We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The IHG One Rewards Premier Business Credit Card

IHG just overhauled their credit card portfolio adding new benefits to their personal cards, and unveiling the IHG One Rewards Premier Business Mastercard. IHG Rewards has certainly piqued my interest with their commitment to improve the program this year, and if their credit cards are any sign of what’s to come… it’s look good.

I already have 2 IHG Rewards personal cards: The IHG Rewards Premier and the now retired IHG Rewards Select. I keep them for whenever I stay at IHG properties, but they also give me a free night every single year on my cardmember anniversary date, valued at up to 40k points. This alone recoups my annual fees, but IHG has improved those nights by allowing members to add points to them to stay at properties pricing about 40k.

I used the 4th night free benefit at the Six Senses Maldives for my honeymoon

IHG One Rewards Premier Business Mastercard

If you’re a business or sole proprietor and you’re looking to gain exposure to the IHG Rewards portfolio, I think this is a really compelling card for you. Without even considering the welcome offer, you can easily recoup the annual fee via these two benefits:

- 4th night free on award bookings

- free night on account anniversary

- up to 40k points ( you can add points to this tho for more expensive properties )

Is this the best ever offer?

Check out our best offers spreadsheet to see the historical best offers on a ton of cards – go here

A free night issued after your cardmember anniversary date

Every year, on your anniversary date, you’ll be issued a free night certificate valid on award stays 40k or less. However… IHG now allows you to add points to that free night award to make the difference if you want to stay at a property that was more expensive than 40k points.

