We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I’ve personally held two IHG credit cards for years now. Why? They are fantastic “supporting cast” credit cards that yield valuable benefits at IHG properties, specifically if you are utilizing IHG One Rewards to stay. Learn about how I think of my wallet like the cast of Friends here.

Cards in this article

- IHG One Rewards Traveler Credit Card

- IHG One Rewards Premier Credit Card

- Chase IHG Rewards Premier Business Credit Card

The biggest reason I keep IHG credit cards ( I have the IHG One Rewards Premier and the now retired IHG One Rewards Select ) are because the cards offer a free night every year and reduce the price of IHG stays with points. All of the currently offered IHG credit cards give you a 4th night free when using IHG One Rewards to book. This is wildly valuable if you’re staying at high end properties and changes the game if you’re teaming that with buying points.

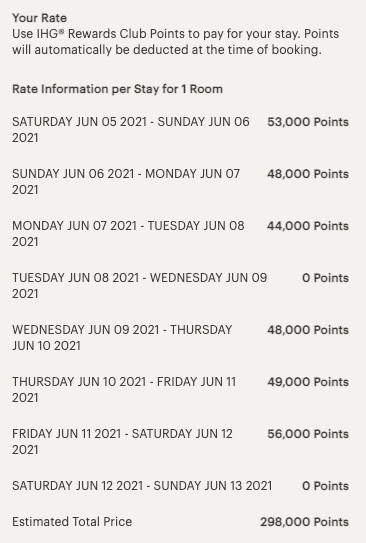

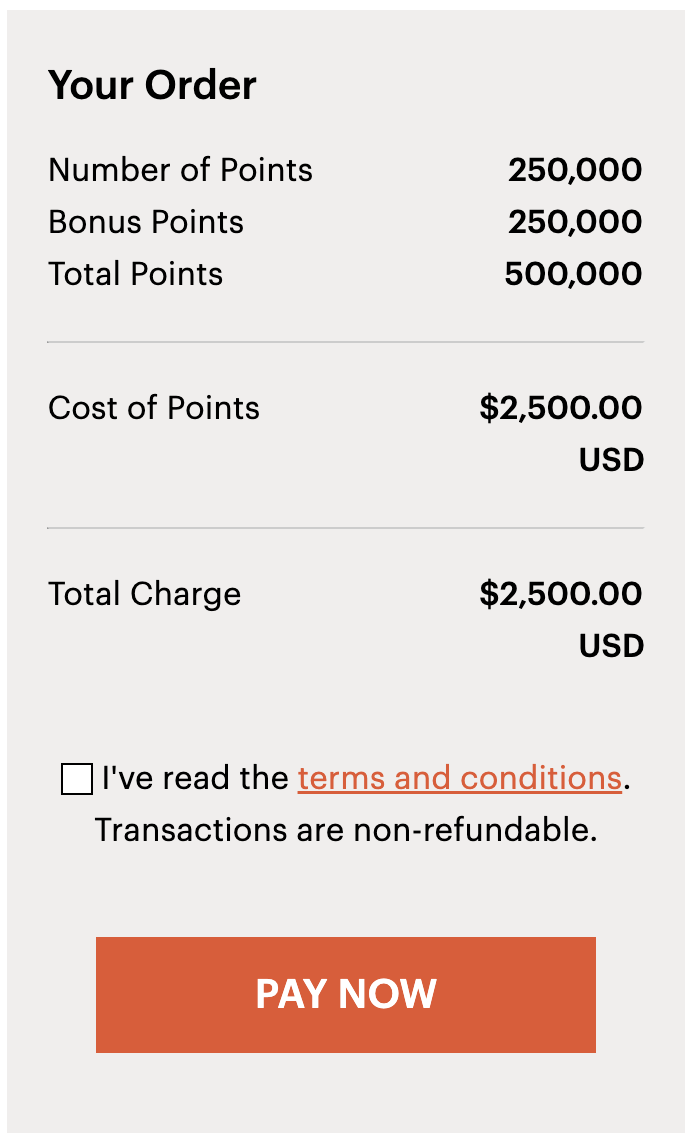

Here’s an example of using the 4th night to stay at the Kimpton La Peer in LA

Often IHG will put their One Rewards on sale…the best deals are about $0.005 cents with the ability to buy 500k points. While this can make using points cheaper than cash without the cards, when you factor in the 4th night free benefit, it can create amazing arbitrage situations where using points is markedly cheaper than paying cash. In the example above, the Kimpton wanted over $400 a night; however, I stayed 8 nights for 300k points… or $1500 if I bought them outright using a 4th night free twice on a single stay.

