This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Why you should always ask about upgrades

Some of the best travel deals I’ve ever negotiated have actually been at check-in. Often times if a hotel or car rental agency has better options available they will discount them when you check in. It’s why you should always ask about upgrades.

I ended up in one of the best suites in the world because I asked about an Upgrade: The Peninsula Suite Bangkok

Staying in one of the world’s finest suites wasn’t an accident – it happened because I asked if anything bigger was available. If you click the link above you can read more about the suite and the trip, but essentially we got an INSANE upgrade on our 3 night stay for about $500 each. Not cheap, I’ll admit, but it was a once in a lifetime experience.

The suite was an entire floor – almost 4000 square feet.

Check the Inventory before you arrive

You need to know your information and your options. If you’re only staying for a night or two you’ll have better odds, but if you see some BALLER suite available for the time period you need – ask if they’ll sell it to you cheaper. If you see an incredible car that hasn’t been sold – ask if they’ll rent it cheaper. You’d be surprised how much you can get just by asking.

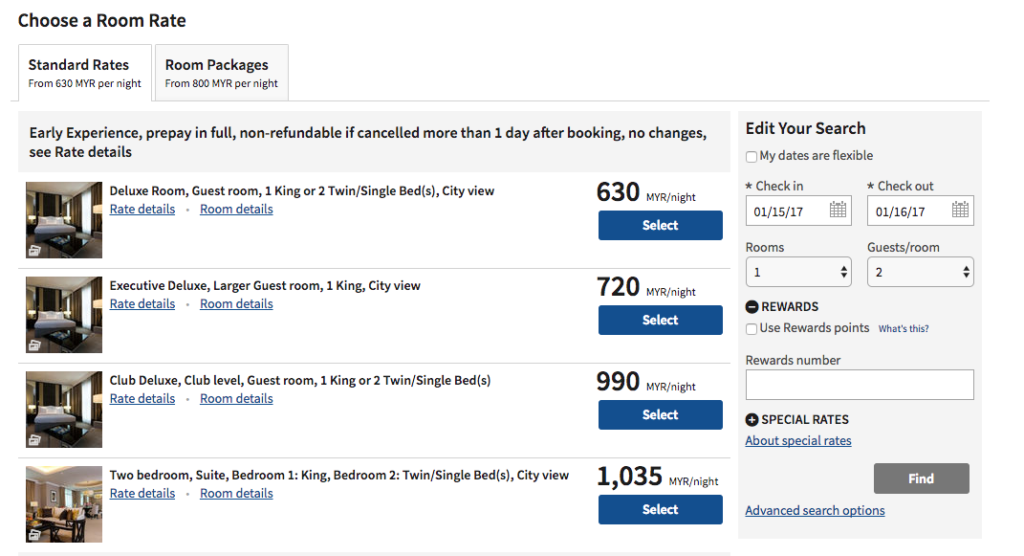

As an example here’s a look at the Ritz Carlton Kuala Lumpur in January 2017

You can see that the 2 bedroom suite is available. If it’s still available at check-in – ask if they’ll give you a great rate on an upgrade. In fact, I did this a few years ago and lemme tell you – it’s a phenomenal experience. Butler and all.

Leverage your status.

I just got a Mercedes C300 for a week and paid just $142 including taxes. I saw Sixt’s inventory before I got to the branch and saw they didn’t actually have any entry level cars even though they were renting them. I also saw they had quite a few swanky German offerings. I was then able to increase my odds by doing some research. I read about a status match on One Mile At A Time and my Hilton Diamond status turned into Sixt Platinum which includes a 2 category upgrade. I’ll write more on this process, but the point is it doesn’t hurt to ask.

If you have status with a brand…it will definitely help you

Last year when I stayed a night at the Grosvenor House in London, A JW Marriott hotel, I asked if any upgrades were available when I checked in. Gold status isn’t the highest, but sure enough, the desk agent hooked me up with a One Bedroom Suite.

This brings me to my last point: BE NICE

Clearly Miles and I like to have fun. The more fun you are, nicer to be around, and ultimately gracious when talking with employees – the greater the odds they will hook you up. I couldn’t tell you how nice the dude was at Sixt and I WAS STOKED to cruise around in a new C300. Every suite I’ve gotten from a check-in bump I have let the staff know how much I appreciate it.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.