This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I’m testing out the incidental airline fee credit

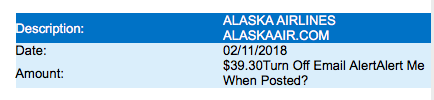

As I’m sure you know, the American Express Platinum cards offers a $200 incidental airline credit as an annual benefit. For the past several years I’d selected American Airlines as my go to airline and purchased 2 – $100 gift cards. Within a few days they would be credited. I’d read where this worked on multiple airlines, one being Alaska, and for 2018 I went ahead and changed my airline of choice align with my favorite loyalty program: Alaska Airlines. The problem? As of mid-2017, AS gift cards no longer code as incidental fees, and aren’t refunded if you purchased them with your Amex Plat. The fix? It’s reported that some cheap fares are being fully reimbursed…BINGO! So to test it out, I purchased a $40 one way fare to Vegas.

I set up a “pending monitor” so I can see if the charge gets reversed once it’s processed.

Log into your Amex account, go to pending charges, and there is an option in the upper right to request notification when the post moves from pending to posted. This is great, as I’ll just wait for the notification rather than having to go through the palava of logging in and pulling up my current statement.

If it gets reversed, I’ll buy 4 more of these bad boys, cancel them, and deposit them into my wallet to use on future flights. I’ll keep you guys up to date.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.