This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I first heard about Cardless from Zach Honig who left The Points Guy to join the FinTech venture. I follow him on Instagram and he’s always posting great travel content. Cardless is digitally a native, in fact, if you get one of their cards it will first populate your smartphone wallet, and once you do receive a physical card it won’t have a number on it. Zach’s been dropping hints at a cool new product they’re working on and now we know what it is – a partnership with LATAM featuring a cobranded credit card for the US market.

Here’s an overview… if you’re interested -> https://www.cardless.com/latam.

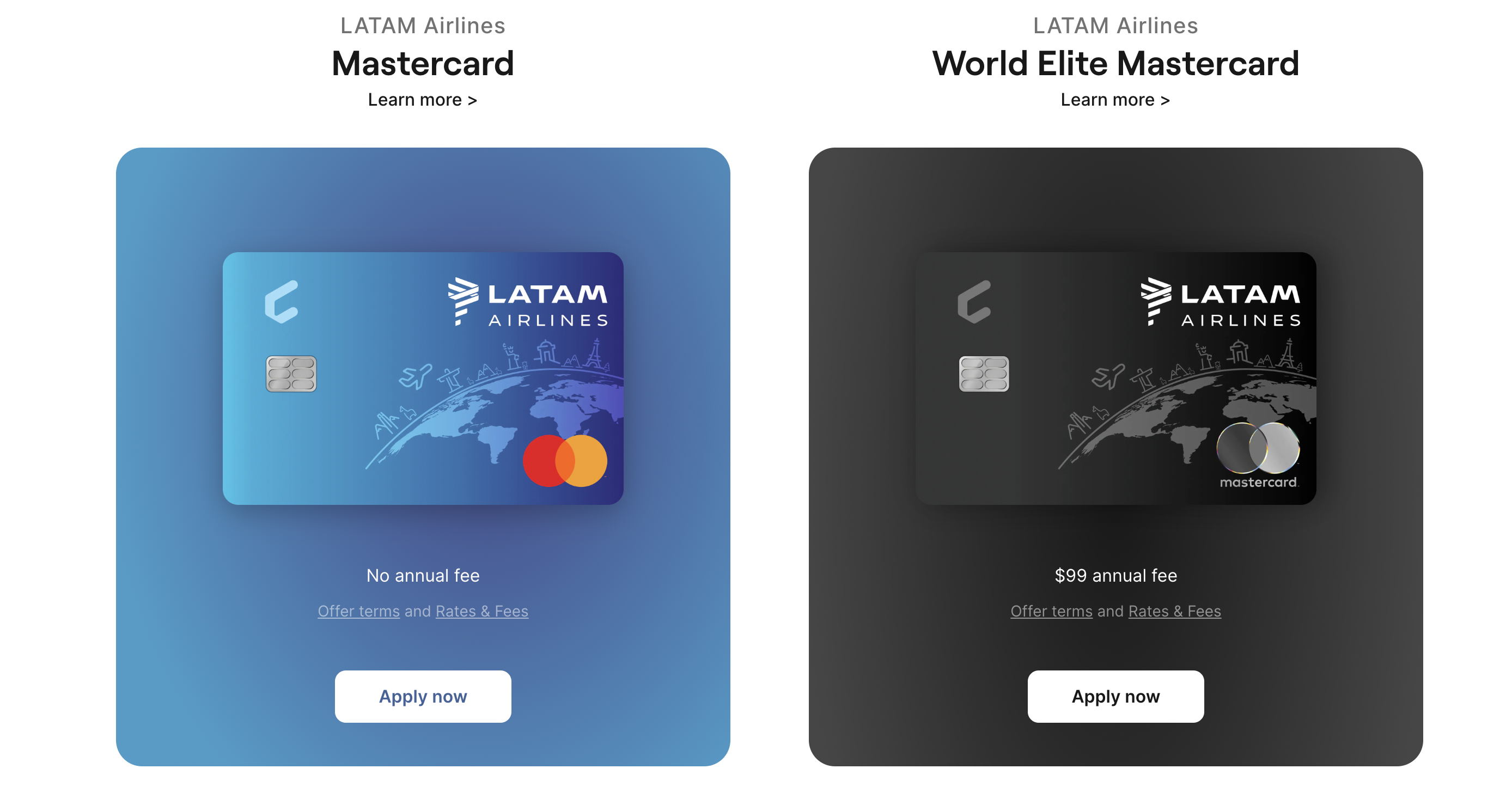

| LATAM Airlines Mastercard | LATAM Airlines World Elite Mastercard |

|

● Annual Fee: $0 ● Sign-up Bonus: 15,000 miles after $1,000 spent in first three months ● LATAM Purchases: 3x ● Restaurants, Ground Transportation: 2x ● Everything Else: 1x ● Qualifying Points: Issued at a rate of 10% of miles earned from card purchases* ● Foreign Transaction Fee: None

|

● Annual Fee: $99 ● Sign-up Bonus: 40,000 miles after $2,500 spent in first three months ● LATAM Purchases: 4x ● Restaurants, Ground Transportation: 3x ● Everything Else: 1x ● Qualifying Points: Issued at a rate of 20% of miles earned from card purchases* ● Upgrade Coupons: 3** ● LATAM Lounge Access: 2 passes per account year ● Foreign Transaction Fee: None |

I’m not going to be adding either of these to my wallet immediately, but I would be most interested in the premium version for these 3 reasons

- Sign up Bonus

- 3 upgrade coupons

- LATAM lounge access 2x a year per account

Those 3 upgrade coupons are enough to upgrade 3 short haul flights, or 1 long haul flight that is booked in Plus or Top Economy. These are based on avail, but if you fly LATAM often, that single perk could be enough to easily justify the annual fee.

The legacy gatekeepers are facing an onslaught of digitally native, tech-savvy, loyalty hungry entrepreneurs looking to shake up the space – Bilt, Brex, Cardless to name a few of the companies built on the rails of traditional finance that are changing the game. It doesn’t stop there. There’s another entire ecosystem of digital assets being developed and run across crypto rails that will bring competition to another entire space as well.

I’m a big believer that over the next 10 years, innovations in the payment ecosystem are going to absolutely blow our minds.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.