We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

IHG Rewards credit cards get positive revamp

( these go into effect 03/24/21 )

IHG isn’t messing around. Not only have they announced a complete overhaul to their IHG Rewards Program, but they’re adding benefits to their credit card portfolio with Chase. If the changes to the credit cards are harbinger of what we can look forward to with the new IHG Rewards benefits rolling out this year…we are going to be quite pleased.

Let’s dig into it, but one of the the aspects I’m most pleased with are the 40k anniversary certificates. They become more valuable since you’ll now be able to add points to it for redemption.

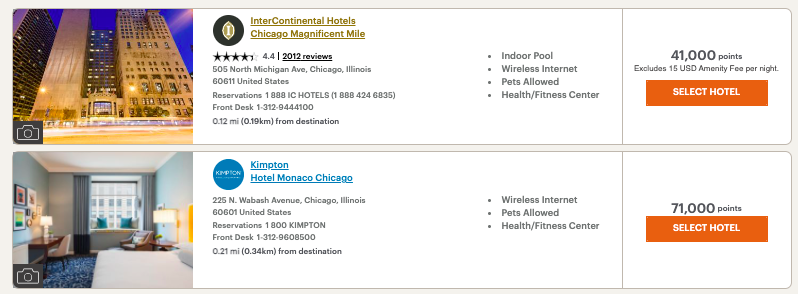

IHG Rewards is a dynamic program, and as such, many properties started pricing at 41k points. What a frustration when it comes time to redeem your 40k night. You missed it by just 1k points. But now, you could just add the 1k to it and use your cert. In the example below, if you’d rather stay at the Kimpton you could do that too, just add 30k.

Cards are also getting

- increased bonus category spend

- spend your way to elite status, including top tier diamond status

- $50 United Travel Bank credit

IHG Rewards Premier

This is very good news if you hold the IHG Rewards Premier since you’re keeping all of the benefits the card has currently as well as adding in some great new benefits.

Those include a $50 United Travel Bank credit, the ability to spend your way to IHG Rewards new top tier Diamond status, a new earning structure that gives bonus 5x bonus category spend to dining, travel, gas, social media advertising, and office supply stores, and 3x everywhere.

It will retain 4th night free when booking with points, the TSA/Global Entry credit every 4 years, a free 40k and under anniversary award night. One thing to note on the free 40k night is that IHG Rewards will now allow you to add points to it if you’d like to stay at a higher value property. Personally, this is huge and will make the certificates much more valuable.

The annual fee will change from $89 to $99. Existing cardholders won’t be affected til 203

Here’s a look at the benefits:

- Automatic Platinum Status

- 4th night free when using points

- $50 United Travel Bank credit

- Global Entry/TSA Pre Fee credit every 4 years

- Free 40k night every year

- this being on your first anniversary heading into your second year of cardmembership

- Spend your way to Diamond with $40k in annual purchases

- Get a 10k bonus points and $100 statement credit when you spend $20k + one additional purchase in a year

- Earning will be as such:

- 10x at IHG Hotels & Resorts worldwide ( this is on top of the bonus you get as a IHG Rewards member )

- 5x

- travel

- gas stations

- dining/restaurants

- social media and search engine advertising

- office supply stores

- 3x everywhere else

IHG Rewards Traveler

IHG’s no annual fee card will get complimentary IHG Rewards Silver status ( which is a brand new status akin to IHG’s old Gold tier and rolls out in March ) as well as some new bonus categories.

- IHG Rewards Silver Status

- Category Bonus spend

- 3x on

- utilities

- internet, cable, phone

- and select streaming services purchases

- gas stations

- dining

- 3x on

- 2x everywhere else

- Earn 10k bonus points after spending $10k in a calendar year

- Earn IHG Rewards Gold after spending $20k in a calendar year.

New IHG Premier Business Card

On March 24, 2022, a new IHG Premier Business Card is being released that will look quite similar to the IHG Rewards Premier card with one big exception – if you spend $60k in a year you’ll earn an additional free night certificate valid at hotels 40k and under. It will also come with a $99 annual fee.

Here’s a look at what it will include:

- Automatic Platinum Status

- 4th night free when using points

- $50 United Travel Bank credit

- Global Entry/TSA Pre Fee credit every 4 years

- Free 40k night every year

- this being on your first anniversary heading into your second year of cardmembership

- Spend $60k and get a second 40k night

- Spend your way to Diamond with $40k in annual purchases

- Get a 10k bonus points and $100 statement credit when you spend $20k + one additional purchase in a year

- Earning will be as such:

- 10x at IHG Hotels & Resorts worldwide ( this is on top of the bonus you get as a IHG Rewards member )

- 5x

- travel

- gas stations

- dining/restaurants

- social media and search engine advertising

- office supply stores

- 3x everywhere else

Overall

Sure the annual fee is going up $10 on the premier and business card, but that’s no biggie when you look at the added benefits each card is getting – Traveler is also staying no fee, but getting better earning and silver status.

The new IHG Rewards Business Card is likely to be added to my wallet at some point in the future for no other reason than the anniversary night being more valuable. I currently hold a legacy IHG Rewards Select and a IHG Rewards Premier so one more card would mean 3 nights a year for roughly $250 in annual fees.

When you factor in the 4th night free on award bookings, I would have the ability to add points to the 3 certificates and conceivably spend a week at any property in the world for a major reduction in cost.

As an example here is a week at the Kimpton La Peer in West Hollywood

I could apply 3 annual night certs to the first 3 nights where I couldn’t have used them before this product update.

- 23k

- 16k

- 18k

- free night

- 63k

- 61k

- 62k

Total = 243k vs 363k points and I used up my certs at a property I wanted to stay at – I’m in a situation whereby I’d get 10% back as well via the legacy IHG Rewards Select card. That brings my total down to 219k points. IHG often sells their points at 1/2c which means they could be purchased for $1250 at 243k and just $1100 at the 219k level. Not bad when you look at the check out cost if paid in cash for the same stay:

Needless to say…this is a great news from IHG. Bravo!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.