We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

50k Amex points for opening an Amex Business Checking Account

American Express is offering 50k Membership Rewards if you open a new business checking account with them and fulfill the following requirements:

- Make a deposit of $5k or more within 20 days of opening

- Maintain an average balance of $5k or more for 60 days

- Make 5 ore more qualifying transactions within 60 days of opening your account

You do need a business, but at the same time, Sole Proprietors should qualify, and it looks as though the deal expires 03/31/24.

Is this the best deal we’ve seen?

They offered this same deal last year

History:

01/31

- $5k deposit, $5k average balance for 60 days, 5 transactions in 60 days

11/23

- 50k

- $5k deposit, $5k average balance for 60 days, 5 transactions in 60 days

12/22

- 60k

- $5k deposit, $5k average balance for 60 days, 10 transactions in 60 days

What are 5 qualifying transactions?

This is what Amex defines as a qualifying transaction – the great thing here is that mobile deposits qualify.

The account is fully digital

The account is fully digital

If you want the ability to go into a branch and speak to someone in person…this isn’t your jam. If you’re cool with it all being online and digital, this could be a nice fit.

Here are some of the benefits of an Amex Business Account

You earn 1 Membership Reward point on every $2 you spend on the Business Debit card

- 1 Membership Rewards for every $2

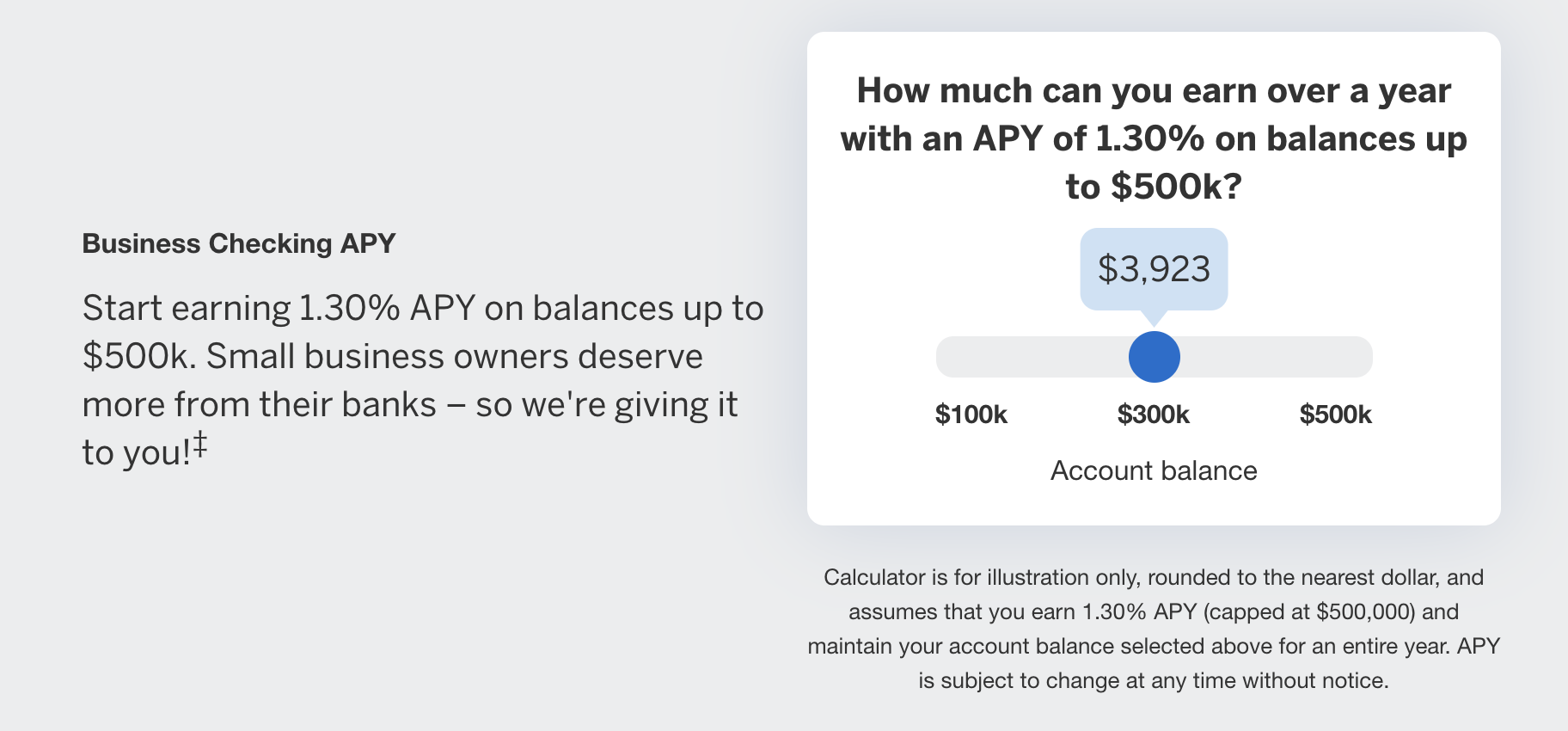

- Earn an APY on Business Deposits

Payments:

