This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Buy AA miles for 1.77 cents until January 3rd

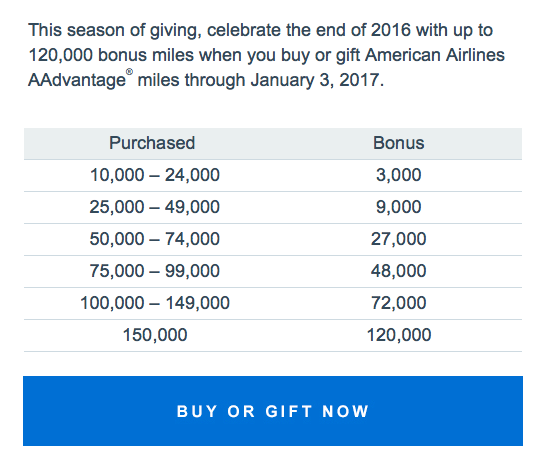

I just received this year end offer from American Airlines. It’s up to 120,000 bonus miles when you purchase up to 150,000 miles. After taxes this comes out to $0.0177 per mile. If you’re thinking you need some extra miles, are short miles for a planned trip, or just want to shore up an account a future trip…this is a great opportunity. Buy AA miles for 1.77 cents until January 3rd.

The offer:

It’s tiered

If you buy the most…it comes out to $4786.88 for 270k miles.

I used 57,500 miles to fly Air Berlin earlier this year. Those miles would cost you 1,017.75 one way. Not bad for a biz class ticket. It would also be enough to fly on American’s Flagship 777-300ER in Reverse Herringbone Business Class. A great, great product.

Air Berlin Business Class

AA 777-300ER Business Class

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.