We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

IHG One Rewards just quietly released a 15% discount promotion on award nights for cardholders and IHG One Rewards Platinum and Diamond Elites. The biggest caveat is that this does not stack with the 4th night free that comes as a benefit on the IHG Premier/Traveler/Business. So, the optimal usage is on stays fewer than 3 nights. I personally have 2 Chase IHG Rewards credit cards – the IHG Rewards Select ( no longer available ) and IHG Premier so my account is showing the promotion. If you don’t have the credit card, but have Platinum or Diamond status, don’t worry, it’s avail to you too!

- Who is eligible?

- Chase IHG One Rewards credit cardholderes have access to the deal

- Chase Platinum and Diamond elites have access to the deal

- Must book by April 27th 2024

- Must complete the stay by 06/30/24

- Doesn’t stack with 4th night free credit card benefit

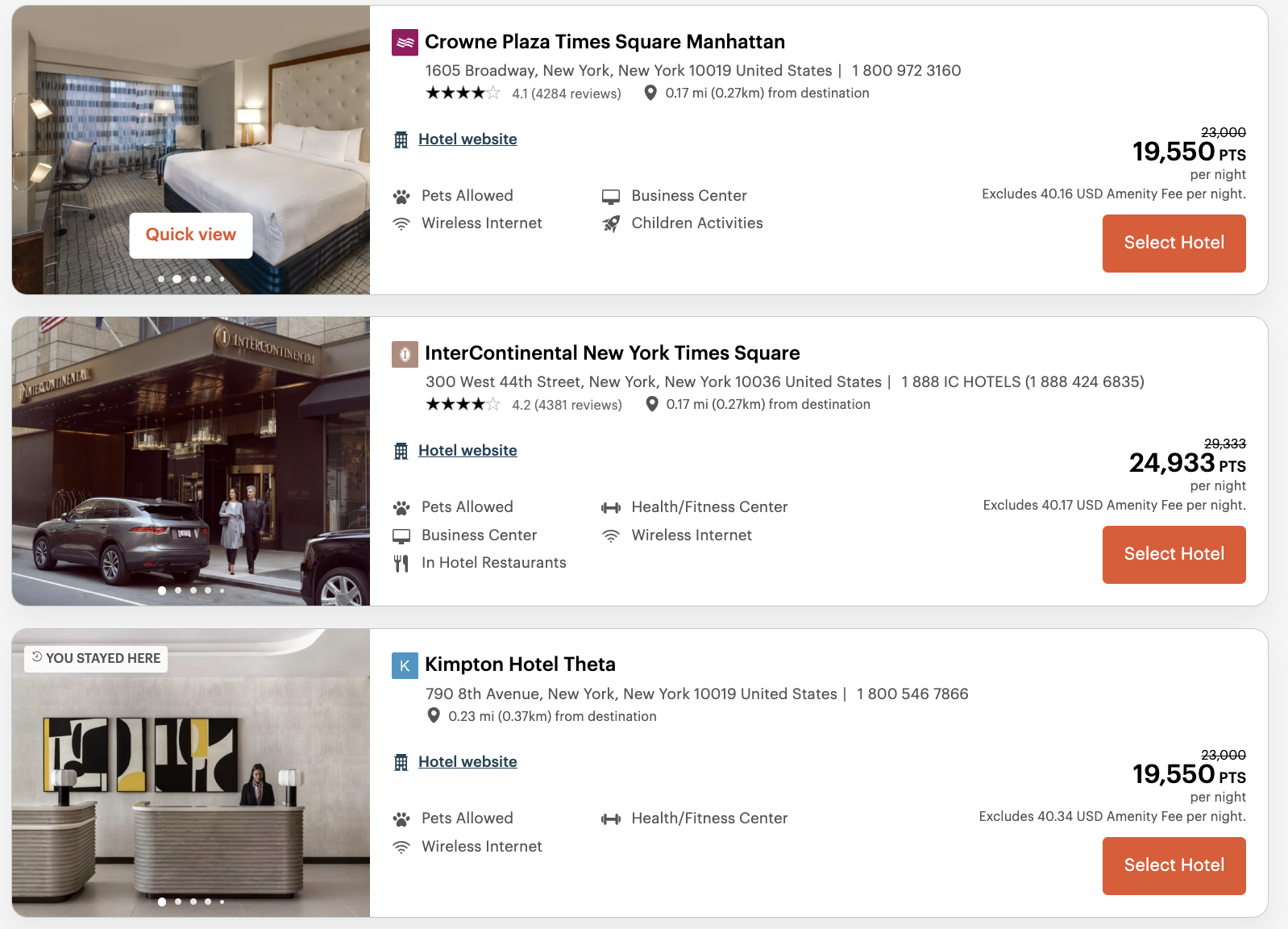

Here’s a look at hotels in NYC showing the discounted rate:

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.