We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Turn Citi Double Cash® cashback into Thank You points

Citi Double Cash® rewards its users with 1% cashback at the time of purchase, and then another 1% when the balance is paid. That’s 2% cashback on every single dollar you purchase, but the greatest perk is the ability to convert that cashback into Citi Thank You points when you concurrently hold a Citi Strata PremierSM or Citi Thank You Prestige. Let’s walk through how you can convert your Citi Double Cash® into Citi Thank You points and take advantage of Citi’s list of transfer partners.

Why would you want to convert cashback into Thank You points?

While I, personally, don’t value Citi Thank You points as much as Amex or Chase, they have a great list of transfer partners and facilitate aspirational travel experiences through those transfer partners. Many of their partners are also Chase/Bilt/Amex/Cap1/Marriott partners, which is beneficial from the perspective that you can spread your drawdown across various flexible currencies.

Giving the Citi Double Cash® the ability to convert cashback into Thank You points is Citi’s way of emulating what Chase permits with its Freedom and Freedom Unlimited cards. Both of those Chase cards are technically cashback cards, but when paired with a Chase premium card, the door opens to conversion into Ultimate Rewards. We often talk about blending a portfolio of Chase cards to optimize earn via a Quadfecta or Trifecta ( read more ).

This is using same underlying strategy, but with Citi: any purchase that doesn’t have a category bonus, put on the card that earns the highest cashback rate, then transfer into the flexible currency, Thank You points.

Citi Thank You transfer partners

Here’s a look at Citi Thank You transfer partners

Step by Step Guide to converting Citi Double Cash® into Thank You points

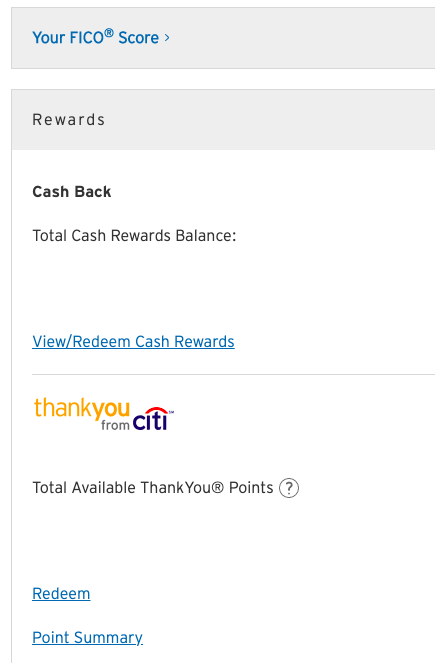

When you’re logged in, on the home screen, you’ll see the following on the right. Click on View/Redeem Cash Rewards

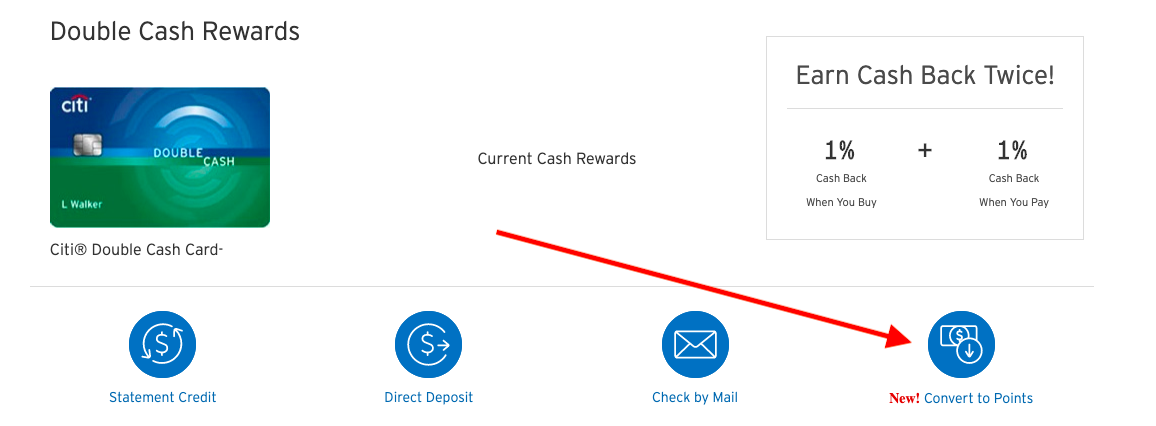

That will load the following screen. Click “Convert to Points”

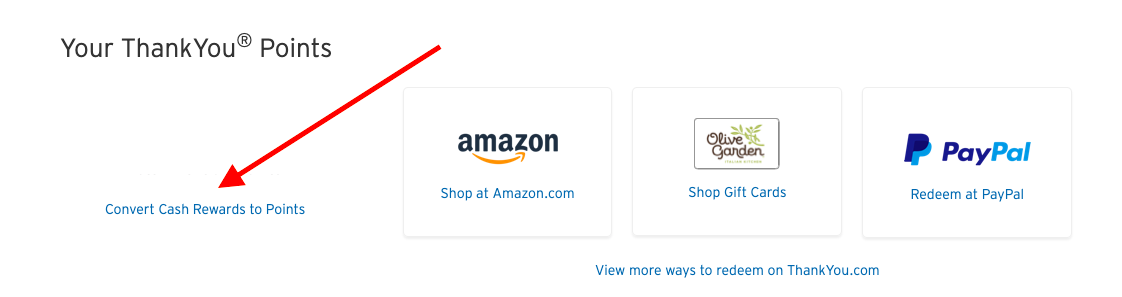

Then Cash Rewards to Points

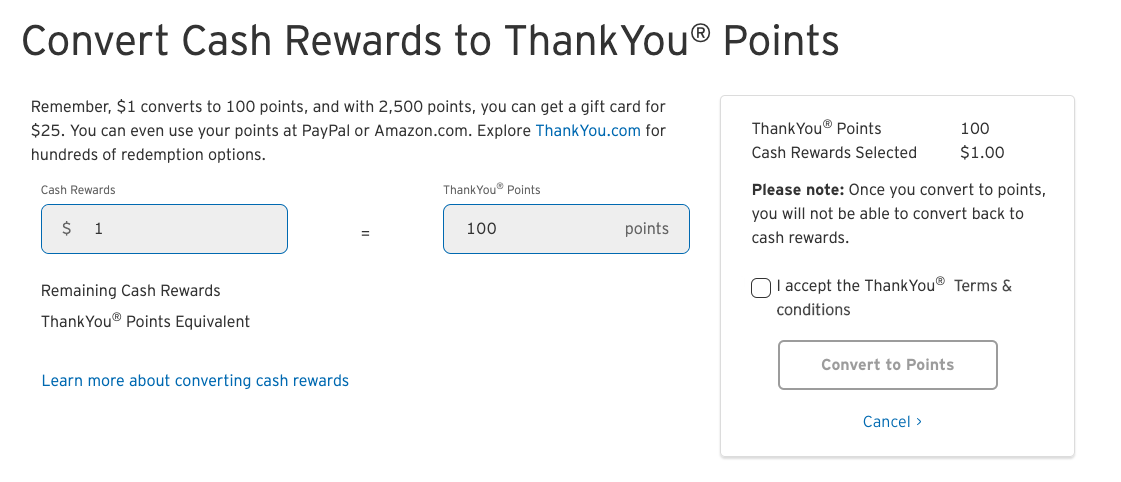

Then you’ll choose how many you want to convert.

The conversion should be instantaneous; however, when I did it this afternoon for this post there was a lag in the conversion. The points are kept in each account, so you’ll see the total amount for each card.

Hope this helps!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.