We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Ink Plus OUT! Ink Business Preferred IN! 80k offer is live

Well, the reddit churning thread was spot on again. The Ink Plus has been yanked and the Ink Business preferred is the Ultimate Rewards premium card now. I played around with the Chase site this morning and it’s official: Ink Plus OUT and Ink Business Prefered IN! You can click below for the 80k offer ( although I don’t have any links myself).

Ink Plus OUT

Oddly the card is still on the chase.com site. Maybe this is because ( as reported by Miles to Memories) there are still ways to get the Ink Plus.

If you try and click those links this is what you’ll see.

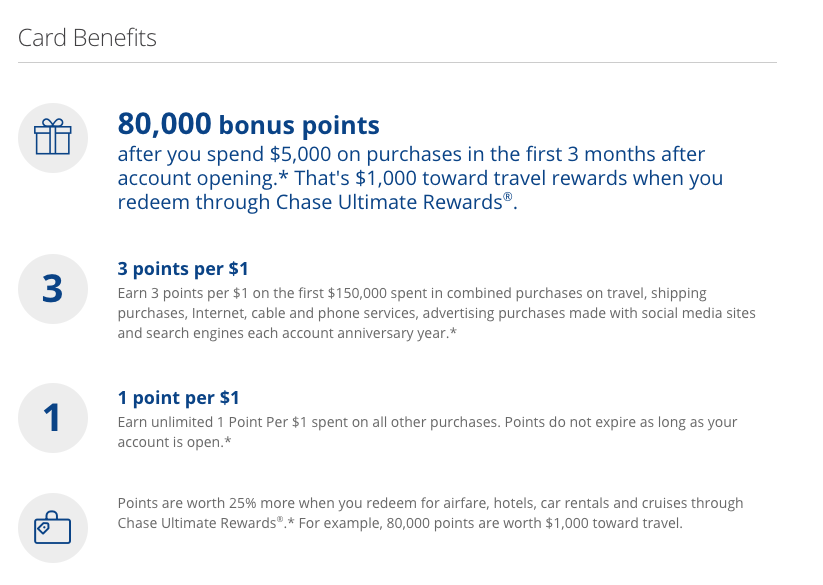

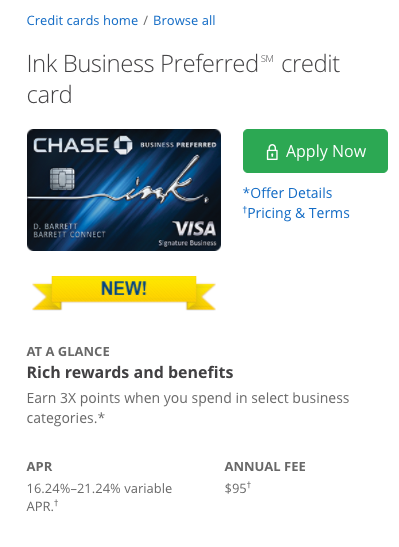

Ink Business Preferred IN! Here’s the official look and link for 80k after $5k spend.

I really wish I was under 5/24 at this point because I would nab a Reserve and a Business Preferred. Both, IMO, are outstanding sign up bonuses and offer TREMENDOUS ways to accrue points. I’m currently letting my cards work off and hopefully will be able to get some good deals next summer when I dip below 5/24 or get pre-approved 😉

And the overview of benefits from chase.com

Does 5/24 apply?

Data points are still being collected but the odds are yes. If you’ve gotten more than 5 new credit cards in the past 24 month you will not be approved. There are exceptions like getting a pre-approval, having Chase Private Client, etc – but for the mass majority it will be exclusive to those under 5/24.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.