This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

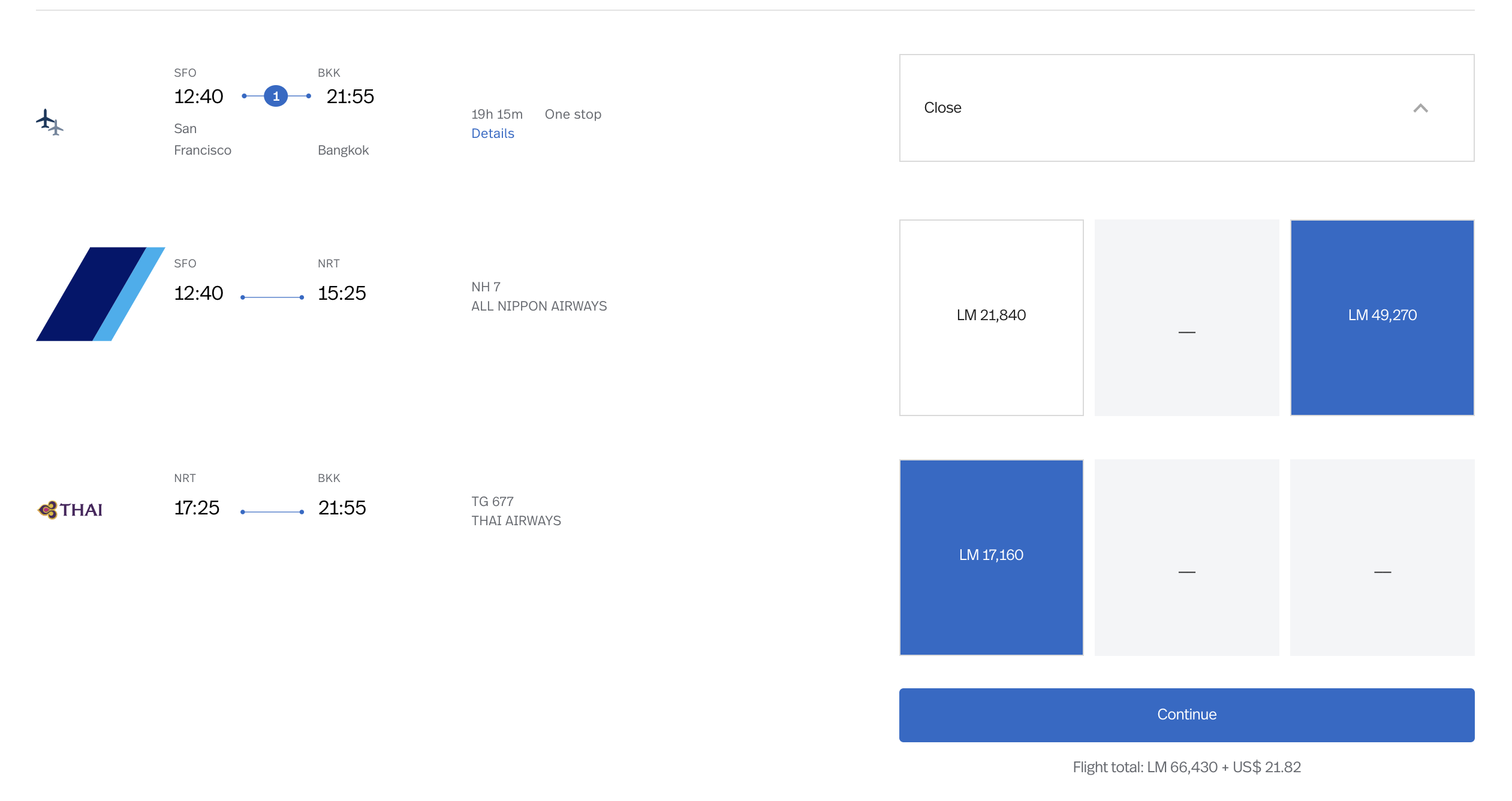

Earlier this week I booked 2 First Class ANA award ticket with Avianca Lifemiles.