- Domestic ACH: No fee

- Domestic Wire (Incoming): No fee

- Domestic Wire (Outgoing): $20

- International ACH (Incoming): No fee

These processing fees are included fee free:

- Monthly account maintenance

- Account opening

- Additional accounts

- Mobile deposit capture

- E-checks

- Outgoing and incoming returns

- Non-sufficient funds

- Stop pay

- Billing inquiry

- Duplicate credit/debit received

- Admin processing

- Statement copy

- Physical checks processing

Zach, what do I need to provide to sign up for an Amex Business Checking Account?

This is what Amex says you will need to provide:

• Your Employee Identification Number (EIN) or Taxpayer Identification Number (TIN)

• Your Articles of Organization or a Certificate of Formation

• Information from a Driver’s License, State I.D., or Passport for each owner

• A Social Security Number (SSN) and ID verification for any Beneficial Owner with ownership of 25% or more

• A “Doing Business As” (DBA) certificate only if your business operates under more than one name

• A U.S. business address

• Information about your industry, size, and the purpose of your account

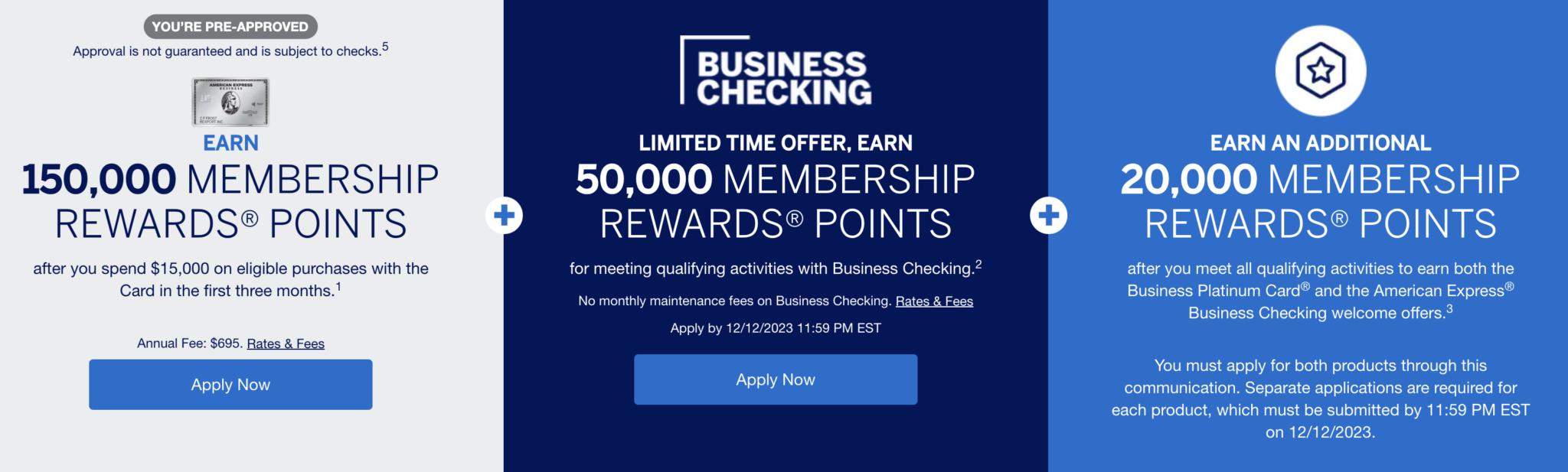

(DEAD )220k Offer in tandem with Amex Biz Platinum

The Business Platinum® from American Express + Business banking Offer –

Go here to see if you’re targeted, must log in

- Spend $15k in 3 months = 150k American Express Membership Rewards

- combine with 50k Business Banking offer mentioned above

- Complete both = 20k bonus points

Will I do this?

I did do this at the end of 2023 and am currently in the process of getting approved ( I used a mailbox vs physical address, but I am on pace to get the 50k bonus ).

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.