We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Singapore Airlines changes award pricing

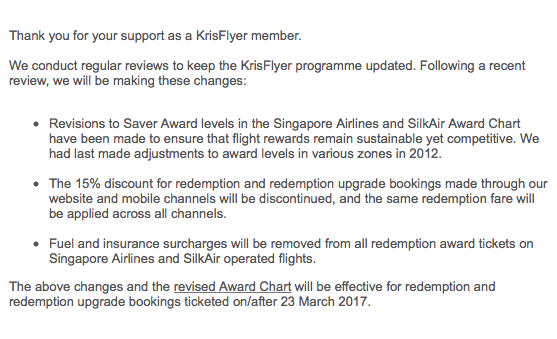

Early this morning Singapore Airlines ( SQ) sent out an email announcing changes to it’s award pricing. The long and short of it: The number of miles are going up, the 15% online discount is being done away with, AND the fuel charges are going away. One of the biggest deterrents to booking tickets on SQ were in fact the fuel surcharges, and they’re eliminating those. That’s a positive. The biggest positives to SQ were the 15% discount and attractive award levels, and they’re devaluing those. Negative Let’s take a look at the changes and get a feel of the changes.

Here’s a look at the email sent out:

- Award prices are going up. Specifically in Zones 7, 9, 11, 12, 13

- 15% online discount is dead

- Fuel surcharges are gone.

2 negatives and 1 positive. Could have been MUCH MUCH MUCH worse.

One, I don’t think this is a surprise to anyone as the program has been at its current rates since 2012. Singapore miles are really valuable as they can be accumulated with 4 transfer partners ( Citi Thank You, Chase Ultimate Rewards, Amex Membership Rewards, and Starwood), so there are a lot of them floating around. While 3 weeks isn’t really a lot of time, they’ve done a huge favor to us by not devaluing the partner flights, and the devaluations that occurred aren’t CRAZY. It would have been nice to have a bit longer to get ducks in a row, they have added value to the program by stripping out the YQ ( fuel surcharges).

As you can see, the new prices only affect Singapore Airlines award tickets on their metal. As I mentioned above, Partner award prices aren’t changing. View from the Wing even pointed out a loophole in new program by adding a partner, like United, on a domestic route you end up getting partner award pricing. With the new chart in place, the partner pricing is sometimes more lucrative than the SQ chart. That great trick was found by Reward Flying and one I’ll DEFINITELY make use of.