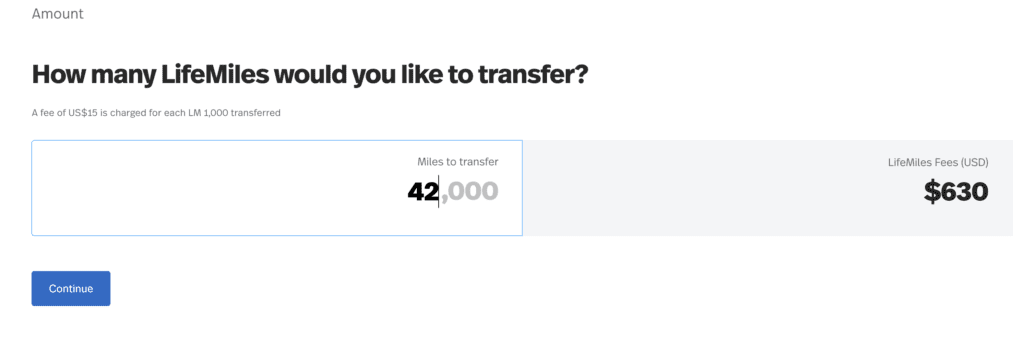

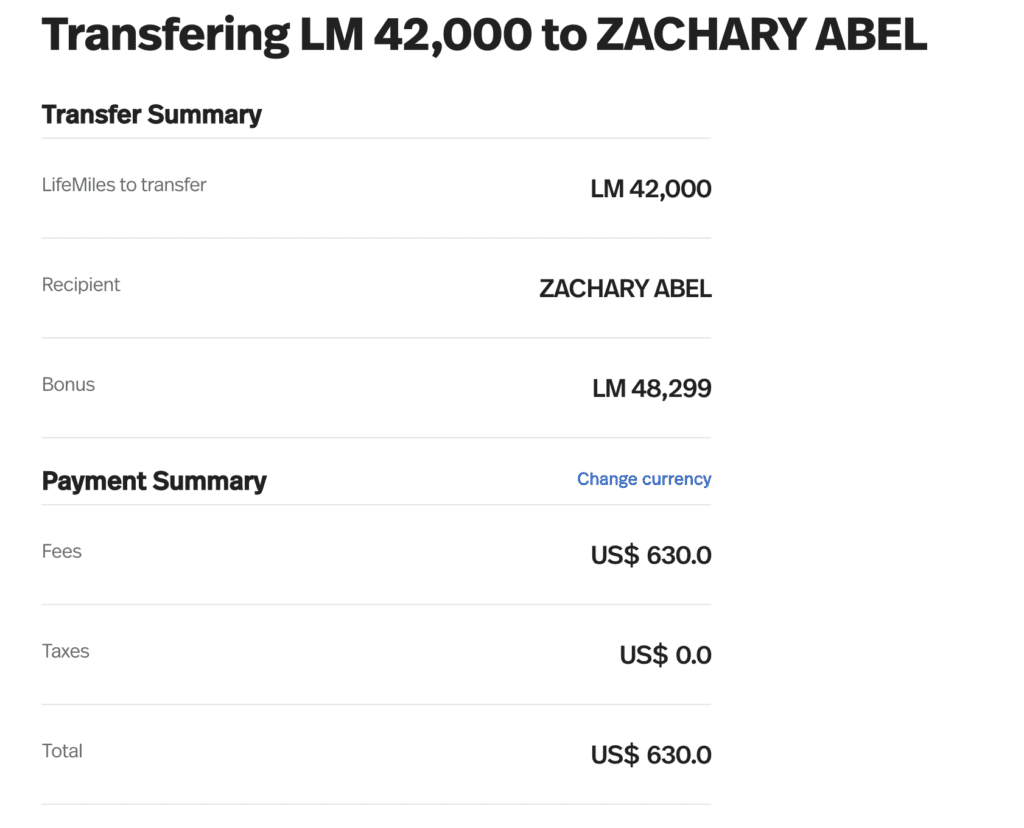

Up until yesterday, Avianca was running a pretty sweet, yet circuitous, point purchasing promotion via a 115% transfer bonus between LifeMiles member accounts. How sweet? Well, we purchased 48k miles for just $630, or just barely over 1.3 cents per point. ( I’d note that OMAAT had a special for the last day of a 120% bonus.) I want to run through a few things that I learned in this process that will be helpful to you if you end up in a similar circumstance.

