We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Cardless has debuted two co-branded cards from Qatar Airways. If you weren’t aware, Qatar Airways is a member of One World ( American, Japan Airlines, British Airways, Alaska, Cathay, Qantas, etc ) and their loyalty program is now a part Avios.

Last year, as a part of the Avios process, you could link your British Airways and Qatar Airways Loyalty accounts and the point balance in either would populate both accounts, and since you can merge BA with Iberia and Aer Lingus, the Avios group is a partner of all transferrable currencies in one way, shape, or form.

It’s also interesting that Qatar Airways chose Cardless instead of Chase which has BA/Aer Lingus/Iberia cobranded cards, and Cardless has debuted two versions of the Qatar Airways credit card.

Let’s take a look!

Qatar Airways Signature and Infinite cards from Cardless

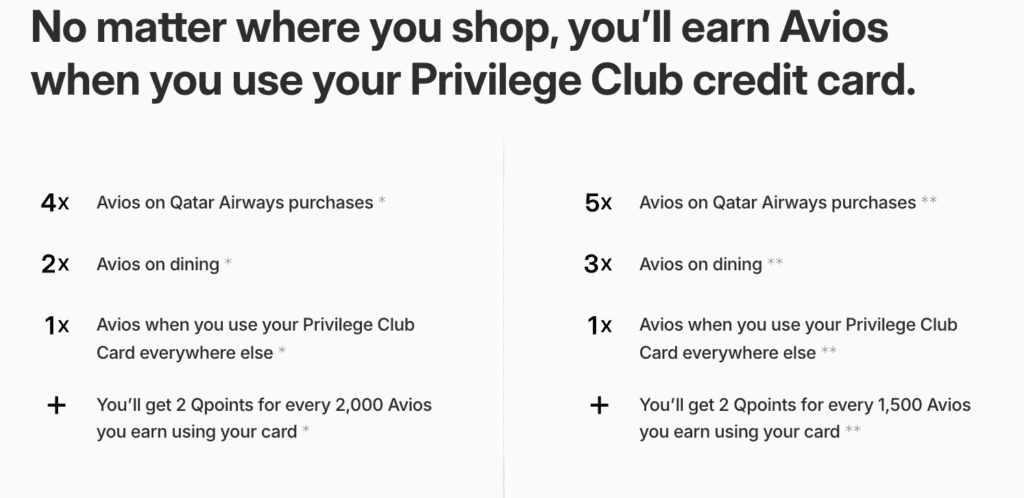

One thing that you could do is earn your way to status, but otherwise, the earn rates aren’t anything to write home about.

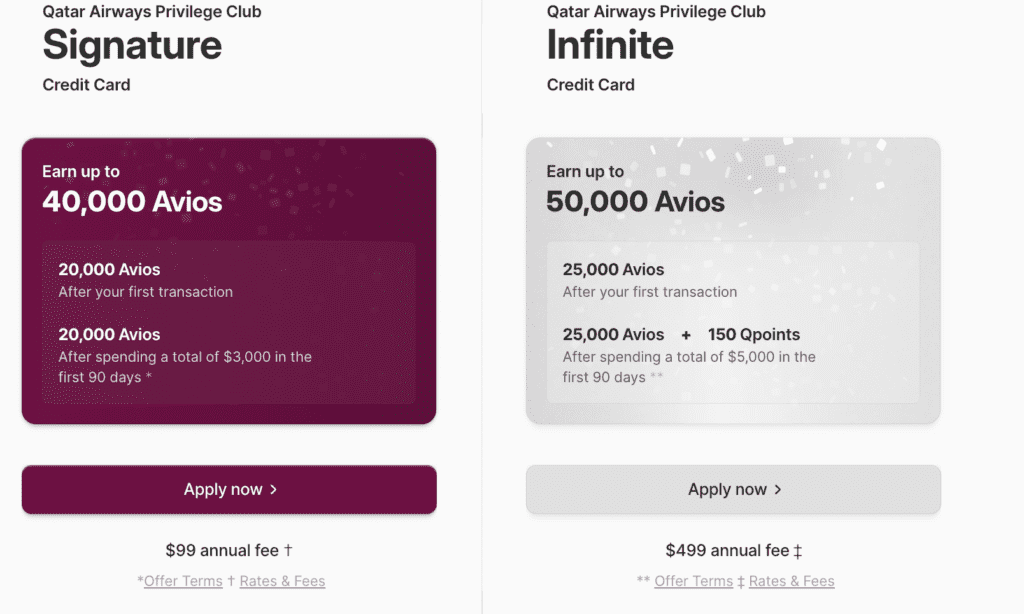

Welcome Offers:

Both cards offer a high enough bonus to offset the first year fee although neither are that mindblowing.

