We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Credit Cards = FRIENDS 🙂

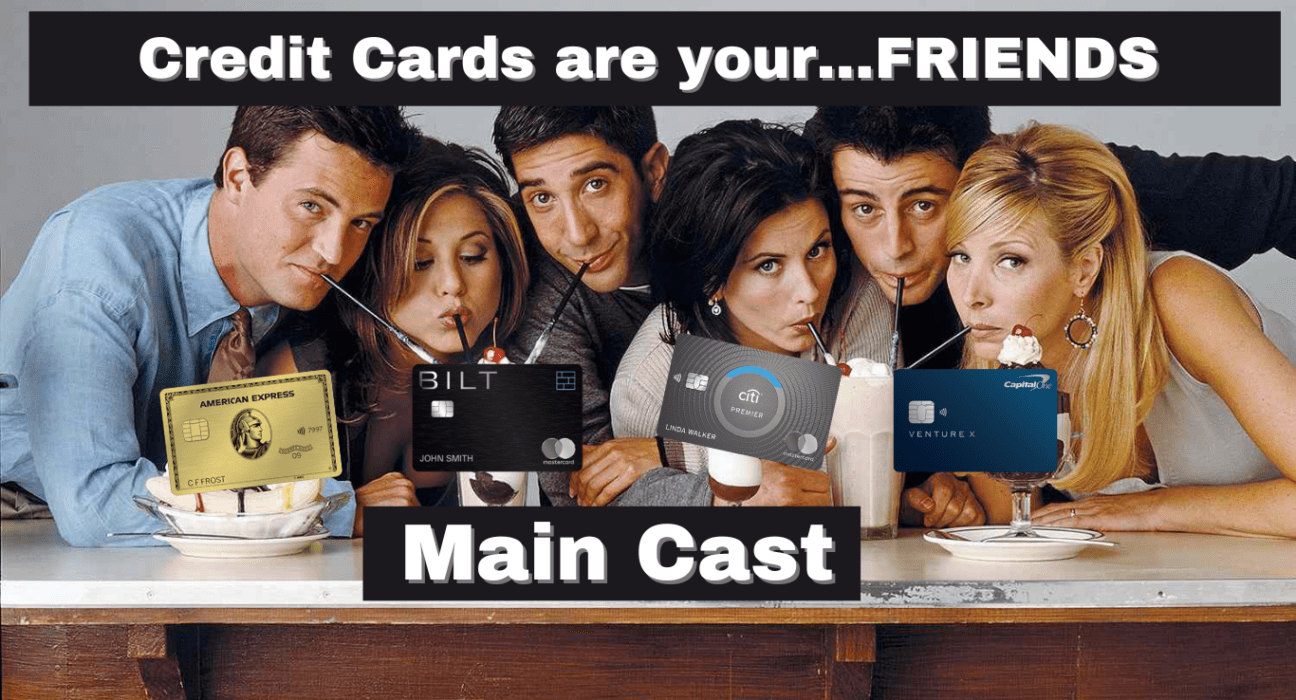

Yes, I view credit cards, and how they work in my wallet, like the cast of “Friends.”

Why? One of the biggest mistakes I see people consistently make when it comes to credit cards is they use the wrong cards!!!. So….thinking of your credit cards like the cast of Friends solves this problem.

You wallet should be comprised of two kinds of cards:

- Main Cast

- Supporting Cast

Using each of these different kinds of cards to achieve your travel goals properly will help you earn more and better points, get more value from your cards, and ultimately having you spend more time flying in like this:

Etihad Apartment booked with American Miles

Don’t forget we keep a spreadsheet of all the best offers on cards whether we make a commission or not! We only publish the best offers.

Table of Contents

Friends has its main cast of characters:

These characters are in every single episode. You love them, you tune every week to see them, and you build a relationship with them over time.

- Ross

- Rachel

- Phoebe

- Joey

- Chandler

Friends also has its supporting cast of characters

These characters pop in for some comedic relief, or stir up some drama. You may love them, you may hate them, but they serve a very specific purpose and they aren’t overly used. Rather than have a deep relationship with them, they’re more of an acquaintance.

- Janice

- Gunther

- Jack and Judy Geller

- Mike Hannigan

- Mr Heckles

- Mr Treeger

Your wallet should mirror Friends with its own main and supporting cast

Main Cast of Credit Cards

Your wallet should have its own main cast, the cornerstones of your wallet. These are credit cards that you use every single day and on the vast majority of your purchases. The only time you aren’t using these cards is when you’re hitting a minimum spend on a new card, or strategically using a supporting cast card mentioned below. They should have the following qualities:

- They earn transferrable points

- These points can be transferred into partner programs

- They earn category bonuses

- You should have cards that earn bonus points on categories where you spend the most

- Gas, Supermarkets, Dining, Etc

- They have benefits that are more valuable than the annual fee

- Tally up the credits and benefits and they should be worth more than the annual fee costs you

- They team with other cards in the program

- For instance, The Chase Sapphire Preferred® and the Chase Freedom Unlimited® can combine points. Same goes for Capital One cards, Citi cards, and Amex cards.

The best programs for Main Cast are as follows:

- American Express Membership Rewards

- Bilt Rewards

- Capital One Miles

- Chase Ultimate Rewards

- Citi Thank You

As you can see below…they have a TON of transfer partners

Here’s a list of my favorite Main Cast credit cards ( My Ross and Rachels )

Personally I think if you have 2 or 3 of these across the different programs you’re doing great. If you rotate these, or hit new offers when they are all time high, great…but make sure you always have 2 or 3 to achieve a minimum 2x blended points per dollar.

