We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Beginner’s Guide: What is a Credit Freeze?

The digital age has brought ease to so many aspects of our lives, but it’s also created large databases of our personal information. If you haven’t been affected by one of these data breaches, you’re one of the lucky ones. For those of us who have received that dreadful notification that your data has been compromised…a credit freeze could help bring you peace of mind. Let’s get into what a credit freeze accomplishes, how to add one to your credit report, and of course manage it through new legitimate inquiries.

What is a Credit Freeze?

Simply, a Credit Freeze is a tool used to restrict access to your credit report. It’s something that can be easily done and will certainly help you if you’ve had any issues with Identity Theft, Fraud, or other issues pertaining to the security of your credit.

A credit freeze can also be advantageous if you’ve had a lot of hard inquiries on your credit report with a certain bureau, but not others. We’ll get into the specifics, but those inquiries may negatively affect your ability to secure new lines of credit even though you’re a solid borrower.

What does a Credit Freeze do?

- Prevents new inquiries into your credit from that credit bureau

- Stops applications dead in their tracks because credit can’t be pulled from the bureau of which you’ve frozen your credit.

Do I have to freeze my credit with all credit bureaus?

NO – there are 3 credit bureaus or reporting agencies ( Equifax, Transunion, and Experian) and they must be done individually.

- You can freeze one, two, or all reports. Fees may apply, but usually it’s free charge.

- Each of the 3 Credit Bureaus need to be frozen individually. Sometimes people have a lot of credit inquiries with one specific reporting agency. They could have applied for a lot of credit cards, or their identity was stolen and numerous accounts were fraudulently opened as a result. They can freeze that report while it heals.

- There are mixed reports that Bank of America and Chase will pull a different report if one is frozen. YMMV, but it’s worth asking, otherwise you’ll have to get a code or do a “temporary thaw.”

- Each of the 3 Credit Bureaus need to be frozen individually. Sometimes people have a lot of credit inquiries with one specific reporting agency. They could have applied for a lot of credit cards, or their identity was stolen and numerous accounts were fraudulently opened as a result. They can freeze that report while it heals.

Can I still apply for a new credit card?

- Yes, you can still apply for a new credit card. In the instance that the application is stopped by a credit freeze you can verify your identity with the credit agency and get a security code so that the bank can still pull your credit. You will save money by “thawing your credit” for that specific credit agency

- Bank of America and Chase will sometimes agree to pull other credit report

How hard is it to unfreeze or “thaw” my credit.

You can manage your credit freeze quite easily online, or if you’d like to speak to someone, they can assist you over the phone. You will need to provide your name, address ( this may be current as well as prior addresses), your date of birth, Social Security number, and perhaps other information that assists in the verification of your identity. Also be prepared to create a pin that will be used for future alterations to your credit freeze whether permanent or temporary.

- By law, they must unfreeze within 3 business days.

Why would I freeze my credit

- Identity Theft: this will help with fraudulent applications. While it will make applying for new credit more tedious, it’ll also safeguard the inquiries.

- A lot of recent inquiries:

- Usually the bureau that your credit report is pulled from is based on the state you live in. Let’s say that’s Equifax. If you’ve applied for a lot of cards, then you may have a ton of inquiries on Equifax, but your Transunion report may be clear or have only a couple hits. You could freeze Equifax and when you apply for a card say that your Equifax is frozen and could they pull from Transunion. This will help you out when it comes down to Hard Inquiries in your report and increases your odds for approval. If they won’t do it, you can either say forget about it, or get them an access code.

- This is particularly useful for credit card companies like Barclay or BofA which may be more strict on application approval depending on how many inquiries you’ve had.

- Usually the bureau that your credit report is pulled from is based on the state you live in. Let’s say that’s Equifax. If you’ve applied for a lot of cards, then you may have a ton of inquiries on Equifax, but your Transunion report may be clear or have only a couple hits. You could freeze Equifax and when you apply for a card say that your Equifax is frozen and could they pull from Transunion. This will help you out when it comes down to Hard Inquiries in your report and increases your odds for approval. If they won’t do it, you can either say forget about it, or get them an access code.

Who can still access my credit report?

There are situations and instances where your credit can still be accessed. So who can access your credit in the midst of a freeze?

- You can! You can still get your free annual report

- You current creditors

- If you currently have a credit card from Chase, Chase can access your credit in regards to those existing accounts, but your freeze would be in effect if you were to open a new line of credit

- Any debt collectors

- Utility companies may be able to in order to establish a security deposit on equipment

- Child Support agencies

- Certain Government agencies in regards to court orders or warrants

How can I freeze my credit?

Each of the three main credit reporting agencies maintain credit freeze pages where you can establish a freeze or manage a freeze.

