We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Chase Ink Business Preferred® Credit Card

The Chase Ink Business Preferred® is my favorite all around small business credit card. I actually have two of them, and Chase has just announced their best ever offer on the card with a 120k point welcome bonus after $8k spend in 3 months.

I may just have to get a 3rd one 🙂 This card earns premium Chase Ultimate Rewards, great 3x bonus categories, and is often the card I refer to when people ask what the best business credit card to get3. Let’s break this bad boy down.

The Benefits of The Chase Ink Business Preferred®

The Chase Ink Business Preferred® has a low $95 annual fee and comes loaded with a bevy of benefits and perks.

First off you earn 3x on the first $150k spent on travel, phone/cable/internet, Social Media and Search Advertising, and shipping. For a lot of online businesses, this is a great way to earn a ton of transferrable points on social/search ads.

- 120k point welcome bonus after $8k spend in 3 months

- 3x on first $150k spent on

- Travel

- Phone, Cable, Internet

- Social Media/Search advertising

- Shipping

- 1x on all other purchases

- Cell Phone Insurance

- No Foreign Transaction fees

- Add additional employee cards

- Redeem at 1.25c for travel with Chase Travel

- $95 annual fee

- Member FDIC

Tell me more about Chase Ultimate Rewards

The Chase Ink Business Preferred® earns premium ultimate rewards which means they can be used in the portal ( for 1.25c with this card ) or they can be transferred in the following transfer partners. This is how we travel in business and first class – outsized value in transfer partner sweet spots.

Is the Chase Ink Business Preferred® limited by 5/24

Yes, if your credit report reflects 5 new accounts being opened in the last 24 months you will not be eligible for the card.

Is this the best offer we’ve seen on the Chase Ink Business Preferred®?

We keep an updated best offer spreadsheet here, but historically this is what we’ve seen

- July 2024 – 120k offer after $8k in 3 months

- Early 2024 – 100k offer after $8k in 3 months

- 2023 – 100k offer after $15k in 3 months

Hitting $8k in 3 months is difficult for my business

I would check out this post where I discuss using Plastiq as a way to put expenses your business would ordinarily pay cash for like rent, auto leases, utilities, contractors, business services, etc on your credit card. When you start to factor in total expenses, many businesses easily spend $5k a month. The ability to earn a massive bonus is worth paying a service charge in my opinion.

But I don’t have a small business, Miles. You may, and not know it. Keep reading.

If you have a side hustle, earn money from the gig economy, or even now what people are referring to as the creator economy…the odds are strongly in your favor that you qualify for a small business credit card. So many people earn money that isn’t W2 income, but they haven’t established formal LLCs or S-corps that have EIN ( Employer Identification Number), and they aren’t taking advantage of what that income opens the door to….but they can still apply and get approved for small business credit cards.

If you’re earning income on a 1099, you’re good to go. Some examples of those are…

- Online Coaches, tutors, etc

- Uber and Lyft drivers (assuming they still get 1099s whenever you’re reading this).

- DoorDash, GrubHub and Postmates

- Social Media income ( TikTok, Instagram, YouTube )

- Cater Waiters

- Personal Trainers

- Dog Walkers

- Freelance graphic designers and web designers

- Singers, artists, dancers, models, etc

- Virtual Assistants

- Ebay, Amazon and Facebook resellers

How about a deep dive into the benefits I extract the most value from:

1) Earning Transferrable Ultimate Rewards

First and foremost, the sign up bonus is amazing and puts you well on your way to some incredible redemptions. How? As I’d mentioned in the intro – this card is one of Chase’s premium cards – meaning it earns fully transferrable points. The ability to transfer into partner programs is the single best way to consistently get maximum value for your Ultimate Rewards

Business class starts at just 60k with United, 65k with Singapore Airlines from the US to Europe. Incredible value to fly flat and hit the ground running when you get to your final destination. You can transfer instantaneously to United and fly on partners like Lufthansa in first class which is uber cool if you ask me.

In fact, 110k United miles will fly you in Lufthansa First Class from the US to Europe. One of the benefits of using United miles vs other currencies is the taxes and fees are minimized.

2) 3x points on Travel

Being in the travel business means it accounts of a large portion of my business expenses. Chase has a broad and generous definition of travel:

Airlines, hotels, motels, timeshares, car rental agencies, cruise lines, travel agencies, discount travel sites, campgrounds and operators of passenger trains, buses, taxis, limousines, ferries, toll bridges and highways, and parking lots and garages

I’m always surprised at the end of the month when I see how many different places I accumulated triple points simply by using this card.

3) Cell Phone Insurance

This is an outstanding benefit and typically not one of the main advertising points of this card, but saves me $10-15 every month. The Chase Ink Business Preferred® provides cell phone protection so long as you pay your bill with the card.

