We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I recently got a targeted for a great opportunity to earn 100k points simply by adding 5 Employee Cards to my Amex Business Platinum card. I have a few of Amex Biz Plats and it seems as though this may actually be applicable to all of them ( I haven’t attempted this yet, but looks promising ). Let’s take a look at the deal

Check here to see if you Targeted

I have the following pop-up after logging in:

![Earn up to 100k Amex Points with Authorized Users on Amex Business Platinum [Targeted]](https://monkeymiles.boardingarea.com/wp-content/uploads/2021/10/Screen-Shot-2021-10-11-at-11.17.21-AM.png)

The Details: Spend $4k in 6 months and get 20k Membership Rewards, up to 5 Employees

- Receive 20k Amex Points after an employee makes $4k in purchases in 6 months

- Can receive the bonus on 5 employee cards

- Ends 12/31/21

![Earn up to 100k Amex Points with Authorized Users on Amex Business Platinum [Targeted]](https://monkeymiles.boardingarea.com/wp-content/uploads/2021/10/Screen-Shot-2021-10-11-at-11.17.30-AM.png)

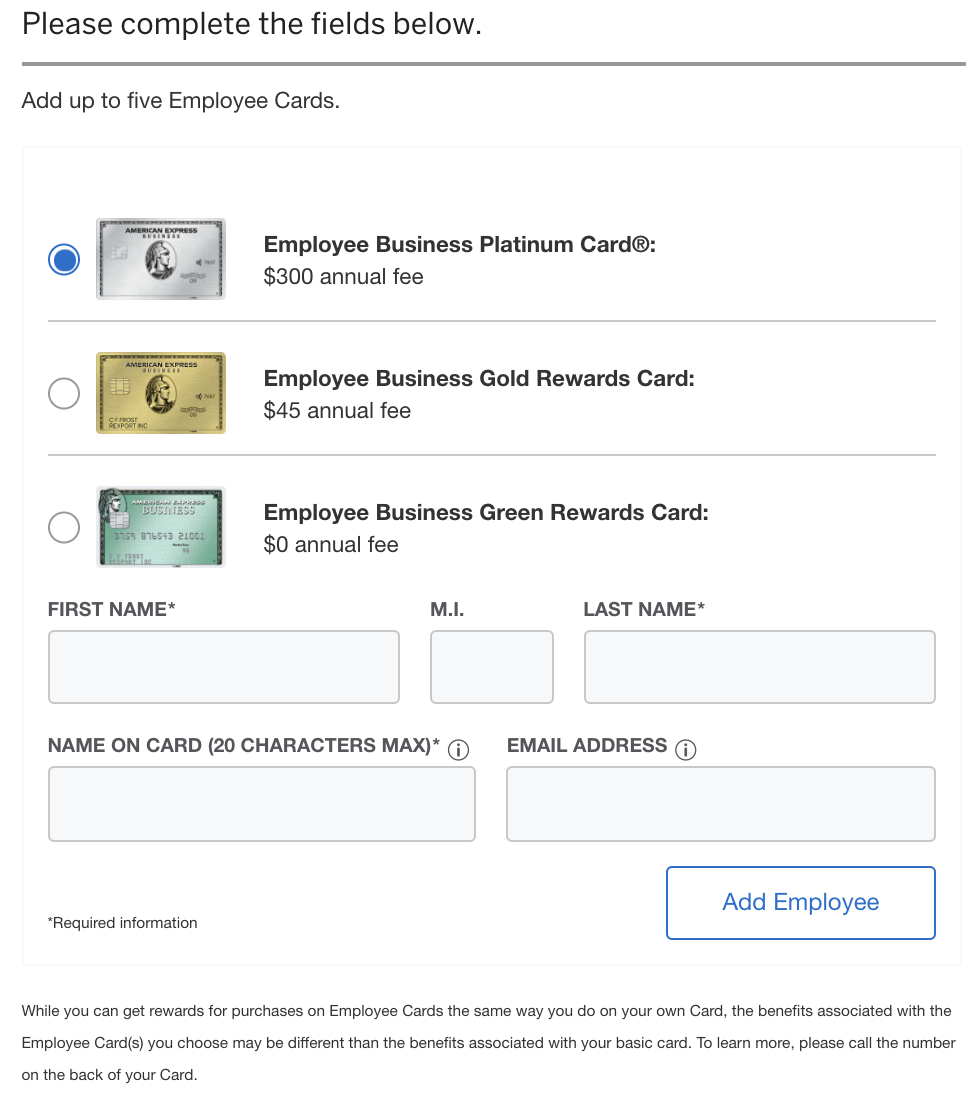

Cost per additional card. No fee option

- $300 for each additional Employee Business Platinum card

- $45 for each additional Employee Business Gold card

- Free for each additional Employee Business Green card

Terms and Conditions

1 Employee Card

Employee Card Spending Limits may be set up online or by calling the number on the back of your Card. The Spending Limit is not a guarantee that the Employee Card Member will be able to make purchases up to that limit. There are certain purchases where the limit does not apply, such as, for example, restaurant tips and hotel stays extended beyond their original reservation period, and the overall Account capacity is taken into consideration. You agree to pay all Charges without regard to whether any Charges exceed a limit, and you agree that we are not liable to you or any other person when a limit is not applied to any Charges and/or when Charges are incurred and billed that exceed a limit. For more information on the application of the limit, please refer to the Employee Card Spending Limits Terms and Conditions at www.americanexpress.com/spendlimits/terms, which will also be provided when you enroll Employee Card(s) in this feature.

2 Offer

Offer is nontransferable. Add new Employee Card Members to your Basic Card Member account here and earn 20,000 Membership Rewards® points after each new Employee Card Member spends $4,000 in eligible purchases on the new Card in their first 6 months of Card Membership. The maximum bonus points you can earn through this offer is 100,000 Membership Rewards points. Your

