We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

20% Transfer Bonus: Citi Thank You Points to Wyndham Rewards

Citi Thank You is currently running a 20% transfer bonus to Wyndham Rewards. If you’re thinking this is a big fat pass because you don’t have much use for Wyndham, you may be wrong. Wyndham Rewards is partnered with Vacasa vaction rentals, and you can redeem just 15k Wyndham Rewards per bedroom on a Vacasa Vacation rental. This is presents a fantastic redemption opportunity for families that may be looking for units with a kitchen, etc. Let’s take a look!

Make sure you bookmark our complete list of transfer bonuses

20% Citi Thank You transfer bonus to Wyndham Rewards

One thing to note, if you have a Wyndham Earner credit card from Barclay ( best deal found on my Best Offers Credit Card Spreadsheet ) you get a 10% discount on Wyndham Rewards stays. If you were to hold one of those cards alongside this offer…you’re looking at some very cheap Vacasa stays.

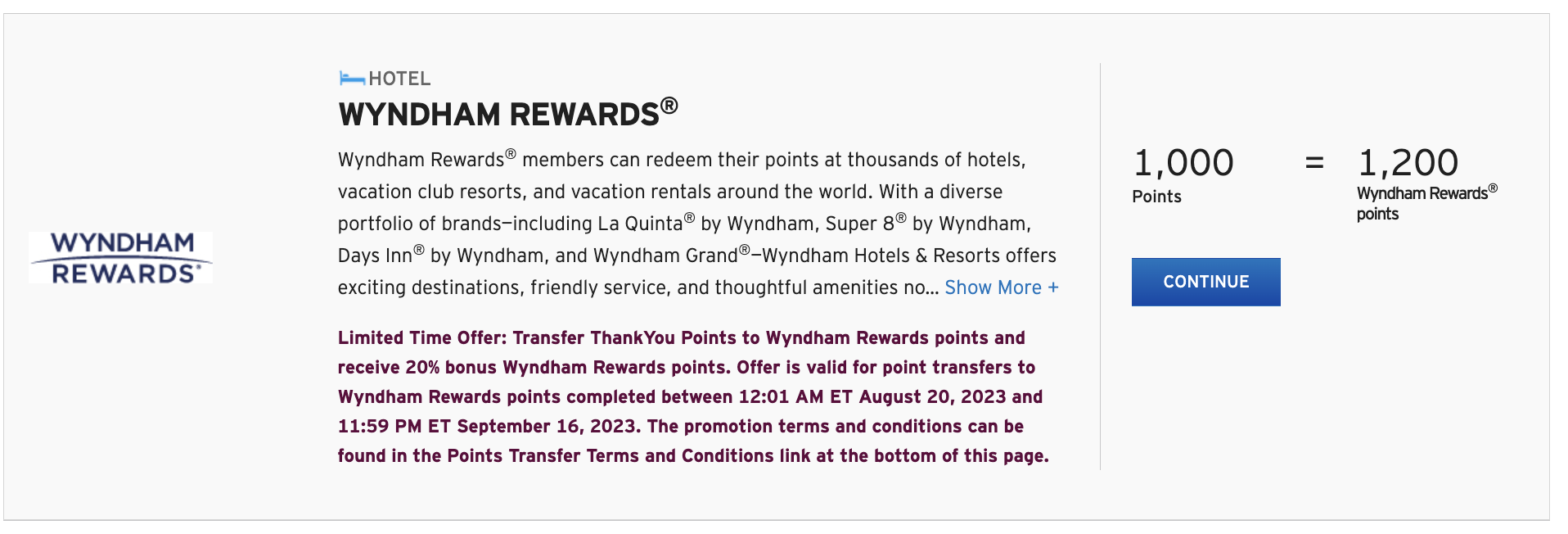

- Starts 8/20/23

- Ends 9/16/23

- 1000 Citi Thank You = 1200 Wyndham Rewards

Using Wyndham Rewards on Vacasa Property Rentals

One of the redemption options for Wyndham Rewards is Vacasa properties – you can find the complete list of included properties linked below. These cannot be booked online and you’ll need to call Wyndham to book.

