We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

New American Express Platinum Benefits + Higher Fee

I received an email this morning alerting me to the New American Express Platinum benefits beginning March 30th. Since then many bloggers have posted on the deal and details have been improved. There are some great additions to the program, but also a higher fee of $550 per year, so let’s take a look at the additional benefits and whether or not it’ll be worth sticking around when the new $550 annual fee hits.

The new benefits:

- Uber credit of $200 per year

- According to The Points Guy the card will earn a $15 credit per month, and $35 for December, totaling $200 for the year. Credits don’t roll over month to month unfortunately.

- 5x Membership Rewards on Hotels

- Must book through Amex Travel

- Must be pre-paid

- Expansion of the Priority Pass program

- According to ViewFromTheWing, Two guests will be able to access the lounge with you for free. An improvement from the current rule of cardmember free, and $27 per additional guest.

- Comped Gold cards for additional cardholders

- decent improvement. Right now you can add 5 cards for $45, this allows you to add them free.

- THE CARD WILL BE METAL!

- I dunno, I just like it.

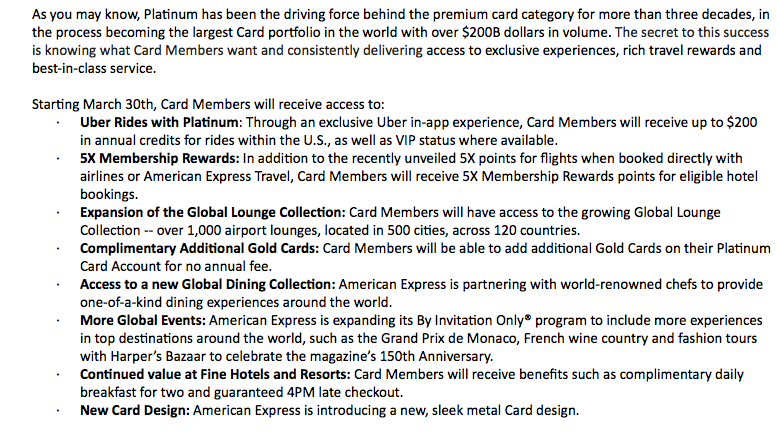

Here’s a look at the email I was sent.

*These new changes affect the personal platinum and all of it’s various forms. Not the Amex Business Platinum. At least that’s what we know right now.

What’s my take on this?

If you use Uber a lot, a $200 credit is pretty awesome, but if you don’t – who really cares about that benefit? I’d say that this is a value to those who live on the coasts or cities where they use ride-shares a lot. I have a lot of family and friends in the midwest and they NEVER use Uber or Lyft. If the benefit rolled over from month to month, then maybe they could use it for airport transfers, but it doesn’t. Use it or lose it. This benefit doesn’t them help offset the extra $100 annual fee. At all.

If you book your hotels with the brand’s website, and not Amex travel, OR want rates that are flexible…the 5x benefit doesn’t help you either because it doesn’t apply. It’s only thru Amex travel and pre-paid. In fact, Amex Travel will not earn you Elite night credits either. They are consolidator rates and most hotel chains don’t recognize those when earning status.

We get a metal card, but I’m not sure that people are willing to pay more for it. Consumers want more real benefits.

The Priority Pass membership improvement is a real gain. The ability to bring in 2 additional guests is great and was needed. This basically brings it in line with the Prestige, but not the Reserve which allows your whole group to come in with you.

If they’d done all of this and kept the annual fee at $450 I’d say these are steps in the right direction. But, with a new $550 annual fee, I’m not sure these are enough “extra” benefits for most to swallow the new cost. If they’d sweeten this with a 100k sign up – that’s a different story 😉

I love Amex, their transfer partners, and ability to earn points through Amex offers, referrals, and category bonuses. I’m interested to hear your thoughts and whether you’ll stick around with the new annual fee.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.