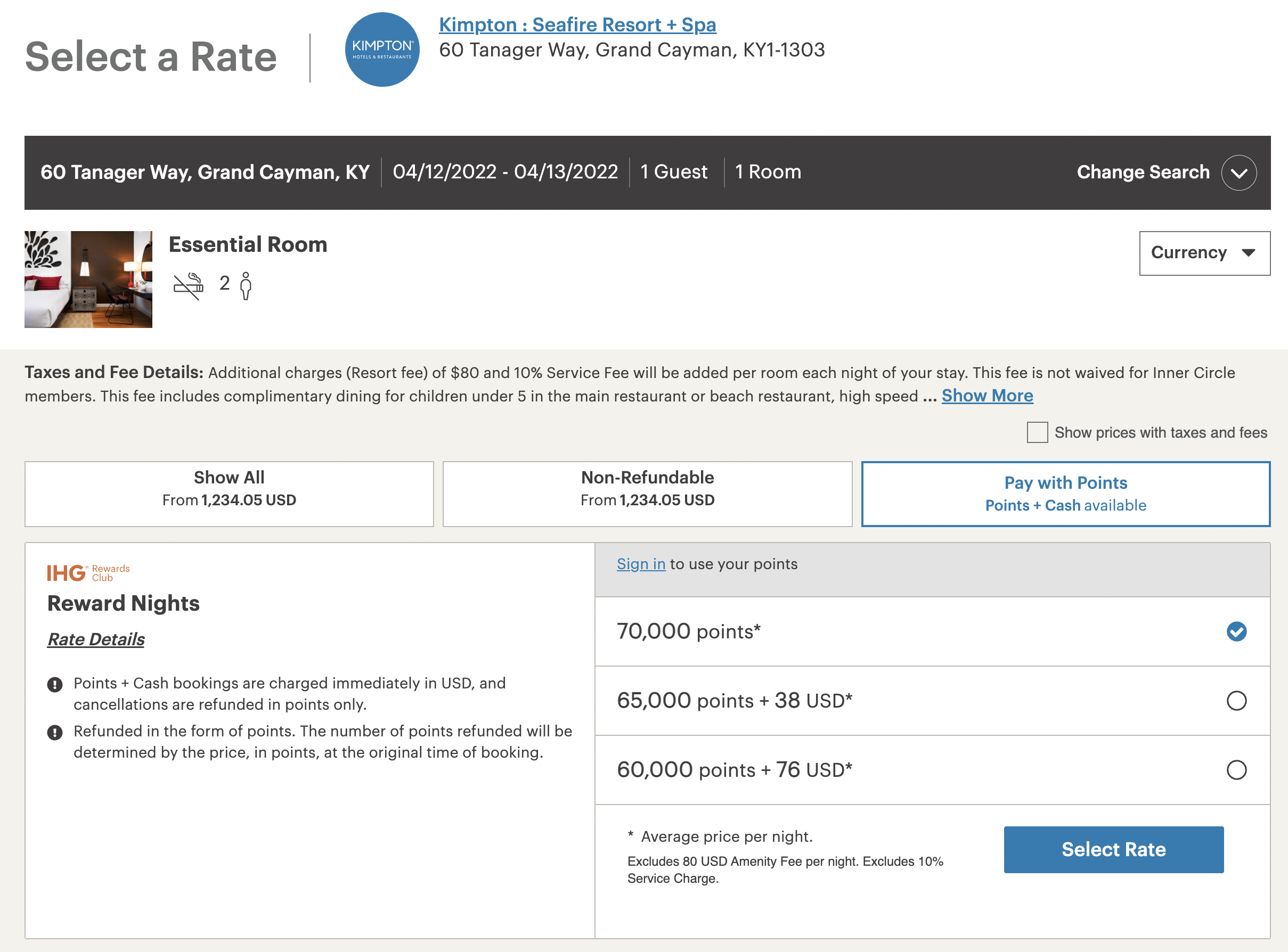

For instance, if you wanted to stay at the new Kimpton Seafire in April you’d be looking at 70k for a single night vs $1234 cash. Ouch. Prior to the update, you couldn’t use your free night here, but now you could just add 30k points and redeem.

But I don’t have a small business, Miles. You may, and not know it… Keep reading.

Chase is very friendly to entrepreneurs and small business owners. In fact, if you haven’t been in business for long, or you haven’t established yourself with an EIN, you can still apply as a Sole Proprietor ( fill in your SSN ). If you run a small side business (think bloggers, ebay sellers, tutors, consultants, etc) and want a card to segregate your business income from your personal income at tax time…this is a great opportunity to earn a load of points and help yourself out.

If you’re like me and already have the now retired IHG Rewards Select…you’ll save even more by stacking.

Let’s take my honeymoon for example.

With the IHG Rewards Premier Business card we’re talking about 300k for a 4 night stay ( 4th night at 100k isn’t charged).

The now retired, IHG Rewards Select offers a 10% discount ( up to 100k points per year ) on IHG redemptions. That means I’d get another 30k points back, reducing the 4 night stay to just 270k points. Unreal!

Power up your status with with Intercontinental Ambassador

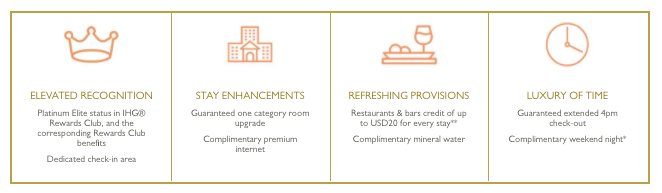

Intercontinental Ambassador is a membership program that you buy for $200 a year or 40k points. It comes with several benefits for members – the biggest are listed below.

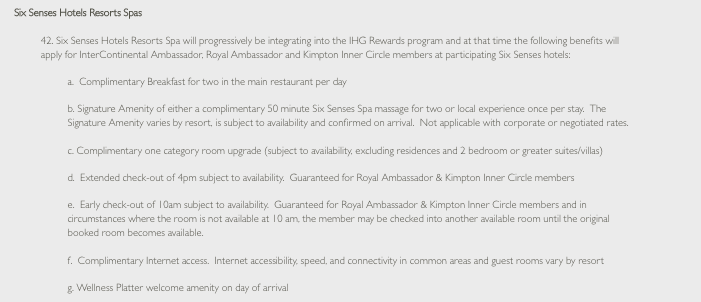

But…there some really cool things that stack with Six Senses in particular. Since I mentioned Six Senses above – I figured it was worth pointing a couple out. These are valid on point bookings as well

But…there some really cool things that stack with Six Senses in particular. Since I mentioned Six Senses above – I figured it was worth pointing a couple out. These are valid on point bookings as well

- Free breakfast ( very valuable at Six Senses )

- Signature Amenity ( like a 50 min massage for two )

- Room upgrade

- Wellness platter

If you’re thinking of going to a Six Senses property and using IHG points…it could very well be worth buying an Ambassador membership.

If you’re thinking of going to a Six Senses property and using IHG points…it could very well be worth buying an Ambassador membership.

Is it restricted by 5/24?

All Chase cards are now restricted by 5/24

Do you have this card?

Not yet, but I plan on adding it to my wallet. I picked the IHG Premier up during 2021 and hold it concurrently with the now retired IHG Rewards Select

Overall:

There are two big reasons I think this card makes sense for people

- 4th night free benefit

- Annual Free Night at 40k and under properties

These two alone easily recoup the $99 fee and then some.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.