We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

100% bonus when you buy IHG points

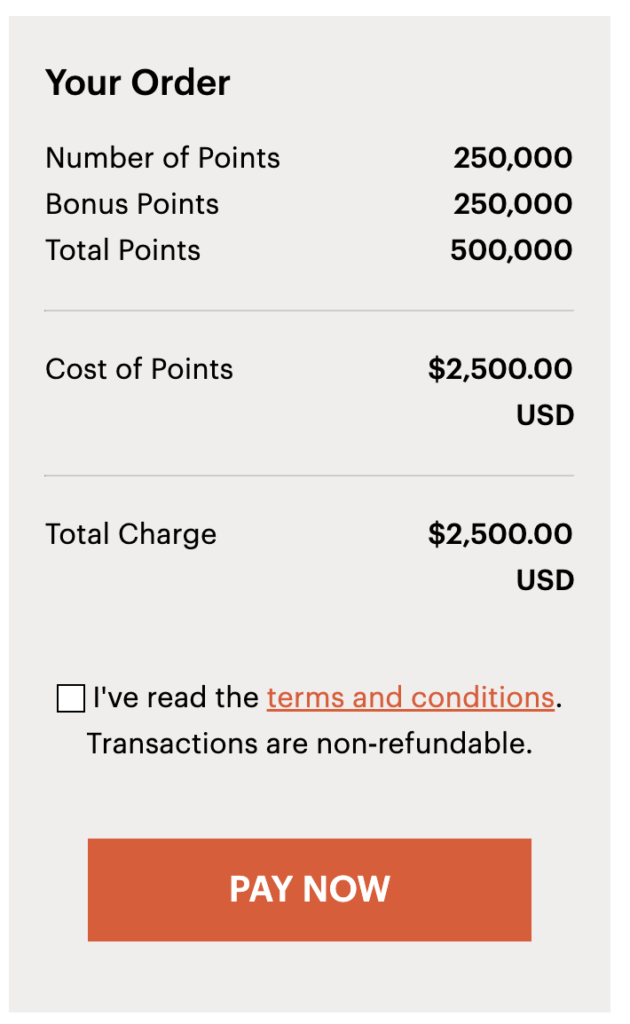

IHG has brought back their best offer on purchasing points ( $0.005 ) until June 29th. This matches the best ever deal price wise and amount wise – you can fill your account with 500k IHG One Rewards if you max out.

I always want to make it clear that you shouldn’t buy points speculatively. Points programs devalue all the time and you only want to seize opportunities like this when you have a booking with award availability and can use the points to lower your check out cost. If that applies… this is a great time to buy price wise.

- The best ever deal is buy 250k get 250k maxing out at 500k points ( $0.005 per points)

Buy IHG points is currently offering a 100% Bonus

- Must buy 5k+

- Max is 250k

- Bonus is 250k

- Price is $0.005

- Until 06/29/24

Should I buy IHG points?

I think buying points is an excellent way to either shore up your balance, or buy a trip at a cheaper price than you’d pay to stay at a hotel with cash. HOWEVER – don’t do this speculatively. Always have an immediate, or at least near term, use for the points. I wouldn’t advise buying them for some trip down the road that you aren’t looking to book soon.

For instance, if you stay at the Kimpton Sylvan – and it’s $250 a night, but you’ll often see point rates between 26k and 40k. That means I could have purchased points and stayed for between $130 and $200. Even less with and IHG One Rewards Premier.

Is this the best price?

The best bonus is 100% or $0.005 per point.

