This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Tip: Remove an Authorized User account from your credit report to dip under 5/24

A lot of people have been affected by Chase’s 5/24 rule. If you’re unfamiliar with 5/24, it’s an unofficial rule whereby Chase will not approve you for a new credit card if you have opened more than 5 cards in the last 24 months. From any bank. Well, some people have Authorized User accounts on their credit report that are included in this 5/24 number. I recently helped a friend out with this problem. His sister was trying to apply for a Chase Sapphire Reserve, but he had added her to one of his credit cards as an Authorized User. So here’s an example of and a “how to” remove an Authorized User account from your credit report to dip under 5/24.

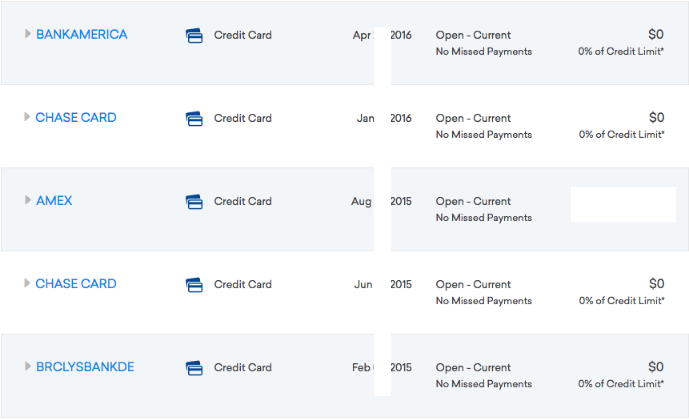

Here’s a look at the side by sides. Before (5/24) and After (4/24) the removal. We used Creditkarma.

FYI, You can still get a Chase Sapphire Reserve with the 100k bonus until March 12th. My buddy’s sister wanted to apply in-branch and wasn’t all too happy when she saw that his card was preventing her from getting under 5/24. He called me and we worked through the steps. As you can see…once we did the proper steps to get it removed, she fell under 5/24. She’ll apply in March to be safe, but I don’t think she’ll have any problems.

Notice the Chase card opened in Feb, 2016. Present on the left, gone on the right.

How did we do it? Here are the steps to removing a Chase Authorized User

- Have the account holder contact Chase. This can be done by calling the number on the back of your card…or via Secure Message. Have the account holder remove the Authorized user and request that the card be removed from the authorized user’s credit report.

- Once it’s removed you’ll receive an email similar to below. Have the authorized user fill out the information:

Dear ———,

Thank you for contacting Chase.

I confirmed ——— is not listed as a user on

your account ending in —- and is not liable for the

balance or payments.To remove the account from her credit report, please print

this email and have ———– complete and sign

the form provided below. You may mail this to Cardmember

Service, PO Box 15298 Wilmington, DE 19850-5298 or fax the

information to 1-888-593-8302.– – – – – – – – – – – – – – – – – – – – – – – – – – – – –

– – – – – – – – – – – – – – – – – – – – – – – – – – – – –

– – –I am not a user on the account, and I hereby authorize the

bank to delete this account from my credit report:Full Account Number: ________ – ________ – ________

– ________Name To Be Removed: _____________________________________

Social Security Number: _______ – ______ -__________

Address:

_______________________________________________

_______________________________________________

_______________________________________________

Signature: _____________________________________________

If you need any other assistance, you can send us a secure

message. We appreciate your business and thank you for

choosing Chase.Sincerely,

————–

Customer Service Specialist1-800-436-7927

It took about a week after faxing in the document for the account to no longer be shown on her credit report

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.