This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

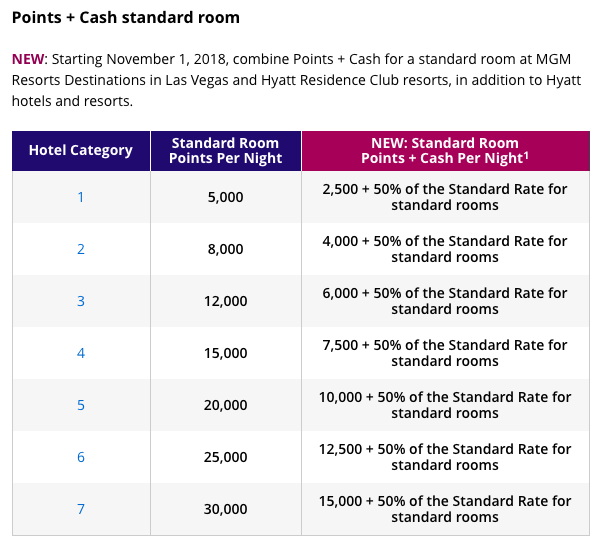

The first hit to the program goes into effect on November 1st. Hyatt has confirmed that Cash + Points rates will change from being a fixed cash portion based on category to flexible based on 50% of the standard rate.

The second is the creation of a new category of redemption, category 8.

The last time we saw the creation of a new category was in 2014 when category 7s were introduced.

Hyatt has pushed back saying that the creation of this 8th category is based on their partnership with SLH, insinuating a need to introduce an entirely new category because their fleet has some aspirational properties. They’ve said that no plans are on the table for Hyatt properties to be included.

- There are a lot of very high end properties in the SLH portfolio, but are they more expensive or aspirational than Park Hyatt NY, Paris, St Kitts, etc?

- Hyatt needs a way to compensate SLH hotels for point redemptions without undermining reimbursement of their franchisee redemption rates – a 40k rate helps

- This creates a pathway for folding in Hyatt properties down the line

- This is the biggest hit and why I think this is a masked devaluation

I don’t mind that SLH properties may be more expensive, but…

Miraval

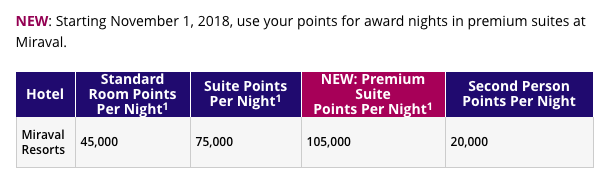

Pizza in Motion points out that there is a pirate ship up for redemption via SLH, and that would obviously require more than the 30k needed for category 7. I totally agree. In fact, I’d say there are multiple hotels in the SLH portfolio that you could argue could price outside the normal chart. But I also say… How about Miraval?

Miraval doesn’t abide by the normal Hyatt redemption rates. They created it’s own chart, and could have easily done so for SLH properties

Belmond

I’ve written about Belmond wanting a buyer, and how Hyatt would be suitable. Clearly with a category 8 redemption level, the road is paved to fold in a truly high end brand into the portfolio with aspirational prices to match.

Overall

My expectation is that sometime next year we will start to see cat 4,5,6 hotels inch up the award chart and then finally Hyatt branded hotels bump into Category 8. The Hyatt award chart, competitively speaking, is still one of the best out there even after these devaluations, but the news is confounding.

SLH has some dope properties – I’m looking forward to gaining access to them via Hyatt, but certainly not at category 8 prices. Hopefully we see some come in well below that.

We’re roughly 2 months away from the end of the year and Hyatt had been on a roll of good press, active measure being employed to incentivize and attract loyalty, and then that’s undermined with two reasons for loyalists to perhaps second guess their loyalty for 2019.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.