We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

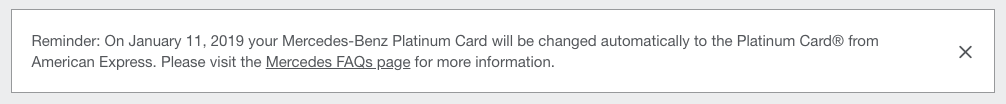

Earlier this year it was announced that the American Express Platinum Mercedes Benz card would cease to exist. I ended up signing up for one of them before applications were removed, and we were told that it would be converted and the general understanding was that it would convert to a standard Platinum. Up until today, unless I missed it, I don’t believe I’ve received notification that this was set in stone ( there was some speculation that the MB would continue onward, grandfathered). I just logged into my account and saw a banner reminding me that my Mercedes Benz Platinum will in fact be converted to a standard Platinum Card on January 11th. If you’re in a similar boat – now you have resolution and a final end date.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.