We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I lived in LA for nearly 15 years, and for a few years of that stint, I was very near “The Grove” and am very, very familiar with the area around it. When I saw that Kimpton opened a hotel just around the corner, I thought it’d be a perfect spot to spend 4 nights on a work trip. I’ve stayed at 3 other Kimpton properties in town ( Everly, Palomar, and La Peer ), and I have to say that this may be the best bang for buck.

Kimpton Wilshire Stay Details

- When: January 2023

- Where: Los Angeles

- Rate: 125k

- 41k to 42k per night

- 4th night free from IHG One Rewards Premier credit card

- 10% back from IHG One Rewards Select

- Status: Diamond

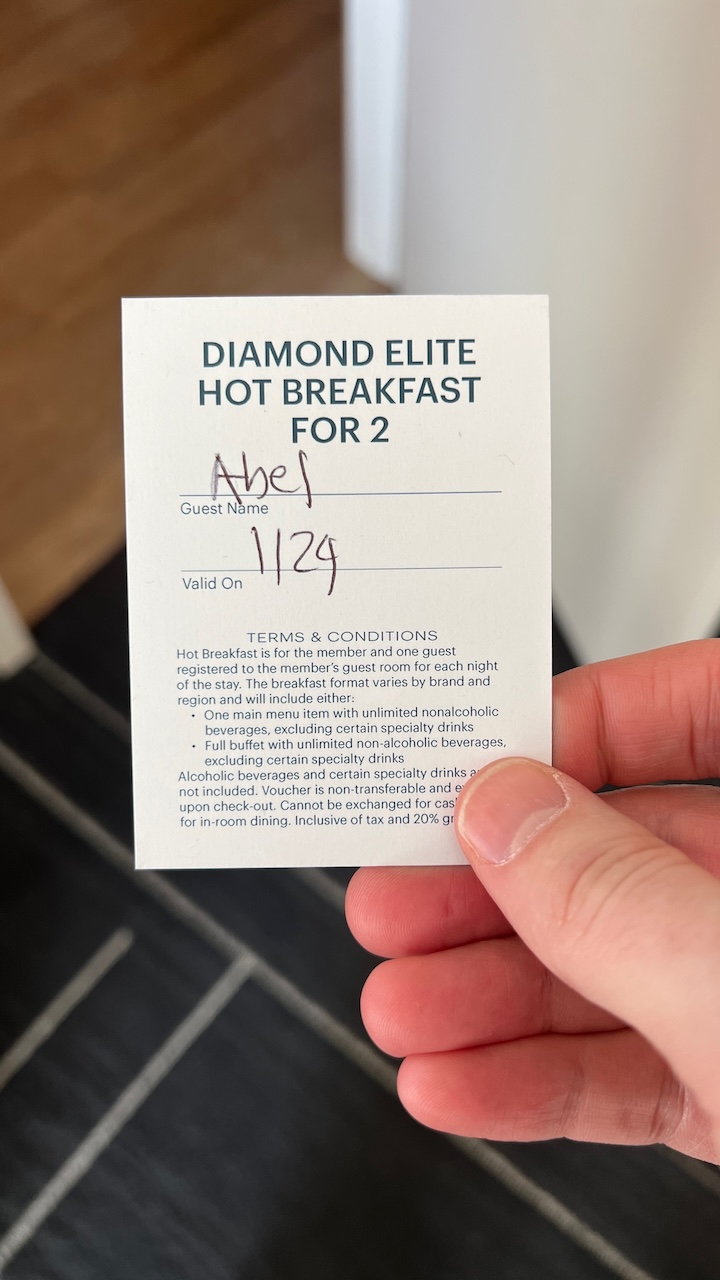

- Free Breakfast

- Late Checkout

- Free Breakfast

- Parking

- $55 a day and not included

- Pet Friendly – no fee

Kimpton Wilshire Location

Having lived in this neighborhood, I’m quite familiar with it and enjoy it; however, despite being very central, you 100% need a car, and aside from the Grove you aren’t really near any of the main tourist attractions.

In a way it’s similar to the Kimpton Palomar which is along the Wilshire corridor and a short walk to Westwood where UCLA is located, but not really close to Hollywood, Beverly Hills, Universal, Santa Monica Pier, etc.

I find this location great as somone who isn’t looking to do those things, but wanted to be close enough to restaurants, friends, and the meetings I needed to attend.

Booking the Kimpton Wilshire

I took advantage of the IHG Rewards Premier credit card 4th night free and booked 4 nights at the Kimpton Wilshire for 125k IHG One Rewards. In addition to that, I still had IHG Diamond status from a status match, and since I still have the IHG One Rewards Select credit card I get 10% of those redeemed points back as a cardmember benefit. In total.. I paid just 112,500 points for a 4 night stay ( roughly $557 ). Typically the hotel retails on the low side for $200 to $250 per night before tax, so using points basically meant I stayed for half off.

