We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

This has been the year of the transfer bonus. Amex and Chase just finished multiple partner transfer bonuses, but its time to rev up those engines. Singapore Airlines is running a deal where you’ll get a transfer bonus from pretty much any bank they’re partnered with. Bonuses range from 12% to 15% and must be completed by 11/22/21. How does it work? Let’s take a look.

Me contemplating whether I want to do this deal or not

US Banks that transfer to Singapore Airlines:

These are the programs that would work from the US – notice that Marriott isn’t listed ( obviously they aren’t a bank, but you could populate Singapore miles this way )

- Amex Membership Rewards

- Brex

- Chase Ultimate Rewards

- Capital One

- Citi ThankYou

Details of the transfer bonus

You can read the full details here, but this is the long and short of it.

Earn 12% bonus miles when you convert between 10,000 to 49,999 miles in a single qualifying transaction

OR

Earn 15% bonus miles when you convert 50,000 miles or more in a single qualifying transaction.

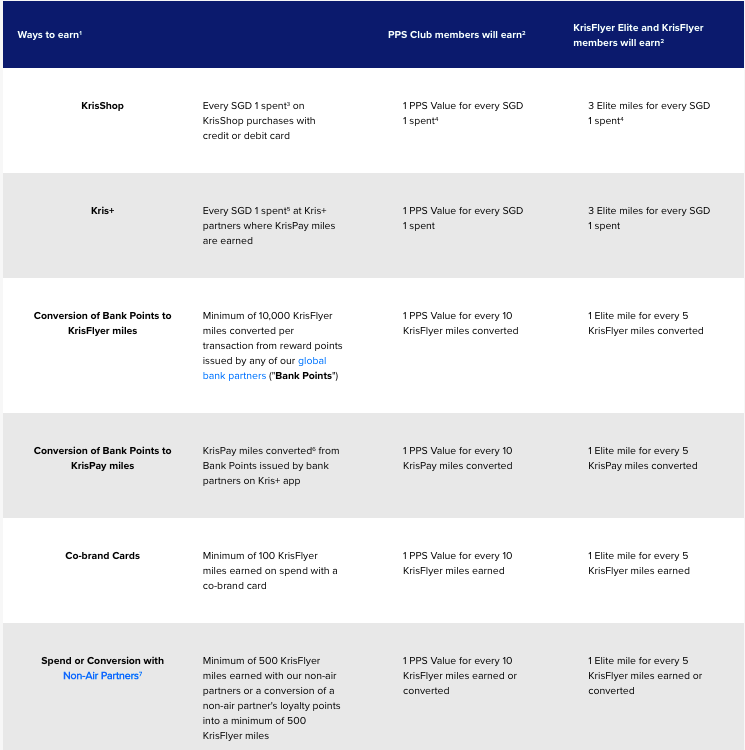

Singapore is still running its elite miles promo whereby you can gain status via point transfer or spend

Singapore Airlines has a promo running whereby miles transferred into the program qualify for elite status at a 5:1 ratio. So if you populate your Singapore account with 250k miles you’d earn Star Alliance Gold.

Great uses of Singapore Miles

- US to Europe for 72k miles in business class

- US to Europe for 87k miles on Singapore First Class ( JFK to Frankfurt route )

- US to Europe for 107.5k in partner first class

- Within Asia – 53k miles for First Class

- USA coast to coast in business class for 25k miles

I used Singapore miles to fly Lufthansa First Class recently

@zacharyburrabelI had Singapore miles expiring and used 107k + $400 to book ##travel ##travelhacks ##traveltips ##creditcards ##lufthansa ##firstclass♬ Paradise – Bazzi

Around the world Tickets

- 180k in Econ

- 240k in Biz

- 360k in First

Features you should be aware of with the Singapore Krisflyer Program

- Miles expired after 36 months

- You can bake in a stopover on roundtrip flights and one way standard tickets ( you can also add stopovers for $100 a piece on roundtrips, up to 3 )

- Most Singapore premium cabin space is only avail to members…

Overall

I’m definitely considering moving over some miles, but highly doubt I’d do 250k to earn Star Alliance Gold. The 36 months expiration would concern me since I almost ran out of time on some Singapore miles here recently.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.