Let’s take a look at the various cards, and how they may fit into your wallet as “Supporting Cast” Cards

Table of Contents

IHG One Rewards Traveler Credit Card

This is the entry level card from IHG and Chase with no annual fee, but you’d still be rocking that 4th night free when you’re using points. Honestly, any IHG status below Platinum or Diamond isn’t really worth chasing, so the comped Silver with a spend your way to Gold, isn’t of much value. IHG One Rewards has milestone rewards that are actually more valuable than status itself – with suite upgrades coming in at just 20 nights. You keep this card for the 4th night free on point bookings.

Keep in mind that if you got a welcome bonus on an IHG personal card in the past 24 months, or you’re holding an IHG Personal card, you’re ineligible for another welcome bonus. So if you choose this, you can’t then qualify for the Premier.

IHG One Rewards Premier Credit Card – in my wallet/my choice

This is the card I have had for a few years now since its debut. The 4th night free benefit has saved me a ton of points, but I have been able to easily recoup the annual via the anniversary night which is good at properties up to 40k IHG One Rewards; however, you wish to use it at a more expensive property ( which I often do ) you can add points to it. Personally, I think this is the best way to go about using the certificate since you’re guaranteed to max out the value.

It also comes with a United travel bank credit which is deposited ( automatically ) into your United account in $25 increments: once in January, and another in July. That can be used against United flights…super easy to use.

Keep in mind that if you got a welcome bonus on an IHG personal card in the past 24 months, or you’re holding an IHG Personal card, you’re ineligible for another welcome bonus. So if you choose this, you can’t then qualify for the Traveler.

Chase IHG Rewards Premier Business Credit Card

This is basically a business version of the Premier. All of the stuff I said up above is a benefit of this card and the annual night easily recoups that annual fee, you get the 4th night, and the United Travel Bank credit. I plan to add this card to my wallet at some point, but just haven’t done so yet ( but then again I already have 2 IHG credit cards ).

Are IHG credit cards affected by the Chase 5/24 rule

Yes, yes they are. If your credit report shows 5 or more personal cards added to your report in the past 24 months, you won’t be eligible for any of the three. However, it’s worth noting that the business version doesn’t add to your number, but both personal cards do.

You can read more on the 5/24 rule here.

IHG Hotel Reviews

I have stayed at a ton of IHG properties around the world. Here are some to check out!

- Kimpton London – The Fitzroy

- Kimpton Glasgow The Blythswood

- Kimpton Atlanta ( Buckhead ) The Sylvan

- Kimpton West Hollywood – La Peer

- Kimpton Palomar Westwood

- Kimpton Wilshire Miracle Mile

- Kimpton Miami – Hotel Surfcomber

- Kimpton Savannah – The Brice

- Kimpton Nashville – The Aertson

- Hotel Indigo, Countrypolitan Nashville

- Intercontinental Austin

- Intercontinental New York Barclay

- Intercontinental New York Time Square

- Intercontinental London Park Lane

- Intercontinental Shanghai

- Interontinental Hong Kong

- Intercontinental Cannes

- Intercontinental Singapore

- Intercontinental Aqaba Jordan

- Intercontinental Chicago

- Intercontinental Sydney

- Intercontinental Paris Le Grand

- Intercontinental Miami

- Intercontinental David Tel Aviv

- Intercontinental Buenos Aires

- Intercontinental Cleveland

- Intercontinental Boston

- Intercontinental Johannesburg Airport

- Intercontinental Johannesburg Sandton Towers

- Six Senses Maldives Laamu

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.