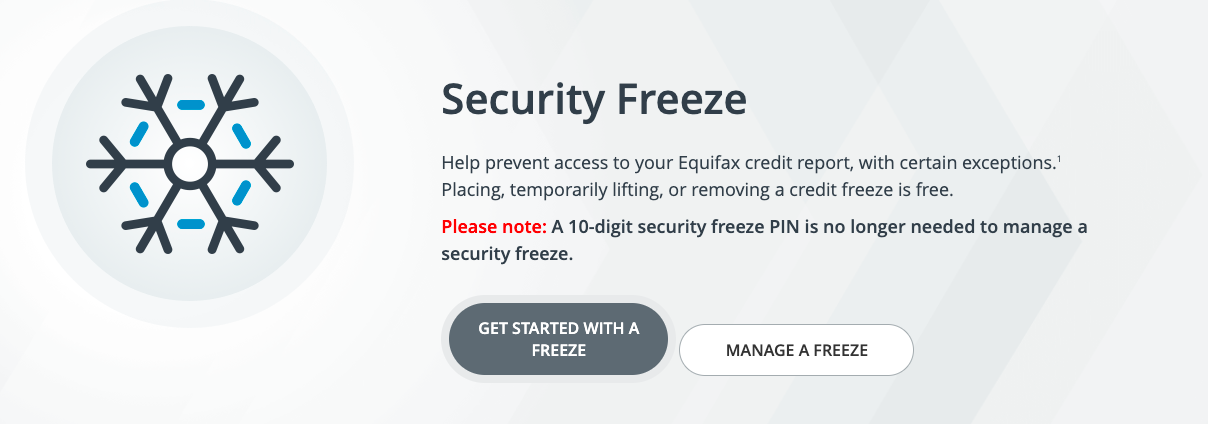

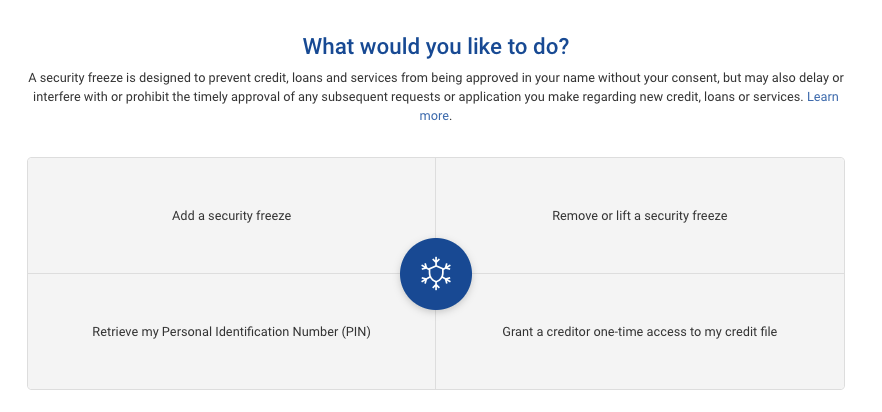

Equifax: You can Freeze your credit here

- Phone: 1-800-349-9960

Experian: You can freeze your credit here

- Phone: 1‑888‑397‑3742

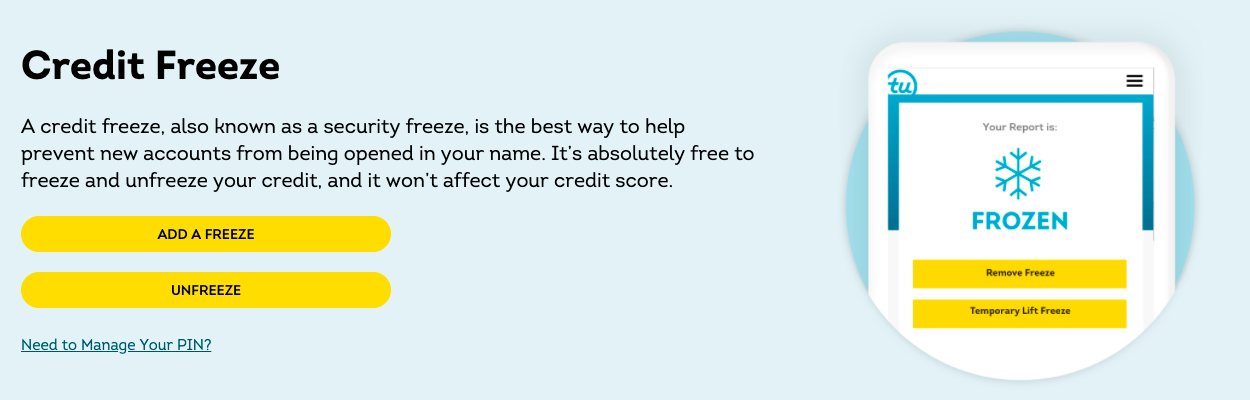

Transunion: You can freeze your credit here

- Phone: 1-888-909-8872

Overall

We are living amidst some historic times, and anything you can do to protect your credit score or position yourself is well worth doing. In fact, I just had someone send me a quick thank you note in regards to a credit freeze helping out. 6 separate credit inquiries had been blocked in the past couple of months.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.