Yes, that’s right, you can switch your current bill over to the Chase Ink Business Preferred®, and you and your employees phones will be covered with following benefits:

- $600 of protection with a $100 deductible

- Claims 3 times per 12 months

Exclusions:

- Lost phones are NOT covered

- Covered phones must be purchased new. Refurbished or resold phones are NOT included

- Only covers you and your employees listed on your monthly cell phone bill

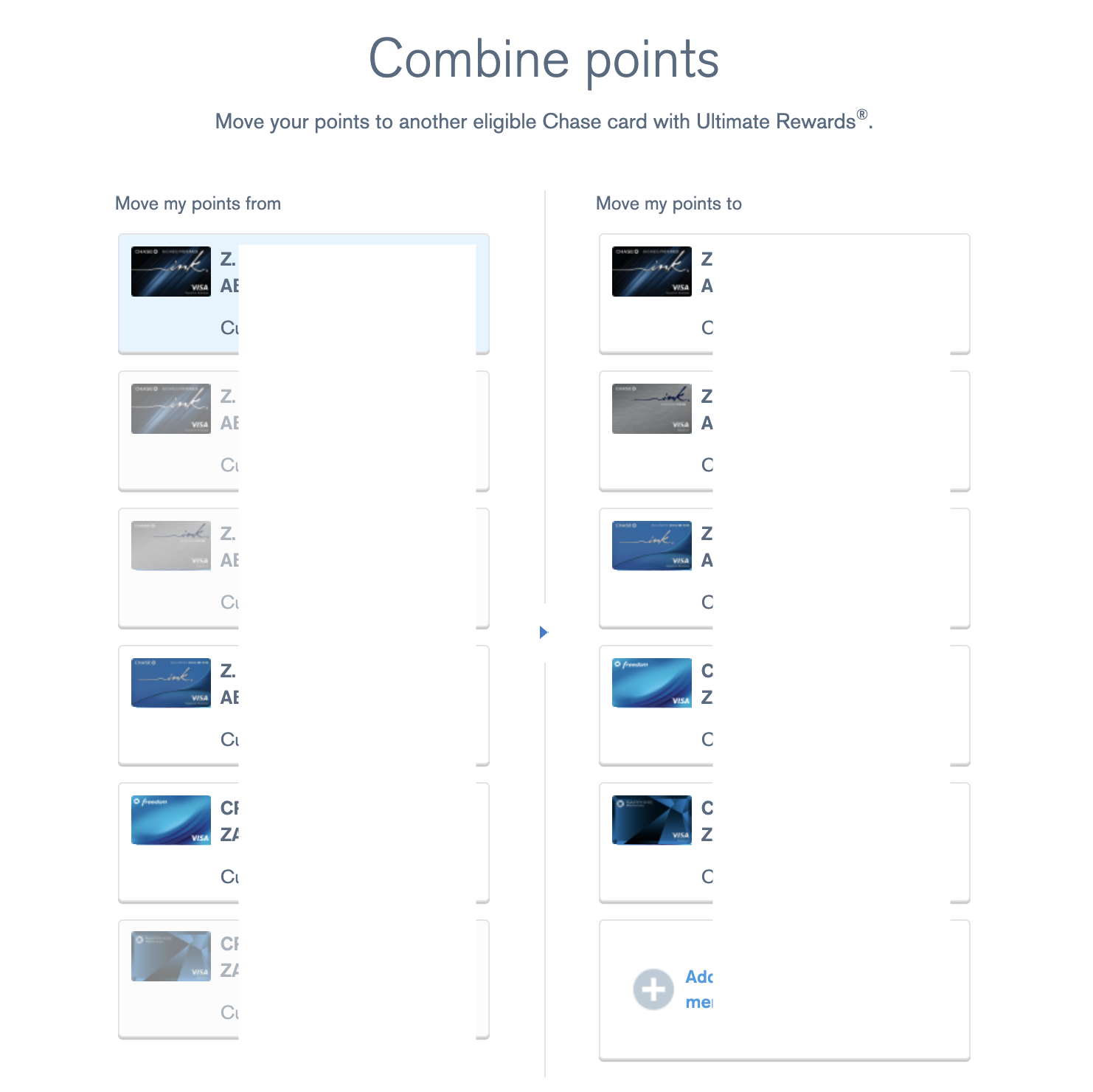

4) Transfer your Freedom/Ink Cash, etc into Ultimate Rewards

One of the great things about having a premium Chase Ultimate Reward earning credit card, is it allows you to increase the value of points you may earn on other Chase products. What does this mean? It means that you can transfer points earned from the Chase Freedom Unlimited®, Chase Freedom Flex(SM), Chase Ink Business Unlimited®, or Chase Ink Business Cash® into the Chase Ink Business Preferred® and they become transferrable.

You can read this article about how that works.

Go here to see our favorite uses of Chase Ultimate Rewards

Overall:

This is a card I can’t imagine parting ways with. It not only has an incredible welcome offer, but has benefits that keep it front and center in my wallet. The only downside to the new offer is the larger spend threshold, but the ability to process

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.