This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

What a Joke.

View from the Wing wrote about AA’s CEO, Doug Parker’s comments on Mileage Running – a slap in the face of a large community who enjoyed flying, and earning status by making use of 1 mile flown, 1 mile earned. It’s that attitude that led me to drop any attempt to achieve status with American this year ( I’m currently Executive Platinum). I mean no status. I’m not even going to go after Gold. Why would I go for Gold when I can just challenge for Platinum later in 2018 ( you can’t do this if you hold any status whatsoever.) Another reason is I’ll end the year at a minimum with Alaska Gold, maybe 75k, and I’m planning on going after British Airways Silver or Gold ( depending on the results of my requested status match) so I can select seats, and have lounge access domestically. Regardless, I was till interested to see what my offer would be to Buy up to Elite Status.

Here’s my current progress

At the beginning of the year I thought that I would try for Top Tier in both airlines. My travel plans changed quite a bit, and Alaska also announced that earning on AA flights would drop dramatically. As a result, I did credit flights to AA somewhat, but for the most part avoided the practice.

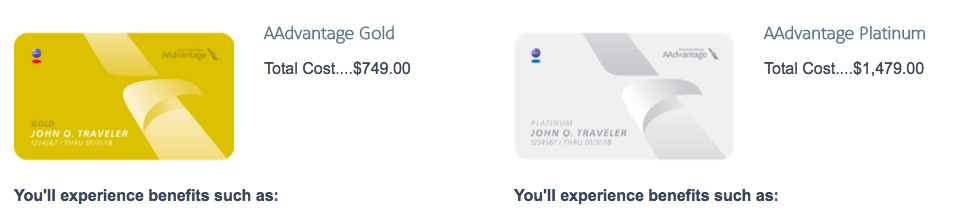

AA’s buy up to Elite Status offer for Gold AND Platinum

Verdict: Not even close to worth it

American offers status challenges all the time. In fact, if you do them post July you’ll retain status for that year and the following. Meaning, if I were to challenge for Platinum in July of 2018 and meet the requirements I’d keep the status until Feb 2020. I’m not even sure I’d care to do that…if I get mid-tier status with British Airways I will gain access to Main Cabin Priority and Extra seating, and I can use all the Admirals clubs when flying domestically. The only real thing that I can see that would make AA’s Platinum status worth it is no $75 close-in booking fee, and use of 500 mile upgrades.

Gold…for $749 – ya, right.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.