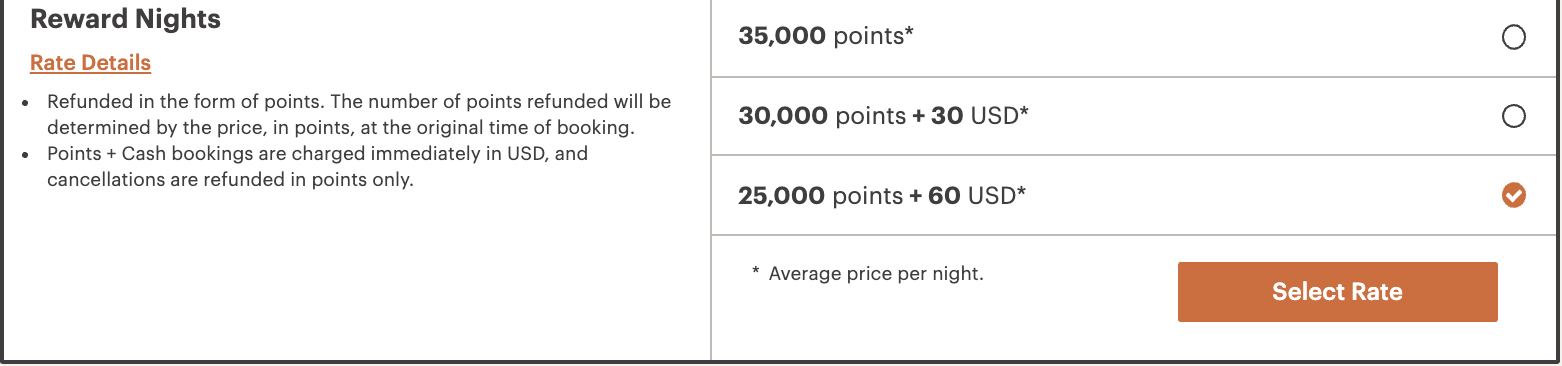

Remember, you can always buy points using the Cash + Points trick for 6/10 of one penny.

If you don’t have enough points in your account for a booking, or you don’t wish to use all of your points at that property, IHG will allow you to book that hotel with Cash + Points – the price is usually around $0.006 per point – roughly 20% higher than this deal.

IHG points are dynamic – important

One of the reasons I want to stress that you have a redemption in mind to take advantage of in the immediate future is because IHG award rates fluctuate day to day based on demand and rack rate pricing. For instance, I reported on that Intercontinental Rome was pricing at 40k over Valentines Day 2022 … that didn’t happen, the opening has been pushed to 2023 and rates are well over 80k. Don’t buy on speculation.

What’s the max I can purchase

Usually IHG has a 100k max on the amount of points you can purchase in a year, but has raised it as high as 250k in the past ( pre bonus ). Currently this deal maxes out at 250k with 100% bonus = 500,000 points for $2,500, or 0.005 per point.

Is this the best deal we’ve ever seen?

The max has been as high as 250k.

Can I have some examples of how to make use of this promo

Sure…the examples I’ll show are merely to illustrate the strategy, and the rates could fluctuate, but the strategy of seeking outsized return remains the same.

Kimpton Seafire Grand Cayman – an example one of the best Kimpton redemptions around