Finding the ANA award space.

I didn’t search with LifeMiles to begin with, my goto for this space is United, but once you’ve found the space elsewhere you need to confirm that Avianca indeed has access to it. While Avianca LifeMiles can have huge advantages price wise, it doesn’t always have the same space available.

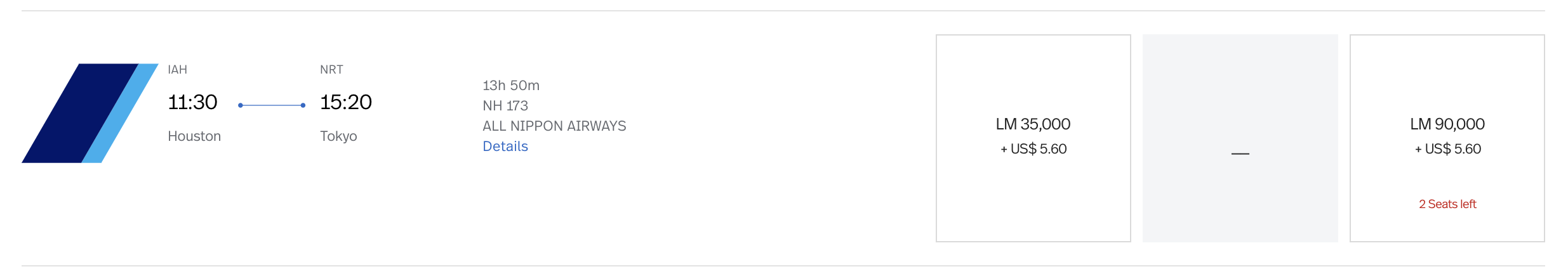

This isn’t very difficult at all, log in to your account, hit fly, and then search. Two ANA First Class seats were showing as available for 90k miles a piece.

Why did we buy points when we had the full amount available?

Both my fiancee and I had the full amount of points in our Amex accounts in order to transfer over 1:1. However, we made use of the promotional transfer bonus as I value Amex points far in excess of just 1.3 cents. How did that work?

Transferring from Amex to LifeMiles to partner account with 115% bonus

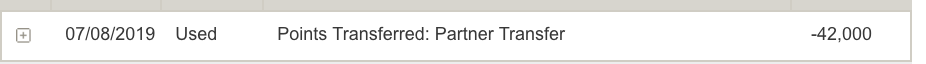

First we transferred 42k points from Amex to Avianca LifeMiles. This is instantaneous

Then I transferred 42000 into my Fiancee’s account. This meant she would net 90k total points. The cost of that was $630. We then repeated the same process of transferring from Amex to LifeMiles to my account.

Our Tickets were confirmed and we had locked down two first class tickets for 42k and $630. Pretty stellar.

We needed to either change or cancel. This, again, proved to be incredibly laborious and difficult.