request to add Employee Cards must be processed and approved by 12/31/2021 11:59PM ET to be eligible for this offer. The 6 month period for each new Employee Card Member to spend $4,000 starts on the date that the respective Employee Card Member is added. Purchases made by other Employee Card Members on your Account, including Employee Cards that you do not add here, will not count toward the $4,000 spend requirement. Your purchases as the Basic Card Member will not count toward the $4,000 spend requirement.

The 20,000 Membership Rewards points will be applied to the Basic Card Member’s American Express account within 8-12 weeks after the Employee Card Member has met the purchase requirement. If we in your sole discretion determine that you or your Employee Card Members have engaged in abuse, misuse, or gaming in connection with this offer in any way or intend to do so (for example, if you added one or more Employee Cards to obtain a bonus offer(s) that we did not intend for you; or if you or your Employee Card Members cancel or return purchases made to meet the Threshold Amount), we may not credit Membership Rewards points to, we may freeze Membership Rewards credited to, or we may take away Membership Rewards points from your account. We may also

cancel this Card account and other Card accounts you and your Employee Card Members may have with us.

Eligible purchases do NOT include fees or interest charges, purchases of travelers checks, purchases or reloading of prepaid cards, purchases of gift cards, person-to-person payments, or purchases of other cash equivalents. In rare instances, the period for the new Employee Card Members to spend $4,000 may be shorter than 6 months if there is a delay in receiving their Employee Cards. Also, purchases may fall outside of the 6 month period in some cases, such as delay in merchants submitting transactions to us or if the purchase date differs from the date they made the transaction. (For example, if they buy goods online, the purchase date may be the date the goods are shipped). To be eligible to receive the bonus Membership Rewards points, your Card account must not be past due, canceled, or have a returned payment outstanding at the time of offer fulfillment.

Overall:

This seems like a no-brainer way to earn a bunch of points on employee expenses.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.