This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

- IHG has said that the devaluation was a technical glitch

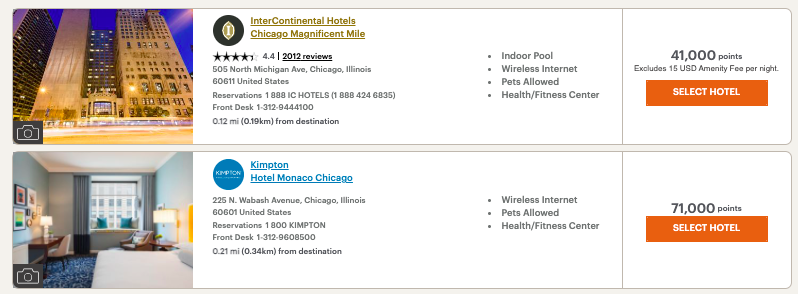

Wow…what a middle finger to IHG cardholders. If you’re unfamiliar with what I’m referring to…if you hold an IHG Premier or an old IHG Rewards Select you receive an annual night certificate worth up to 40k per night. Hotels are now pricing at the magic level of 41k. Gimme a break.

When IHG introduced dynamic pricing, many hotels would dip below the threshold when demand wasn’t high, and it took a bit of the sting out of their move from a fixed award chart to demand based. That sting just became a welt.

It was one thing to read about the 30%+ overnight, without warning, devaluation to the IHG program. That, in and of itself, is terrible communication and lacks respect of those who have been loyal to the brand over the years. We’re sensible people, but give us warning and ability to navigate. Programs devalue all the time, but to do it in the dead of night, amidst a pandemic, is pretty terrible. But…introducing a new level of pricing that just barely moves a property out of qualifying for an IHG free night is pretty awful. The rate for the IHG was a little over $260.

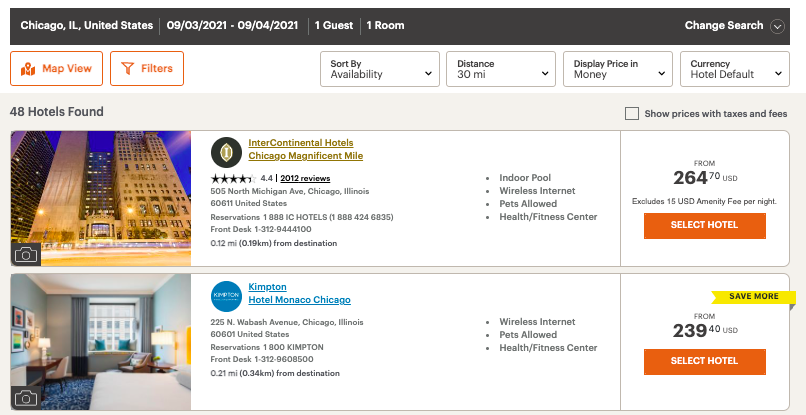

As an FYI…here are the cash prices for Sept 3rd to 4th.

As an FYI…here are the cash prices for Sept 3rd to 4th.

- IHG is $.0064 per point

- Kimpton is $0.0034

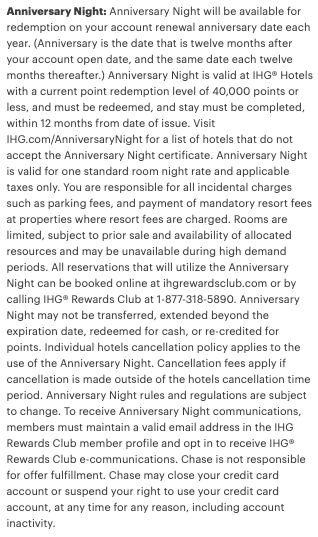

Here you can see the terms and conditions for the free night certificate – 40k or less

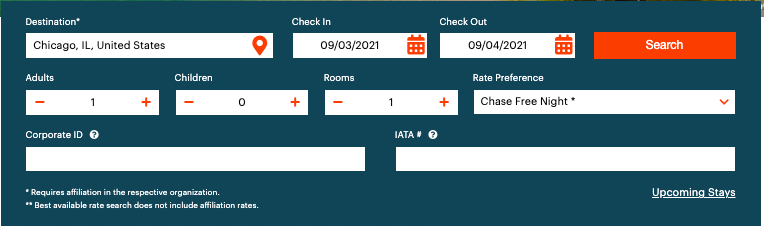

I searched with Free Night stipulated to see if it would indeed work ( maybe they folded in properties that were within 1k points – giving IHG the benefit of the doubt ). Nope. Didn’t work.

I searched with Free Night stipulated to see if it would indeed work ( maybe they folded in properties that were within 1k points – giving IHG the benefit of the doubt ). Nope. Didn’t work.

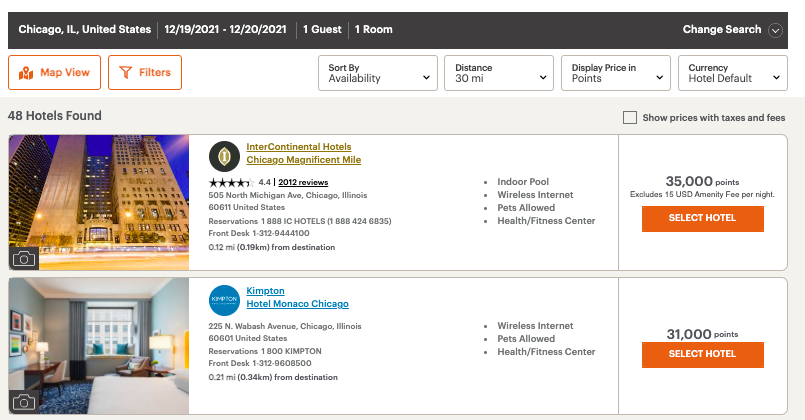

However…when I changed the dates into December, the 19th and 20th to be exact when rates are around $220.

the property prices at 35k and it works. Roughly $0.0062 per point.

the property prices at 35k and it works. Roughly $0.0062 per point.

You can also see the Kimpton plummet in points. No surprise here – Chicago in December is brutal. But a 40k point swing at Kimpton Hotel Monaco.

Overall

Was it purposeful? They certainly could have programmed their code to bump anything around 40k down to 40k. Dynamic pricing means rates will fluctuate and could land on 41k, but as you can see from examples the algo doesn’t assign a fixed value to the points in any predictive manner. Is it offer season? Amount of rooms booked? Who knows. But negating award certificates by pricing a mere 1000 points ( which could be bought for roughly $6 using Cash and Points ) seems pretty petty.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.