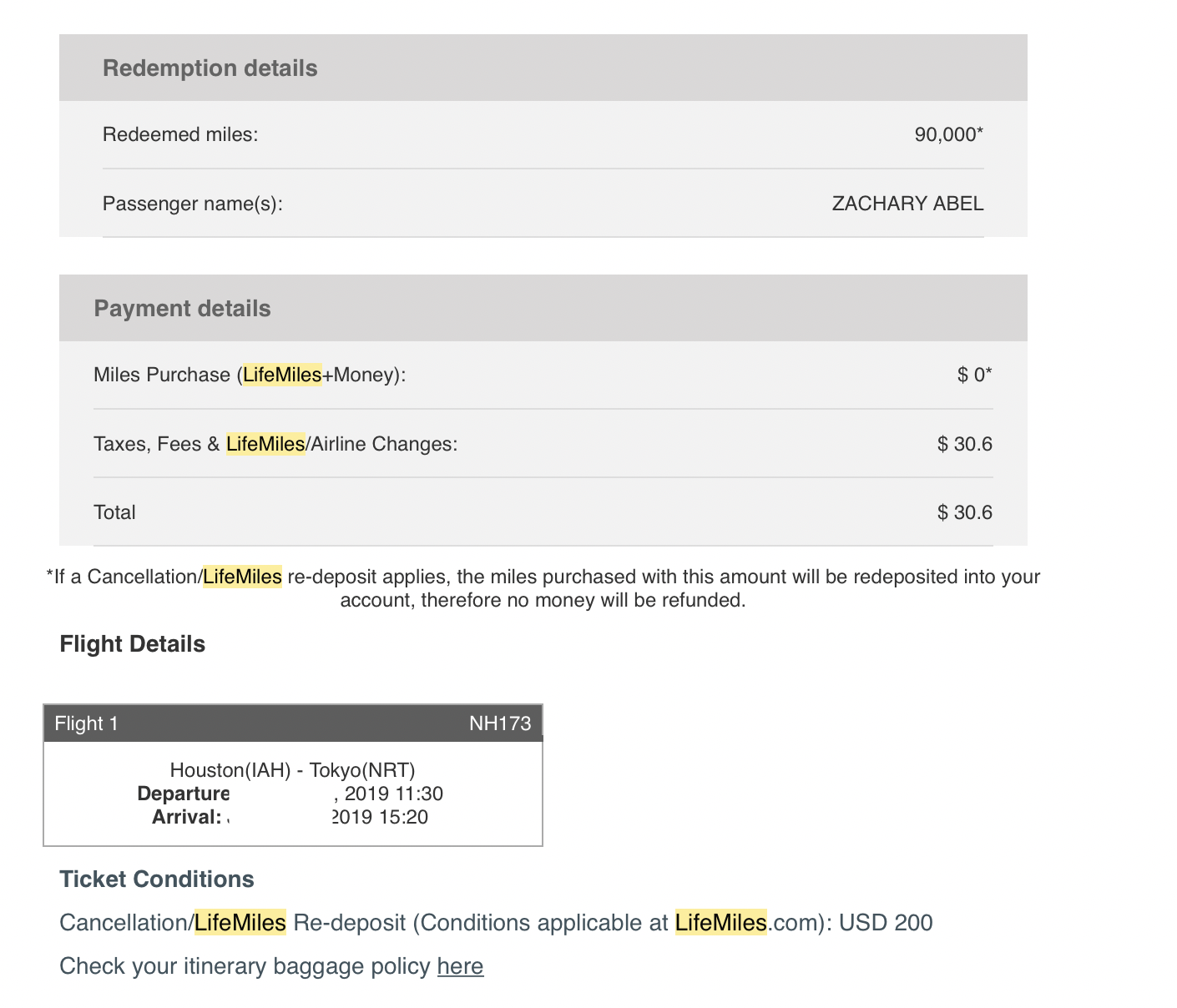

While I’ve had to do this in the past, I haven’t run into this specific situation where I just wanted to keep regions the same, but change origin, and/or destination. As you can see above, the fee to do so is $200

I learned a few things

- Calling LifeMiles near their closing time meant no one picked up unless I requested the main Avianca number to manually patch me through. This happened multiple times. The English line is closed from midnight to 6am ( GMT -5) .

- Whether it’s possible or not, after a handful of different reps, over a few days, the origin and destination could not be altered.

- I thought this would be possible if I tried enough times…no cigar. Hard and fast rule apparently, you can cancel, change the date/time, but you can not change the origin or destination. Maybe I didn’t HUCA enough, but seemed hard and fast.