- Find complete list of Vacasa Properties here

- If it costs less than $500 per night, per bedroom, it’s thought to be bookable.

- Call this number to book: 800-441-1034

- Must cancel outside of 30 days or forfeit all your points

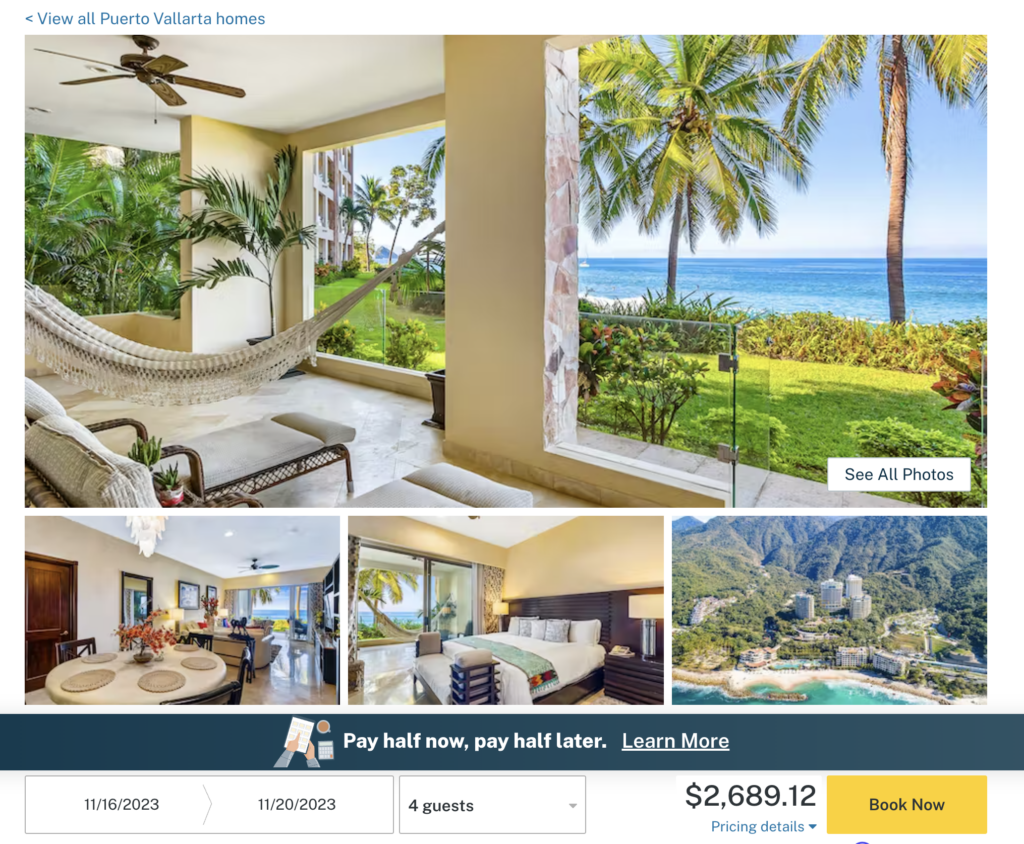

Example in Puerto Vallarta, Mexico this fall/winter

Garza Blanca is a beautiful, oceanside, resort that has a condo element. This is an oceanfront 2 bedroom unit. As you can see this is a 4 night stay, found here, and would set you back $2689 this November. That’s $672 a night for a 2 bedroom, so it’d run you 30k Wyndham Rewards per night, or with this transfer bonus, 25k Citi Thank You points per night. That’s roughly 2.7 cents per point. If you had a Wyndham Earner card, you’d be looking at 27k per night, or 22,500 Citi Thank You per night. Wow…3 cents per point.

Citi Thank You Transfer Partners

Overall

Could be a great opportunity if you have a use for Wyndham Rewards in the near future, especially if you’re looking at Vacasa rentals

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.