We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

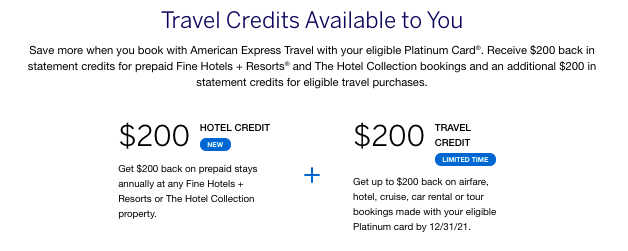

Amex Platinum $200 hotel credit

AND $200 Travel Credit

Nope, you didn’t read that incorrectly. I was able to make use of 2, $200 credits on a single hotel stay. First off, Amex Platinum cardholders get a $200 statement credit when they book a pre-paid Fine Hotel and Resorts or Hotel Collection stay (enrollment required). Second, and I must sheepishly admit, I had completely forgotten about the Amex Platinum $200 travel credit floating around. These were targeted and served as a sort of pre-emptive retention bonus that many Amex Platinum cardholders received in 2020. These can be combined and I was reminded of it prior to booking a hotel stay this upcoming week. Let’s dig in a bit.

Miles…I had no idea about the Amex Platinum $200 Travel Credit. Do I qualify? Check here

Miles…I had no idea about the Amex Platinum $200 Travel Credit. Do I qualify? Check here

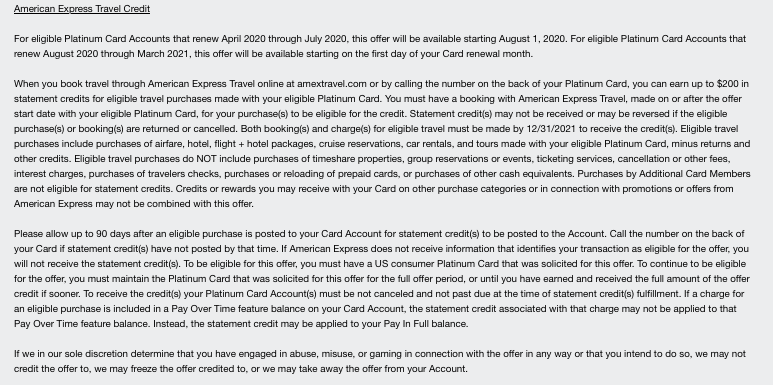

That link up above should tell you if your account is eligible, but here’s the skinny:

- If you renewed between 4/20 and 7/20 the credit was available starting 8/20

- For those who renewed 8/20 to 3/21, it was available starting on the first day of your renewal

- Must book via Amex Travel

- airfare

- hotel

- flight + hotel

- cruise

- car rental

- tours

- see details for restrictions

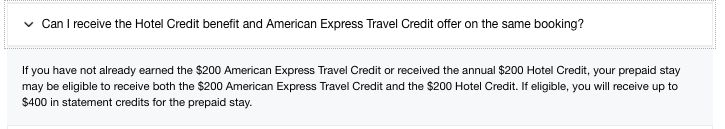

Can the Amex Platinum Hotel and Travel credits be combined?

Yep…and I just saved $400 off a hotel booking.

See if your account is eligible here

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.