchase I make.

Pay $395 fee and get:

- $300 Travel Credit in the Capital One Portal

- 10k miles worth a minimum of $100

That’s without even taking into account the 2x miles, lounge access, welcome bonus, etc.

Over the past few years, Capital One has quietly been gaining traction on Chase and Amex. Not only do they have an incredible list of transfer partners, which puts them in the ring with the heavyweights, but they landed some serious body blows earlier this year when they dramatically improved their transfer ratio – the program is nearly all 1:1 now.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.