This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

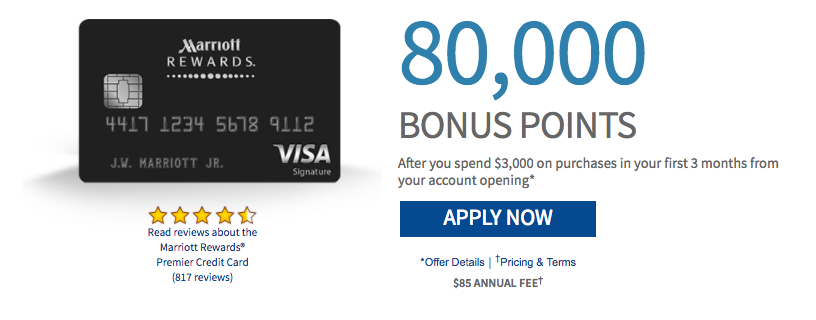

This is a deal that’s worth mentioning, but not one that I’d necessarily recommend getting UNLESS you’re really looking for Marriott Rewards. The reason? Earlier this year Marriott offered a 100k bonus after $5k spend. That’s 20k more than the 80k that is regularly avail, and one that I’m sure will come around again. We’ve even seen 100k bonuses for the business version too. Both of those deals offer great bonuses for a much smaller minimum spend. It’d be a great 1-2 punch if under 5/24, but alas, I haven’t been in the situation to take advantage of those offers. Annual fee is waived the first year. $85 after that.

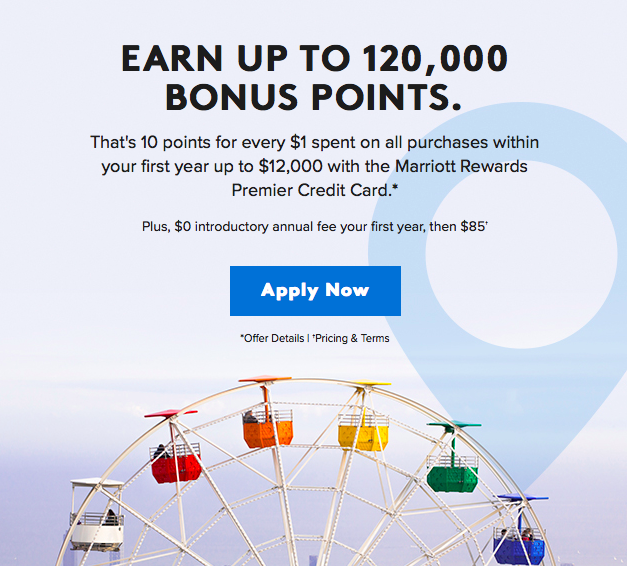

Here’s the public offer which equates to 87,500 points

Two of the biggest benefits, IMO of the card. Free annual night and reward nights toward elite status.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.