We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

One month left for 2% Plastiq fee on Amex payments

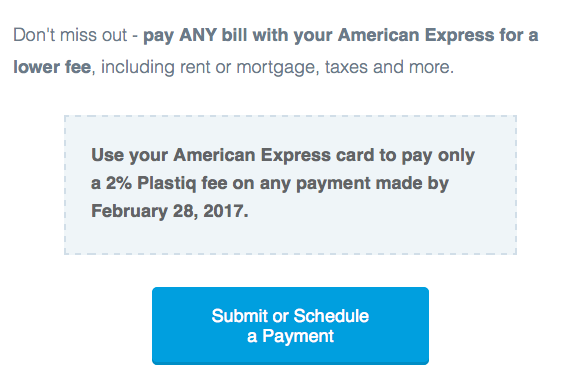

Until the end of the month you can take advantage of a great deal: Plastiq is offering a reduced fee of 2% on all payments scheduled with an Amex. Typically the fees for credit cards are 2.5%. If you’re unfamiliar with Plastiq, it’s an online bill payment service whereby you pay Plastiq, they charge you a fee, and then they pay your bill. I’ve used Plastiq a few times when making a minimum spend requirement, and feel it’s totally worth the fee to earn the extra points. It’s a great way to pay your rent, mortgage, or other large ticket item that wouldn’t ordinarily take credit card.

A few things to remember:

- 2% is quite hefty so I wouldn’t put your ordinary spend thru Plastiq

- Focus on Min Spend

- Target’s like the Chase British Airways Credit Card that offers a companion ticket after $30k annual spend or earning EQM from spend on airlines.

- Bills to consider using Plastiq

- Rent

- Mortgage

- Car Payments/Lease Payments

- Tuition

- Schedule your Payment

- Make sure the processing date is before February 28th, 2017

- And for goodness sakes remember to use an Amex to pay! 😉

Let’s say you recently got the American Express Business Platinum with a $15k min spend. If you used Plastiq for the entire min spend you’d pay an additional $300 in fees. Not terrible considering you’re picking up a cool 100k points.

*feature image courtesy of Plastiq.com

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.