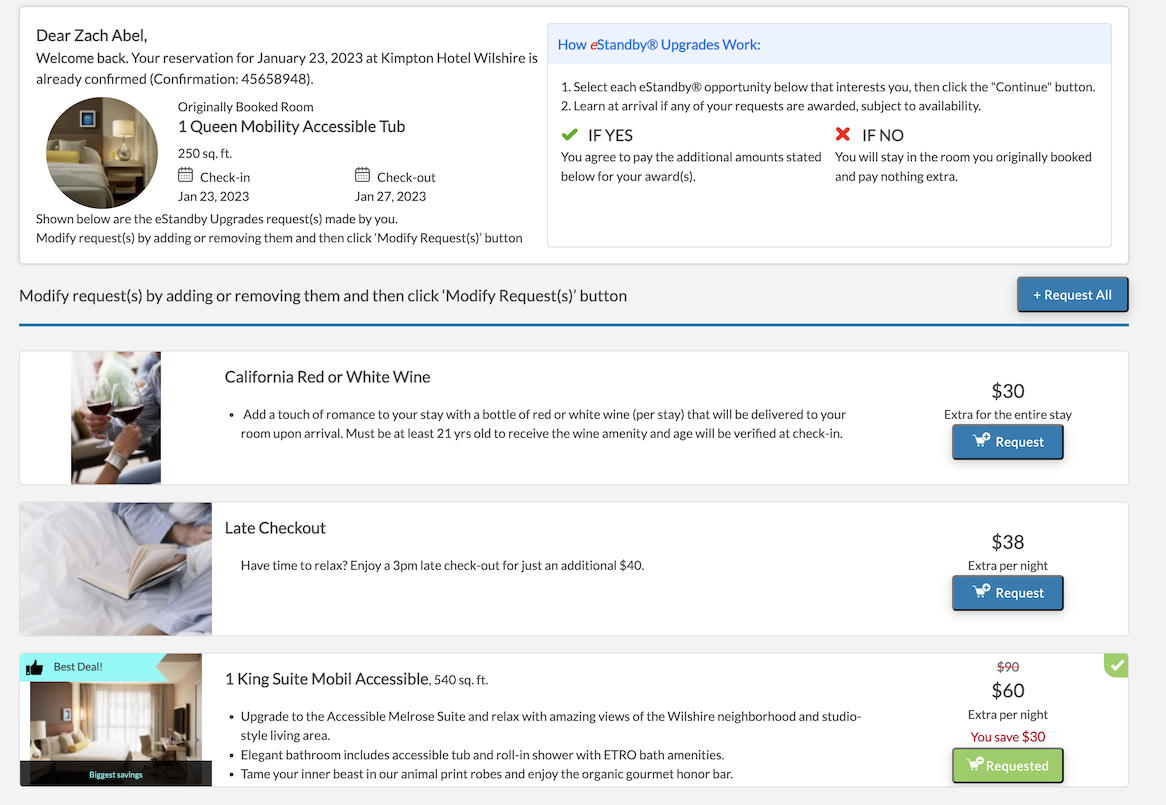

I also took advantage of an upgrade offer of $60 per night to secure a suite for stay ( well worth it for this price ).

Check in

Check in

We arrived late evening, after a great British Airways First Class LHR to LAX flight, and we were told that we had a King Suite waiting for us. Part of me wondered if we’d get upgraded further, but alas, we had the room we upgraded to.

I was given breakfast vouchers at check-in and told that it was served on the roof. THE ROOF?!

2nd Floor Lounge

There is a coffee station and work areas akin to a co-working space

King Suite Mobility

The King Suite is more of a Junior Suite than a true suite, but the added space was welcomed for a 4 night stay. Whenever I’m traveling with my wife, or really anyone else, and jetlag is involved, it’s always very nice to have a place where you can do some work and not disturb the other person. The living space in the suite was offset, but not really enough to completely obscure light at odd hours.

The suite as per Kimpton

The mini bar

In inquired if we could move suites since we had no need for the accessible bathroom, but nothing else was available.

Breakfast/Pool at Videre

Breakfast/Pool at Videre

This is undeniably the coolest part of the hotel…rooftop pool looking over the Hollywood Hills where you can have drinks and food.

The food was very good, in fact, I’d almost come here when not staying at the hotel just for a great view and hardly anyone was ever there.

Overall

I would stay here time and time again if the prices are in this range.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.