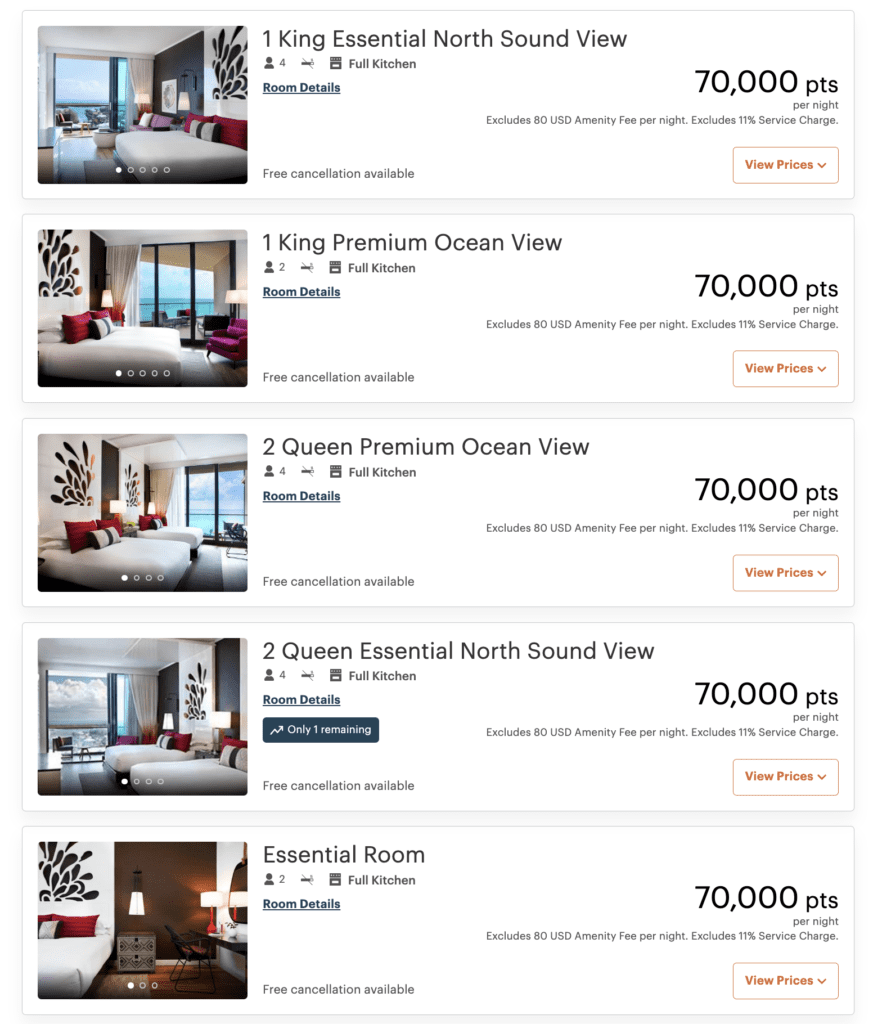

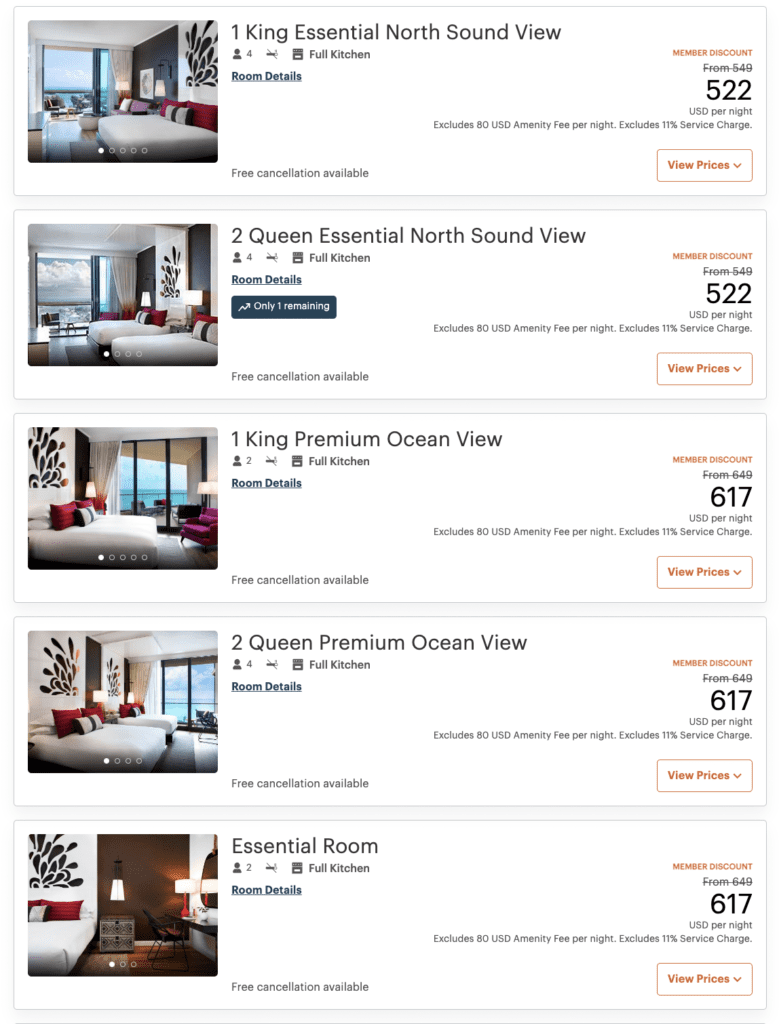

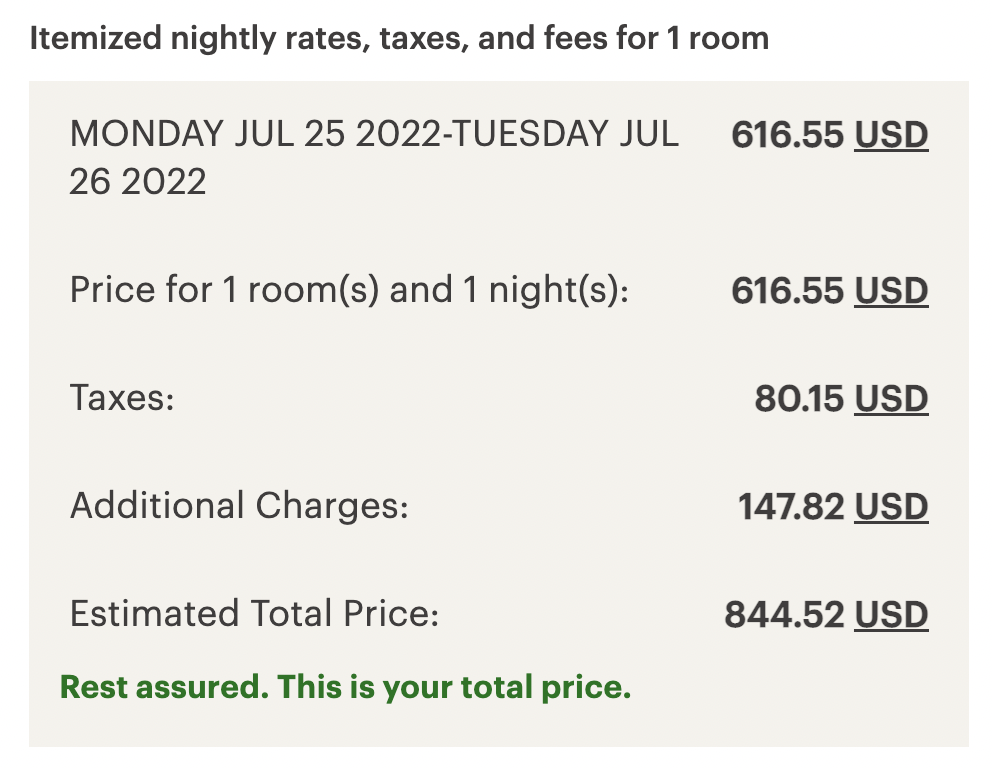

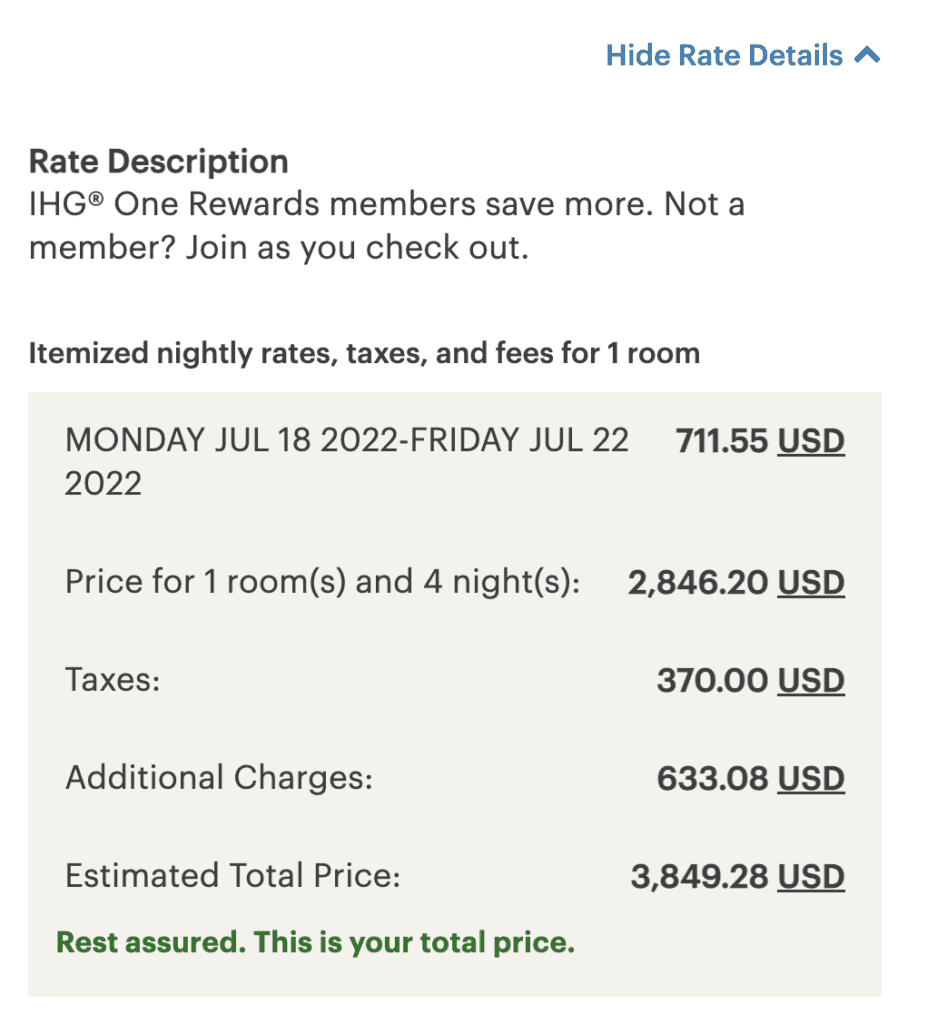

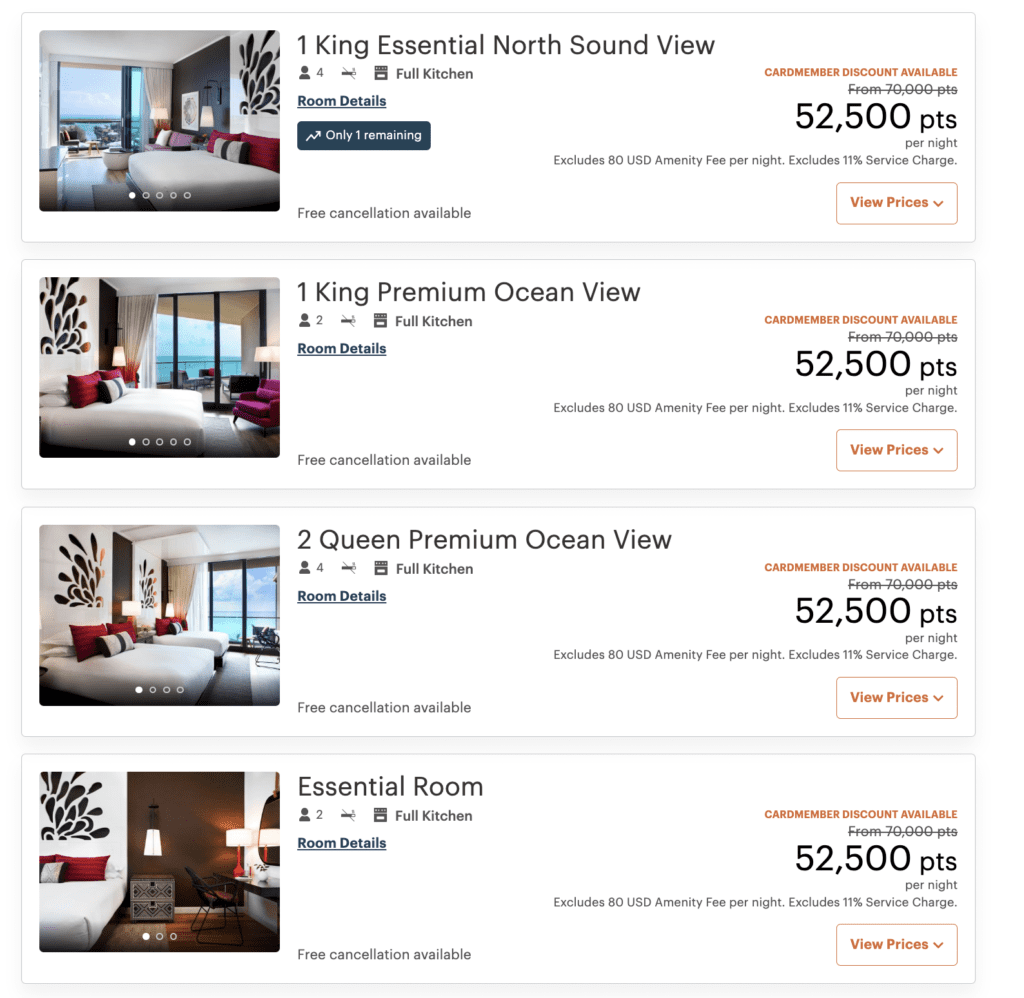

Let’s look at the Kimpton Seafire in the Cayman Islands on a 1 and 4 day trip – this example is from 2022 with a 100% bonus, but it is purely to illustrate the mathematics.

