We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

MMMondayMemo: Use promotions for bonus miles

Each Monday, Miles has decided to drop a tip, hint, tutorial, or trick that maybe you’ve missed or haven’t heard before. If you’re an expert in this field, some of these may be things you already know, but there are a lot of beginners out there who are just getting their feet wet. This week, the Monkey Miles Monday Memo focuses on “promotions for bonus miles.” This week MMMondayMemo uses the Earn up to 5kAA with Avis/Budget rental promotion to illustrate this principle.

Loyalty programs run promotions all the time.

I get a lot of emails for promotions. For the ones that require registering, I register. Worst case scenario, in most instances, is that you don’t earn any bonus miles because you didn’t satisfy terms. Best case…you get a bonus. Then there are the emails that offer you bonus miles, but you need to use their link or offer code. These are harder to remember if you don’t have an immediate need for the product they are promoting

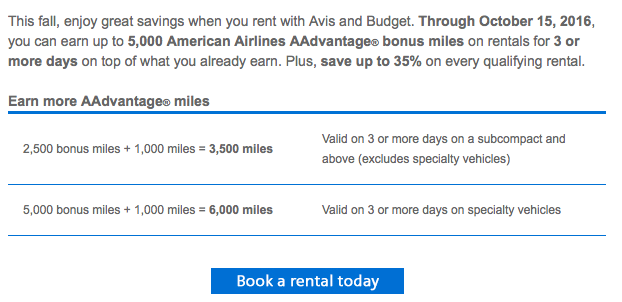

Last week I received an email from American. They are running a promotion in conjunction with Avis and Budget for bonus miles. The terms are shown below, but essentially you can earn up to 5000 AA miles per rental if you satisfy certain requirements. It wasn’t a promotion that you register for, but rather one that you had to use the link to earn through, so I made a mental note that if need be I could earn some bonus points on car rentals.

Make a mental note to Google for bonus miles offers

Ok, this may sound obvious because we google everything these days, but a lot of people just forget. I knew I’d received an email promoting bonus miles on car rentals, but I couldn’t remember the exact terms. I’ve trained myself to just make a mental note that certain areas of business may have an offer…I’ve never had Direct Tv, but if I ever decide to get it I know that they offer HUGE mileage bonuses for new accounts. I’ll google to see what is the best.

At the time I received this email I had no intention of renting a car before Oct 15th. However, some things have changed, and I remembered getting an Avis/Budget offer, so I googled to see what those terms. I saw a lot offers for bonus points, and then searched my email for the exact I offer I received. It pays to just see what other offers are out there, and who knows, you may end up finding something better than what you were directly offered.

Make a mental note to check out if there are any outstanding offers before purchasing, you could end up with a lot more points!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.