This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I just got an Amex Blue for Business. 10x dining here I come!

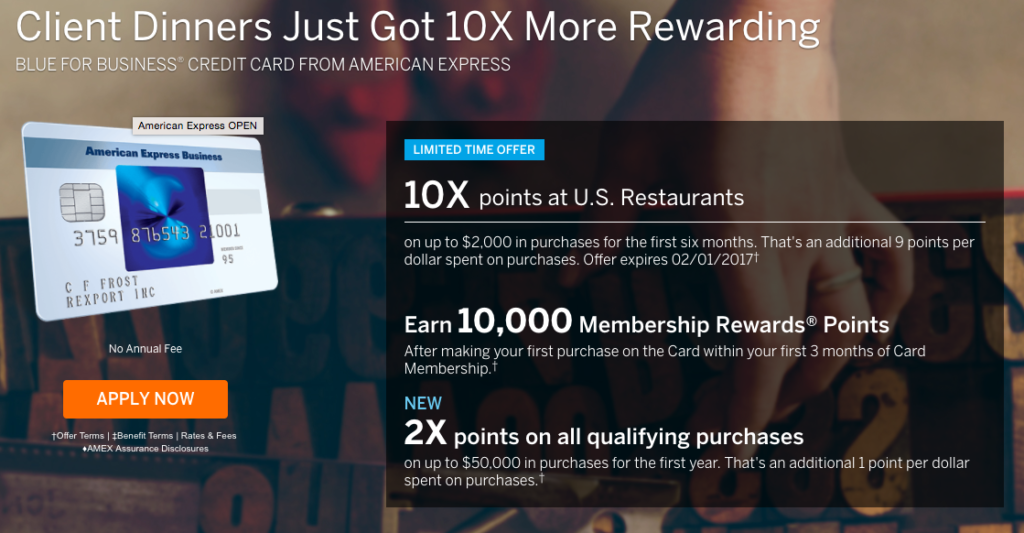

I wrote earlier this week that a great deal was ending on the Amex Blue for Business card. No Annual fee, 10k bonus points after first purchase, and 10x on restaurants for 6 months with a $2k max. It won’t go against my 5/24 and is an easy 30k points. I’ve never carried an American Express branded card that didn’t earn the fully transferable Membership Rewards so this is going to be a fun journey to blog about and investigate. I absolutely love my Amex Business Platinum card, and this will be a great additional to the family of cards that I have with them. The offer ends tomorrow, Feb 1st, which is why I just got an Amex Blue for Business today!

Miles is excited to entertain some clients and earn 10x points!

Just to reiterate…

-

Doesn’t go against 5/24 – Amex biz cards don’t count

- Let’s be honest…that’s YUGE

-

10x Restaurants for the first 6mos

- It’s capped at $2k but that’s an easy 20,000 points

-

No Annual Fee

This is a big one.

-

I have an Amex Business Platinum. I can co-mingle the points for higher value thru transfer.

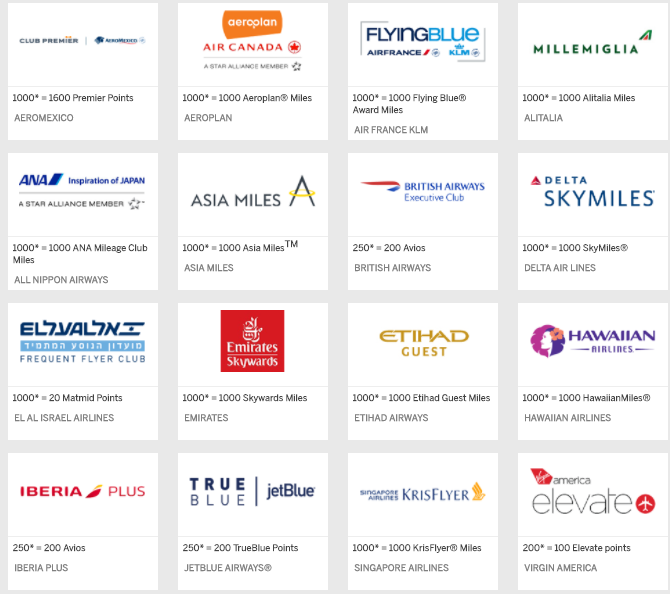

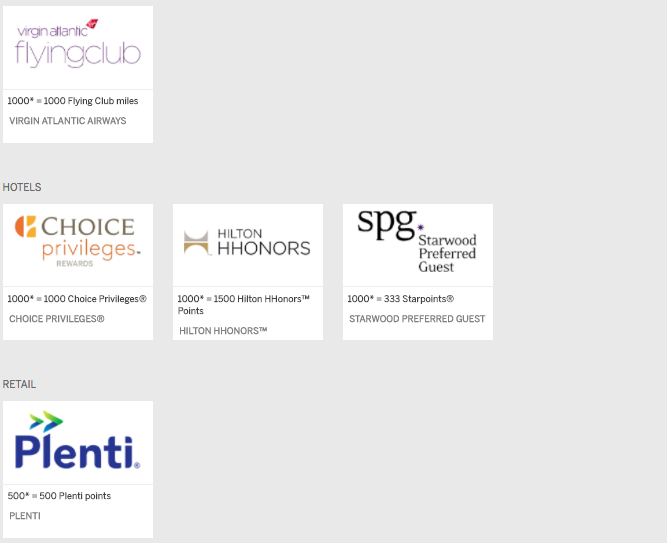

If you don’t carry a Membership Reward earning card you can go here and check out what you can get with these points. But, honestly, if you aren’t going to use them in conjunction with a card that can transfer to a partner…I’d pass-a-dena. ( that’s what we say in LA when we’re going to pass and by we I mean me…and Miles 😉 ) We like flexible currency the most, and if we’re going to throw spend on a card, we want the most bang for our bucks. So there’s no confusion:

We want to sip champagne, wear noise canceling headphones, request turn-down service, crack open our amenity kits after we shower at 35k feet, and sleep in a fully lie-flat position. We need transfer partners for that =) In essence…we want our points to make us feel like this

As a reminder…Amex transfer partners:

* Etihad Business Studio is the feature image.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.