First Year on Infinite = One World Sapphire

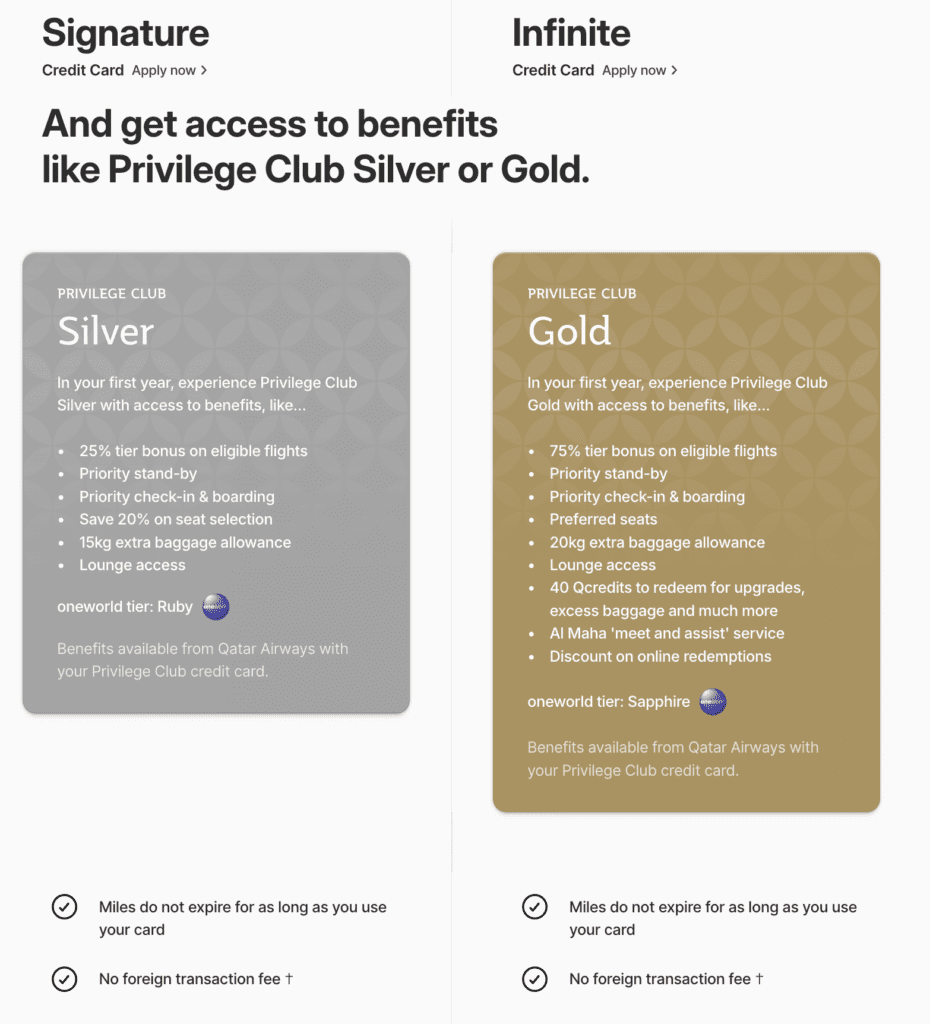

Personally, I see quite a bit of value in the premium version, and little value in the lower annual fee version. Why? The premium, Visa Infinite, for the first year, comes with Qatar Airways Gold Status = One World Sapphire.

Why is One World Sapphire a big deal?

It means you’d be able to use business class lounges when traveling in economy everywhere except Qatar. So, if you’re flying on an economy ticket in the USA, and you show your One World Sapphire status at an American Airlines Admirals Club, you’d gain entry. This is very valuable if you travel a lot and could make use of the lounge access within the One World Network. Is it enough to entice me to get the card….I’m not sure. I just recently status matched to British Airways via Virgin Atlantic, I’ll see how that turns out, but I may have access that way.

Would I get a Qatar Airways credit card from Cardless? Possibly the $499 Infinite one.

Would I get a Qatar Airways credit card from Cardless? Possibly the $499 Infinite one.

The fact that you could pick up 50k Avios + lounge access for a full cardmember year is worth $499 easy. Is it worth a slot in your wallet long term? To me, it probably isn’t if I get matched to BA, but if that status expires and this offer stands, I may just add it to my wallet and enjoy some lounge access when I fly econ in the USA.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.