This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

A month in…I’m well on my way.

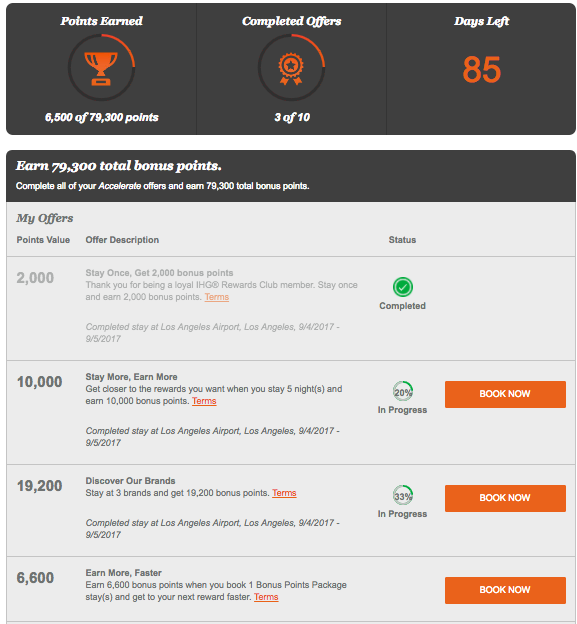

IHG Accelerate is a quarterly promotion that IHG offers to its members. While I’ve been targeted for decent offers in the past, this year was different. I got an offer that would net me north of 80k points with just three stays. I had to make use of it. I thought I’d update you guys on my progress, but also remind you to register and see what you’d been targeted for as well.

Don’t forget to register. You can do so here.

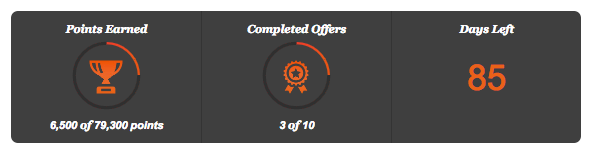

Here’s a look at my progress. 1 Month down. I need to hit 4/5 of remaining requirements to get my bonus .

I took a weekend trip to Tokyo earlier in the month, and to start the trip off, we spent a night at the LAX Crown Plaza. For $115, it was not only a solid deal, but it ticked off 2 requirements, and one bonus.

I have a weekend to New York planned as well, and scored a very good deal at an IHG property. That will help with the 3 brands requirement.

I’m currently planning a weekend trip to Shanghai later in the year…

I may be crazy, but I’m really on a weekend warrior kick, plus I have 2 SWUs left and want to make good use of them.

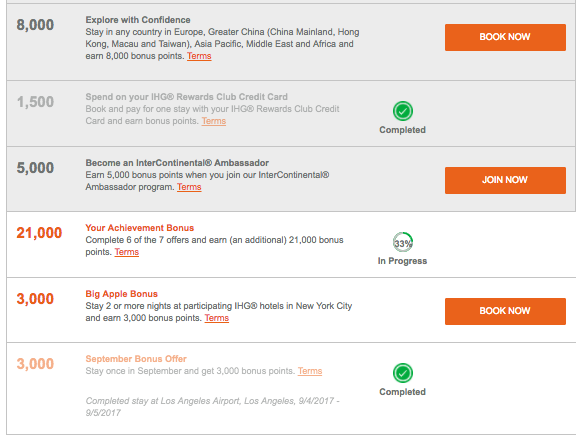

Staying in Shanghai will tick off the stay in any country ( Asia, Great China, Asia Pacific, Middle East, and Africa) requirement. My original plan was to stay just one night at the Intercontinental, and then hit up the JW Marriott as well. However, I’ll already have 2 nights at IHG by the time I go in November, so if we stayed there the whole time and did one night with a bonus package, I’d not only hit the 5 night bonus, but also the bonus package requirement. This would stitch up the whole Accelerate and I wouldn’t need to join Ambassador.

However, Marriott has a promotion whereby you can earn a free night after just 2 stays. Seems silly to not get one of those stays while in China and get to experience another hotel.

I’ll keep you guys updated. Have you registered? How’s it going?

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.