What you’re looking to do is earn points that can be transferred into as many partner programs as possible so when it comes time to redeem, you’re able to generate points in the program with award space to your destination.

My top:

- Chase Sapphire Preferred®

- Pair it with Chase Freedom Unlimited® or Chase Freedom Flex (SM)

- Bilt Rewards Mastercard®

- Best for Renters – Earn points and pay your rent without any transaction fees ( i’m an investor and advisor )

- Capital One Venture X

- This pairs nicely with the Capital One Savor

- American Express Gold®

- You could sub in The Platinum Card® from American Express

- Citi Premier® Card

- Pair this with the Citi® Double Cash Card

American Express

- American Express® Green Card

- American Express® Gold Card

- The Platinum Card® from American Express

- The Business Platinum Card® from American Express

- American Express® Business Gold Card

- The Blue Business Plus® Credit Card from American Express

Bilt Rewards Master Card

Capital One

- Capital One Venture X Rewards Credit Card

- Capital One Venture X Business Credit Card

- Capital One® Venture® Rewards Credit Card

- Capital One® Spark® Miles for Business

- Capital One Savor Rewards

- Needs Venture Rewards, Venture X, Venture X Business, or Spark Miles to transfer

- Capital One Spark Cash Plus

- Needs Venture Rewards, Venture X, Venture X Business, or Spark Miles to transfer

Chase

- Chase Sapphire Preferred® Card

- Chase Sapphire Reserve®

- Chase Freedom Flex(SM)

- Needs CSP, CSR, or CIP to transfer

- Chase Freedom Unlimited®

- Needs CSP, CSR, or CIP to transfer

- Chase Ink Business Preferred® Credit Card

- Chase Ink Business Unlimited® Credit Card

- Needs CSP, CSR, or CIP to transfer

- Chase Ink Business Cash® Credit Card

- Needs CSP, CSR, or CIP to transfer

Citi

- Citi Premier® Card

- Citi(R) Double Cash Card

- Needs Citi Premier or Citi Presitge to transfer

- Citi Custom Cash(SM) Card

- Needs Citi Premier or Citi Presitge to transfer

I transferred Chase points to Hyatt to stay at the Alila Villas Bali

Here’s a list of my favorite Supporting Cast Cards ( My Gunther and Janices’)

The only time I really pivot spend to a supporting cast card is when I’m hitting minimum spend on a welcome offer/bonus, or if I’m spending on the airline, hotel, etc that the card is associated with point wise.

I also move these around a lot depending on what I think I may do travel wise in the year. If I don’t think I’ll fly American much, I’ll either downgrade or cancel the card ( always try to move your credit line within the bank to another card). Same goes for hotel cards if I don’t think I can use the benefits, I’ll look elsewhere. However, hotel cards often include free nights and since I travel so much I’ll usually make use of them and keep the card cause they often outweigh annual fee cost.

The point I’m trying to make: use these strategically, and rotate them based on the value they serve you. Don’t silo your points into a single airline or hotel currency.

You want to use these cards for the following reasons:

- Elite status, or boosts for elite status

- Free annual night certificates at the hotel chain of your choice

- Perks

- Free Bags

- In flight discounts

My top picks ( I’d say most people can get by with 2 or 3 of these )

This is going to be different for every person, and it will depend on the airline you love most, the hotel you prefer, etc. A lot of people go for the Southwest Companion Pass when it’s a perk, but this is what my wife and I currently hold:

- Barclay Aviator Red Business ( currently unvail )

- IHG® One Rewards Premier Credit Card

- IHG® One Rewards Select Credit Card ( retired )

- I keep this because it offers an annual 40k night + 10% back up to 100k points on Reward bookings

- Marriott Bonvoy(TM) Business Card from American Express

- Ritz Carlton Card

- You can upgrade a Chase Marriott card after a year to this card

- Hilton Honors Aspire Credit card from American Express

- Alaska Airlines Business Card

American Express

-

- HIlton

- Delta

- Delta SkyMiles® Gold American Express Card

- Delta SkyMiles® Platinum American Express Card

- Delta SkyMiles® Reserve American Express Card

- Gold Delta SkyMiles(R) Business Credit Card from American Express

- Platinum Delta SkyMiles® Business Credit Card from American Express

- Delta SkyMiles® Reserve Business American Express Card

- Marriott

Bank of America

- Alaska Airlines

Barclay

-

- Barclay Aviator Red

- Barclay Aviator Red Business ( currently unvail )

Capital One

-

- I don’t really like any of the non-main cast Capital One cards

Chase

-

- Aeroplan

- Hyatt Perks

- IHG Perks

- IHG® One Rewards Premier Credit Card

- IHG® One Rewards Premier Business Credit Card

- IHG® One Rewards Traveler Credit Card

- Marriott Perks

- Ritz Carlton Card

- Marriott Bonvoy Boundless® Credit Card

- Marriott Bonvoy Bold® Credit Card

- Marriott Bonvoy Bountiful® Credit Card

- Southwest Perks

- United Perks

- Citi

Overall – you don’t need 25+ cards like me

You wallet should be a weapon with its sights set on incredible, aspirational travel. Curating your wallet to achieve your goals is paramount in turning those dreams into reality, and one of the easiest ways to understand how to organize your wallet and allocated your spend is separating them into two categories: Main Cast and Supporting Cast.

If you do this, keep some cards long term, rotate cards in and out depending on if they give you value…you’re way ahead of the game. I think keeping a few main and a few supporting and maybe adding or substracting 2 of 3 every year will unlock one or two big trips every 18 months to help you unlock your bucket list.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.