Whenever you compare rates make sure the cancellation policies are the same. In this case, both the flexible rate and the point rate have the same 4 day cancellation policy. Notice all the taxes added on to the booking brining the total up top $844 – this includes a $80 resort fee + 11% service charge. When you book with points, you need to pay the $80 resort fee but not the 11% service charge. You could buy the same 70k points for around $350, and with the $80 service fee, your cost would be $430 vs $844.

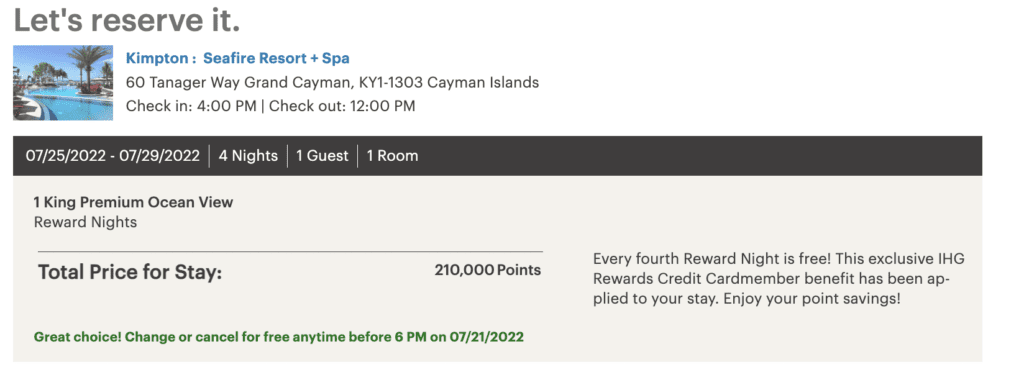

If you had an IHG Rewards Premier card, IHG Rewards Traveler, or IHG Rewards Premier Business you’d get a 4th night free on award bookings. This makes the price reduction even more noticeable. A $3850 stay would drop could be booked for 210k points, or $1050 with this sale. That is amazing, but remember you’d still owe $80 a night in resort fees, so your check out price would be $1430 vs $3850 for 4 night stay. That’s $360 a night vs $960 a night.

