We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Chase My bonus Spending Offers for Q2, 2024

Each quarter, Chase has targeted spending offers for many of their credit cards called My Bonus Spending Offers. These are capped at $1500 in combined purchases across the targeted categories, per card, and run for 3 months. If you have a Chase Freedom Flex(SM) you’re familiar with rotating 5x category bonuses and these work in the same way. This quarter, Chase is targeting cards with 5x bonus points on purchases made at grocery stores, gas stations, and home improvement stores. Lets’ take a look!

Chase “My Bonus” Spending Offers for Q2 2024

If you’re targeted the bonuses will run from April 4th to June 30th and is maxed out at $1500 total spend on combined spend. Usually these are 5x on the categories targeted, but in the past we have seen IHG cards bump up to 7x points.

Details

- Can activate now

- For purchases between 04/04/24 to 06/30/24

- Max $1500 in combined purchases

- if you have more than 1 Chase card that is targeted, the $1500 is per card

The Categories being targeted

- Gas Stations

- Grocery Stores

- Home Improvement

I have a few of these Chase cobrand cards and all I got was a HBO Max offer.

What a dud…

Cards that are likely included in the Chase My bonus Spending Offer:

Aside from the Chase Freedom cards listed, the cards that are targeted are cobranded cards listed below:

- United Cards

- Hyatt

- Marriott

- Marriott Bonvoy Boundless® Credit Card

- Marriott Bonvoy Bold® Credit Card

- Chase Ritz Carlton Card

- Chase Freedom Cards

- Southwest Cards

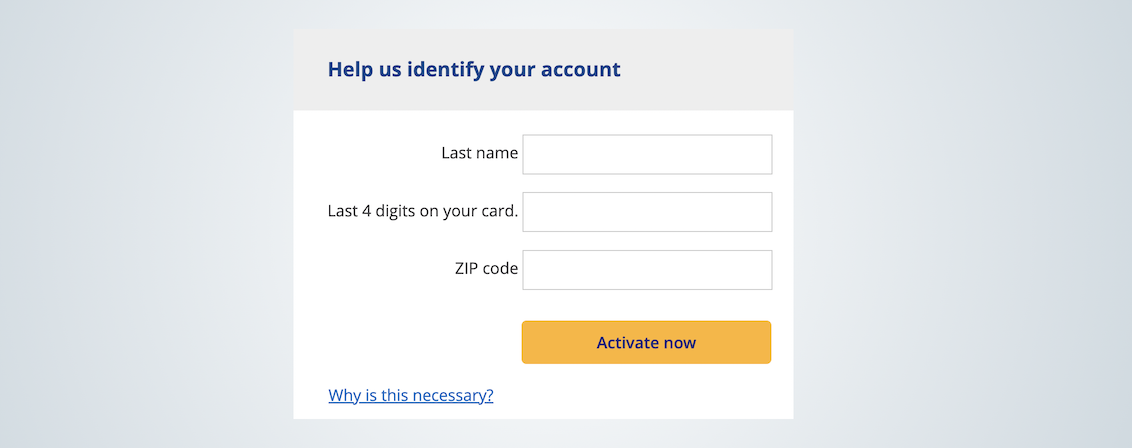

How to see what your offer is? You go here and fill in your information: Chase My Bonus Spending Offer

Should you pivot purchases to targeted cards?

It really depends. If you don’t have a card that earns bonus points on the targeted categories, it could make senes, but if not, it may net you a lower return on spend.

For instance, if you have a Chase Sapphire Preferred® and you’re earning 3x on dining I wouldn’t pivot to the IHG card and get 5x on restaurants. Why?

Chase Ultimate Rewards are conservatively worth 1.5c per point, meaning a 3x multiple is the equivalent of getting 4.5c back when you pay with your Chase Sapphire Preferred.

I’d value IHG points at $0.005 cents per point ( you can often buy them for this price ). So a 5x multiple is just earning 2.5c back per dollar spent on restaurants.

Now…if you don’t have a card that earns a multiple on gas, getting 5x points, as I was targeted to receive up above, is the equivalent of getting 3.5c back per point, and I’d say that would be a good use if you don’t have another option. Comparing again, if you had a Citi Premier that earns 3x on gas, you wouldn’t pivot away since Citi Thank You points are worth at least 1.5c per point.

Simply put… you need to make sure you’re earning the most back per dollar in dollar terms, not in point terms.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.