- We actually wanted to cancel/change at the 25 hour mark. They were willing to make an exception to the 24 hour cancellation rule, but said it would take 5-10 business days for their office to process the request. It couldn’t be done over the phone and someone would need to contact me. We wanted to use the miles in that window so we passed.

The process of cancelling.

Calling during the day has proved to be very expeditious, and I got a rep on the phone within a couple of minutes each time. Canceling, however, was more work that it should be

- You need

- your Record Locator

- Avianca LifeMiles number

- All flight details

- Pin…located in your profile at the bottom

- You Cannot

- Cancel someone else’s itinerary without them being on the phone

- Use another person’s credit card ( I added my parents as authorized users to hit my Amex authorized user bonus )

How quickly did my miles show up in my account after cancellation?

The miles were in my account instantaneously. They will tell you it can take much longer, but my experience was instant.

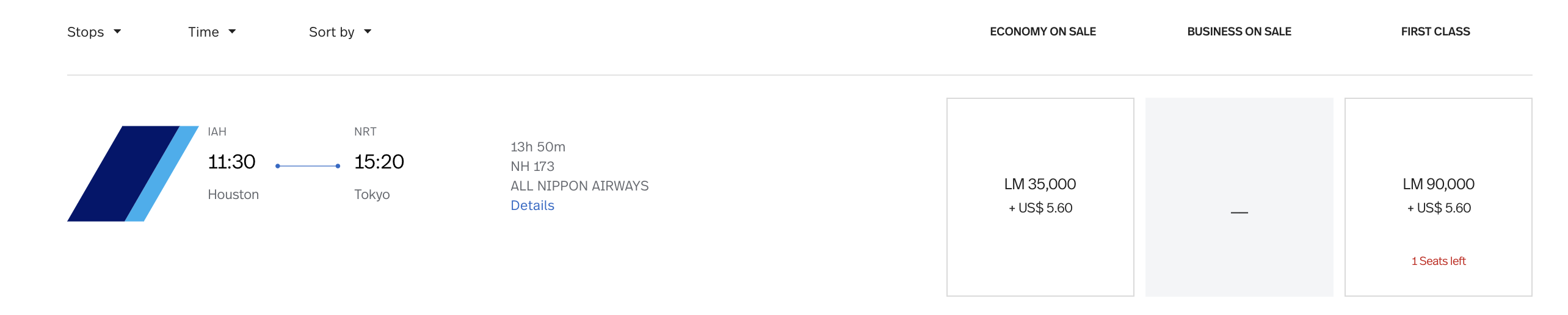

Did the ANA First Class space come back?

It absolutely did. Within a couple hours it was back up. Could have been instant but I ran out to lunch right after my hour long cancellation call with LifeMiles. They were in there when I returned a couple hours later.

Looking to book ANA for even fewer Avianca points? How’s less than 67k points sound?

It’s well known that LifeMiles prices their tickets per segment, and if you add segments in a lower cabin class, it’ll reduce the amount needed not only for the First Class segment, but the entire segment. This can, and often does, result in a total lower price for a multi-segment routing than a one way. Check out this crazy pricing…

With the same strategy as we employed above…you could access this inventory with just 31k points because 31k * 2.15 = 66,650 LifeMiles. Of course…you’d have to pay for the bonus points ( roughly $463 ), but what a deal!

Recap

With Avianca in financial trouble, they’re coming up with more and more creative ways to generate revenue, and highly likely profit through mileage sales. They had a tremendous sale earlier this year, and this transfer bonus was even better ( IMO ). However, despite the appeal of cheap points and great access to premium cabins, we have no idea what Avianca might do with the program. I’m sitting here with 90k points in my account and urgently awaiting some clarity on this trip we’re looking to take because I want to burn them fast.

It absolutely stung having to eat $400 in cancellation fees, but unfortunately for us, what started out as a mega win redemption wise, quickly proved to be a learning lesson.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.