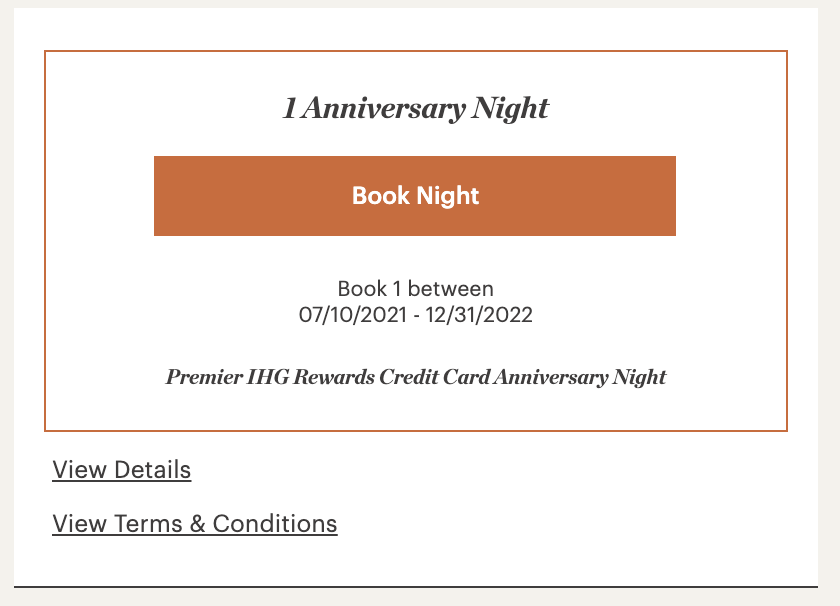

Buying points to use a free night certificate

The free night certificate earned from certain IHG credit cards is eligible for top up. What does this mean? In the past, the free night certificates were only valid at properties that priced a night at 40k or below. Now, you can add points to that free night certificate which makes it much more valuable.

If you don’t have the points in your account, it could be valuable to buy what you need to top up your free night to the needed amount of points for the redemption. This could really useful if you’re adding a 5th night for a 4 night reservation.

If you had 210k points along with the IHG Premier, and wanted to stay at the Kimpton Seafire you’d have enough for 4 nights. But, what if you wanted to stay 5 and you had your free night certificate sitting in your account? Well, you could purchase 30k IHG points and top it up, and with this deal you’d be paying just $150 for those points.

Unlocking the IHG Premier

The IHG Rewards Premier comes with an annual anniversary award night as I mentioned earlier which you’ll be able to top-up. You can use this to stay at properties up to 40k in value. Having a stand alone night can often mean you have to pay for a night to accompany it since many of us won’t just do somewhere for a single night, but soon you’ll be able to pair it with any booking and top up the difference from 40k. Buying points can help offset cost and make better use of your night since you’re more apt to plan a longer stay if you can offset cost.

- Automatic Platinum Status

- 4th night free when using points

- $50 United Travel Bank credit

- Global Entry/TSA Pre Fee credit every 4 years

- Free 40k night every year

- this being on your first anniversary heading into your second year of cardmembership

- Spend your way to Diamond with $40k in annual purchases

- Get a 10k bonus points and $100 statement credit when you spend $20k + one additional purchase in a year

- Earning will be as such:

- 10x at IHG Hotels & Resorts worldwide ( this is on top of the bonus you get as a IHG Rewards member )

- 5x

- travel

- gas stations

- dining/restaurants

- social media and search engine advertising

- office supply stores

- 3x everywhere else

Recap

This is a very solid offer if you have reason to buy points and redeem. Crunch the numbers, do your own research, and make the right decision. If you decide to move forward we appreciate you using our links!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.