We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Chase Freedom Unlimited®

The Chase Freedom Unlimited® has been a pillar of the Chase credit card portfolio for years now, and there are two great offers for you to consider. Both of them are attractive in their own individual ways depending on the categories you spend the most money on.

As is our practice, we always want to provide you with the best deals, and in this case, they both have merit and come down to individual preference, so we offer links to both offers.

First: Chase Freedom Unlimited® extra 1.5x up to $20k

The affiliate offer from Chase Freedom Unlimited® adds an additional 1.5x on all purchases up to the first $20k. After the $20k they earn rate will revert. That would look something like:

- Up to 3x cash back on all purchases

- 1.5x up front when you purchase

- 1.5x bonus first year up to $20k total combine purchases

- Up to 4.5x cash back on drugstore purchases

- 3x up front when you purchase

- 1.5x bonus first year up to $20k total combine purchases

- Up to 4.5x cash back on dining at restaurants, including takeout and eligible delivery services

- 3x up front when you purchase

- 1.5x bonus first year up to $20k total combine purchases

- 6.5x cash back on travel purchased through Chase Travel(SM)

- 5x up front when you purchase

- 1.5x bonus first year up to $20k total combine purchases

- No annual fee

- Member FDIC

The second is the reader referral = 20k after $500 spend in 3 months + 5x Gas and Grocery Stores up to $12k

This offer could be more attractive to you if you aren’t going to spend much in the first year of card-membership. This is our referral, but you can leave yours on our Chase Referral page here

- Earn $200 or 20k Ultimate Rewards after $500 spend in 3 months

- 5x on combined gas station and grocery store purchases (not including Target® and Walmart®)opens overlay to offer details** on up to $12,000 spent in the first year (that’s $600 cash back!)

- 5x on Travel purchased through Chase Travel(SM)

- 3x on Dining including take out/eligible delivery services.

- 3x on Drugstore

- 1.5% or 1.5x points on every purchase

- No annual fee

Pairing Chase Freedom Flex® with Chase Sapphire Preferred® ( or Sapphire Reserve®, Ink Business Preferred®) makes your points transferrable

The Chase Freedom Unlimited® credit card is a cash back card when held on its own. This means you’ll earn your points or rewards in the form of Ultimate Rewards which can be used as cashback/statement credit or within Chase Travel(SM) at a penny a point.

However, since it’s in the family of Ultimate Reward cards, if you hold any of these Ultimate Reward cards concurrently

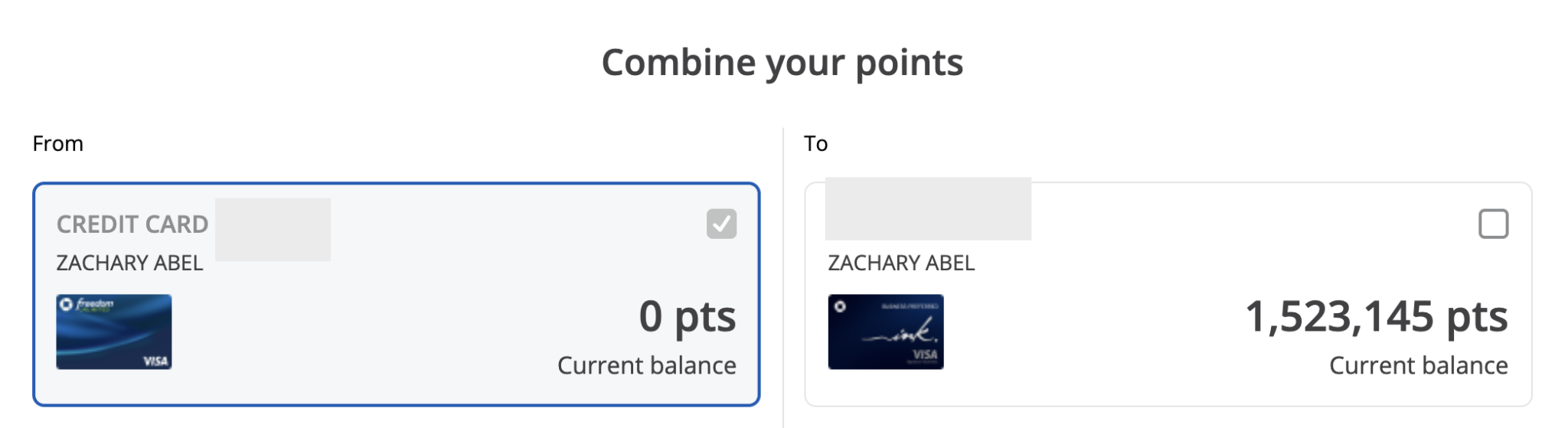

you can transfer your points from the Chase Freedom Unlimited® to one of the premium cards 1:1. You can go here to learn more about combining Chase points. It’s super simple and looks like this:

This would give you access to Chase’s great list of transfer partners so you could potentially get even more value.

Below is a picture of the Lufthansa First Class – You can book for 100k Aeroplan miles which Is transfer partner of Chase Ultimate Rewards (available when this card is paired a premium Chase credit card like the Chase Sapphire Preferred )

Is there a welcome offer or bonus for signing up for the Chase Freedom Unlimited?

There are two offers that are both competitive and listed above. You can also find our spreadsheet on the best current offers as well as the best ever offers here.

How does this card help me reach my travel goals?

It guarantees a great 1.5x base rate on your standard purchases allllll without an annual fee. Let’s say you already have a Chase Freedom Flex® which earns 5x points on rotating categories throughout the year, and an Chase Ink Business Preferred® which gives you access to transfer partners. But what about those expenses you’re missing out on? This card would help fill in the gaps so that you’re maximizing your rate of return on purchases everywhere. Achieving your travel goals is about continually increasing your point balance, and then taking advantage of award availability to get more lux for less bucks 😉

Overall

While the Chase Freedom Unlimited is technically a cash back card you can convert your Freedom Unlimited Cash Back into premium Ultimate Rewards by moving the rewards between accounts. This means that you can earn even more premium Ultimate Rewards when you hold the Freedom Unlimited alongside cards like the Chase Sapphire Preferred®, Chase Sapphire Reserve®, or Chase Ink Business Preferred®.

The Chase Freedom Unlimited® presents a great way to get massive earn a lot of points where you spend money the most + guarantee 1.5x on all purchases. This helps you get closer to those amazing first class seats and 5 star hotel rooms we so often blog about.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.