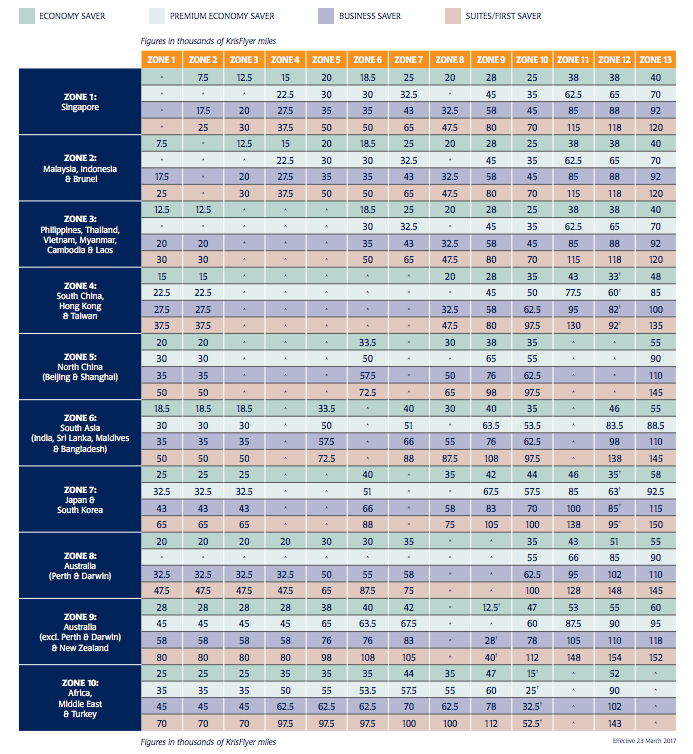

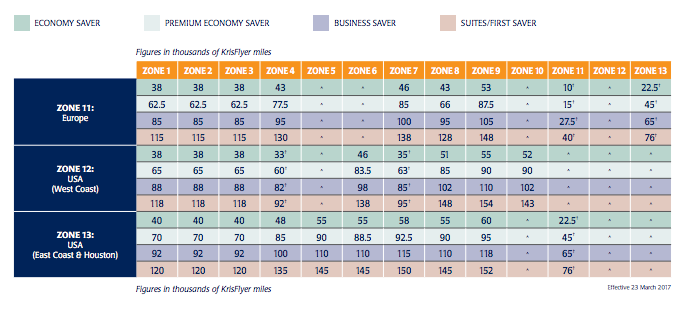

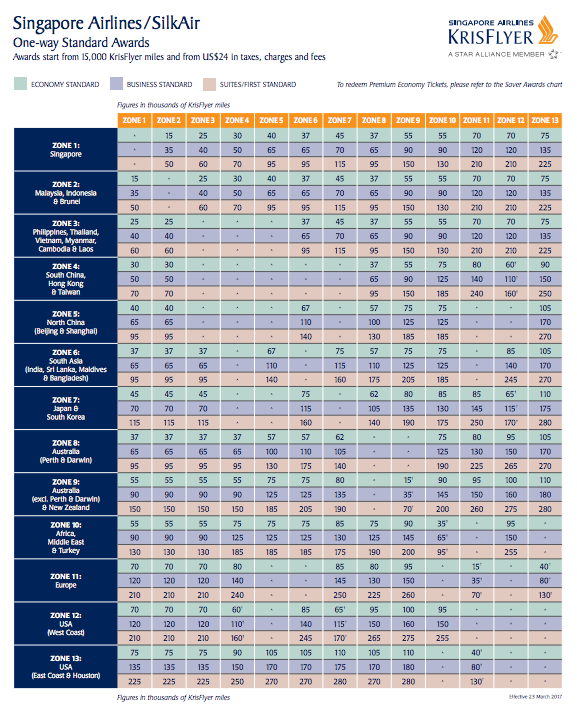

Here’s a look at the new charts that are effective March 23, 2017:

Saver Awards:

And Standard awards:

Where are the biggest changes?

The actual devaluations aren’t really that bad. Where it really stings is comparing the effective rates when factoring in the 15% discount. The elimination of that perk is, by far, the biggest devaluation. Here’s a quick look at the saver level prices to or from Singapore in the zones that are changing.

*(current online 15% off price)

Zone 1 to Zone 7

- Econ – 22.5 (19.1) to 25

- Biz – 40(34) to 43

- First – 60(51) to 65

Zone 1 to Zone 9

- Econ – 25(21.25) to 28

- Biz – 55(46.75) to 58

- First – 75(63.75) to 80

Zone 1 to Zone 11

- Econ – 35(29.75) to 38

- Biz – 80(68) to 85

- First – 107.5(91.375) to 115

Zone 1 to Zone 12

- Econ – 35(29.75) to 38

- Biz – 80(68) to 88

- First – 107.5(91.375) to 118

Zone 1 to Zone 13

- Econ – 37.5(31.875) to 40

- Biz – 85(72.25) to 92

- First – 110(93.5) to 120

As you can see, the actual prices aren’t hugely impacted, but rather the effective pricing after the online 15% discount is quite a bit.

What isn’t changing?

- Partner award pricing

- No phone booking fees

- No fees for booking last minute

- Stopovers on saver flights for $100 look to be staying in place

Overall

This could have been MUUUUUUUCH worse. While it would have been nice to have more warning, I don’t think the deval is that bad. The 15% online discount was dope, but it’s removal isn’t that surprising and can be attributed to most of the deval. The new prices aren’t terrible, and seeing as though Singapore Miles are easier to accumulate than most any other currency, it’ll be easier to shore up accounts to the new rates. Leaving the partner chart in tact was quite nice as well, and we all know fuel charges are BS. Removing them at the same time was a nice wink to the consumer.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.