This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

It all tastes better when it’s free.

I’d argue that Marriott Gold is the best mid-tier status around. Ordinarily you’d have to stay A LOT of nights to attain it. 50 to be exact. I mean that is a lot of nights, and unless you are a road warrior/corporate traveller, the odds are you won’t be hitting Gold year in, year out. I don’t stay near that many nights and have gold status. How? Over a year ago, when SPG and Marriott released extended details about their merger, an opportunity poked its head out – I blogged about it then ( but I think many don’t utilize the perk) . SPG Gold matches to Marriott Gold. SPG Gold is a benefit of any American Express Platinum charge card. Ok, great Miles, you have Marriott Gold status…what’s the big deal? You guessed it. Club Level. Marriott Gold Elite members get guaranteed club level access at MOST of their properties. THIS is how I get free Marriott club level with a credit card.

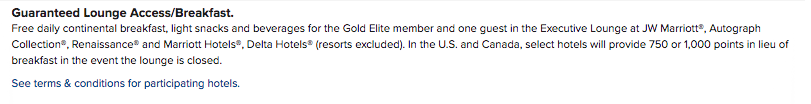

I’m not lying…it’s guaranteed at MOST Marriott properties.

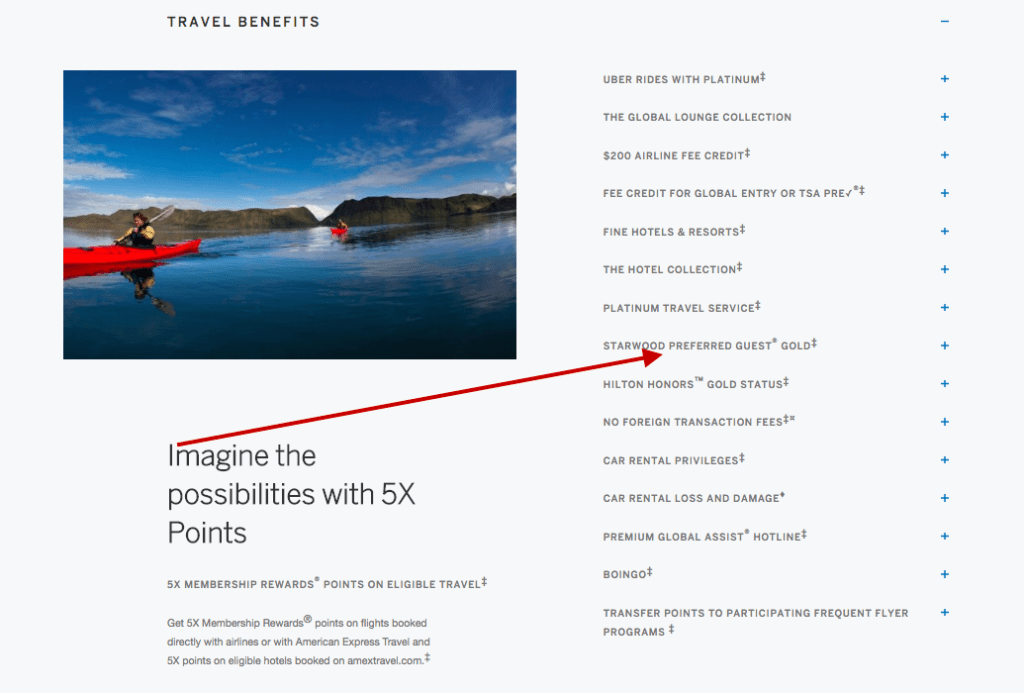

Amex Platinum gives you SPG Gold.

I carry an Amex Biz Plat. Just ordered the metal version 😉 Any version will do, but it does have to be the charge card version. Not a Delta Platinum, SPG Platinum, etc.

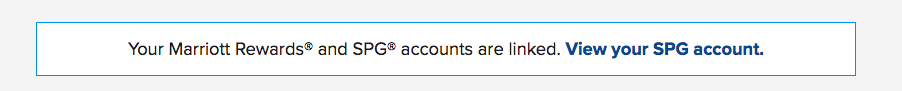

You can link your accounts here:

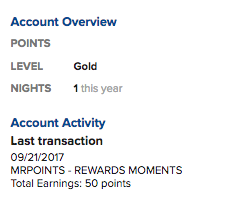

Voila…Gold Elite with just one night.

Club level can save tons of money on an extended stay.

You’ll normally get a fantastic breakfast spread along with evening canapes ( In Asia they offer full meal replacements in the evening, US/Europe less so), and some period of time where open bar is available. There’s normally a lot of space to hang out with friends, and cold drinks and snacks are pretty much available 24 hours. The Marriott Marquis in D.C. has a great club level.

In London, I stayed at Hotel Xenia for a little over £100 – I was given a fantastic breakfast option. A perk, if there is no club level available.

We really do appreciate you reading!! If you’d like to receive our posts daily —-> Subscribe!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.