This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Air Canada’s new Aeroplan program details

In case you missed it, Air Canada announced that it will launch a retooled loyalty program, Aeroplan, on November 8th. I have to hand it to Air Canada, this is something that has been spoken about for quite some time, and while I’d say it’s a devaluation of the program, it’s pretty mild and doesn’t occur for a few months. Meaning…you can still lock in the old chart before things change if you’d like, but award pricing hasn’t skyrocketed if you wait. This is in contrast to the American carriers who are notorious for unannounced, dark of night devaluations and chart removals. Air Canada has done none of this – so kudos to you Air Canada.

If you don’t want to read through the entire article there are really just a few major takeaways

- The massive surcharges are gone – that is a major win

- Booking partner tickets will incur a $39 fee – in Canadian Dollars

- Stopovers on one way flights for just 5k points

- Liberal routing rules seem to still be in tact

- A 4 Zone award chart ( N. America, S. America, Atlantic and Pacific )

- Any partner can be combined on a ticket

- Family sharing – up to 8 accounts

You can read booking rules here

Why should you care about Aeroplan

It’s a phenomenal program that is a transfer partner of both American Express and Capital One. It has provided fantastic ways to access aspirational products like Lufthansa First Class and its new partner Etihad. While the mileage redemptions have been some of the best in the industry, the taxes and fees were so high that many were deterred.

The New 4 Zone program

Air Canada has split the world into 4 Zones:

What’s really cool about this is optimizing the zones with multiple partners and the new stopover rule. Hypothetically, this means you should be able to fly from New York to Frankfurt in Lufthansa First Class then Etihad First Class to Abu Dhabi stopover and then carry on to Sydney in Apartments for 145k points. You’d pay none of those nasty taxes and fees that AC used to assess and instead just a $39 CAD partner surcharge.

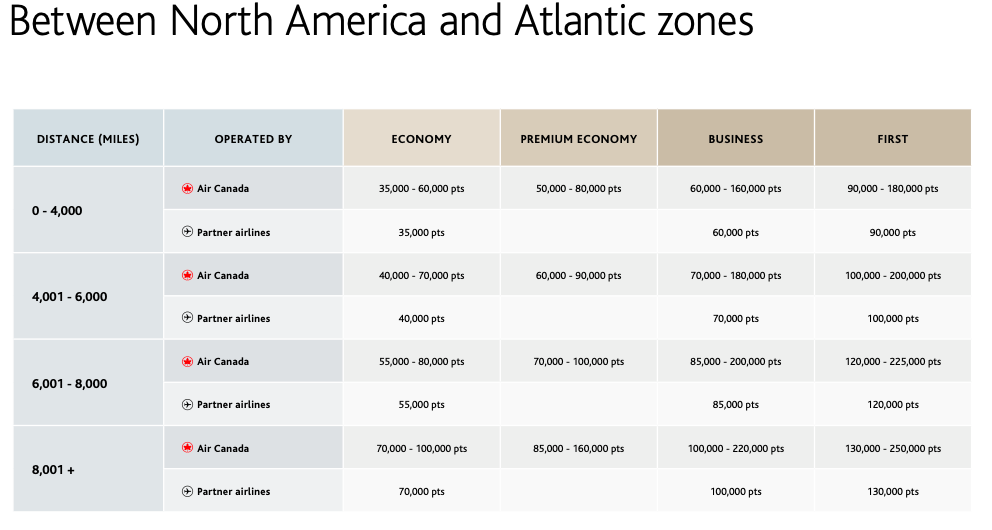

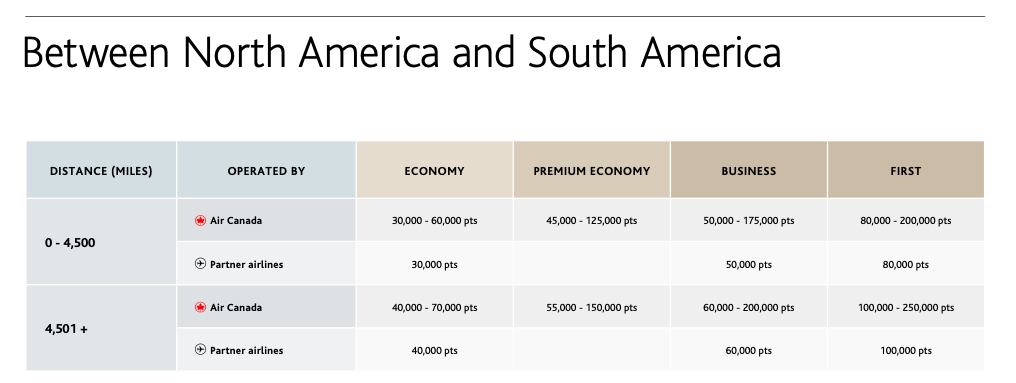

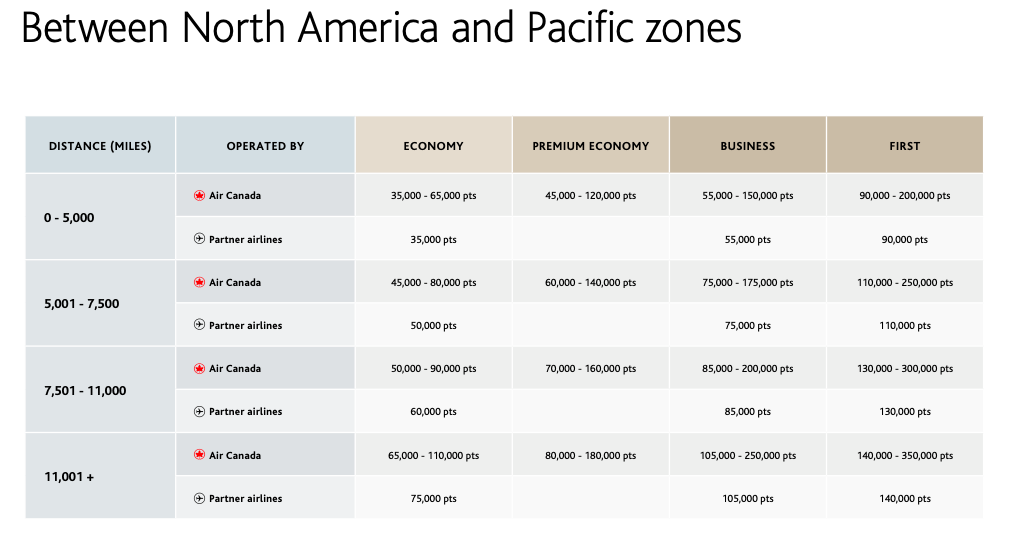

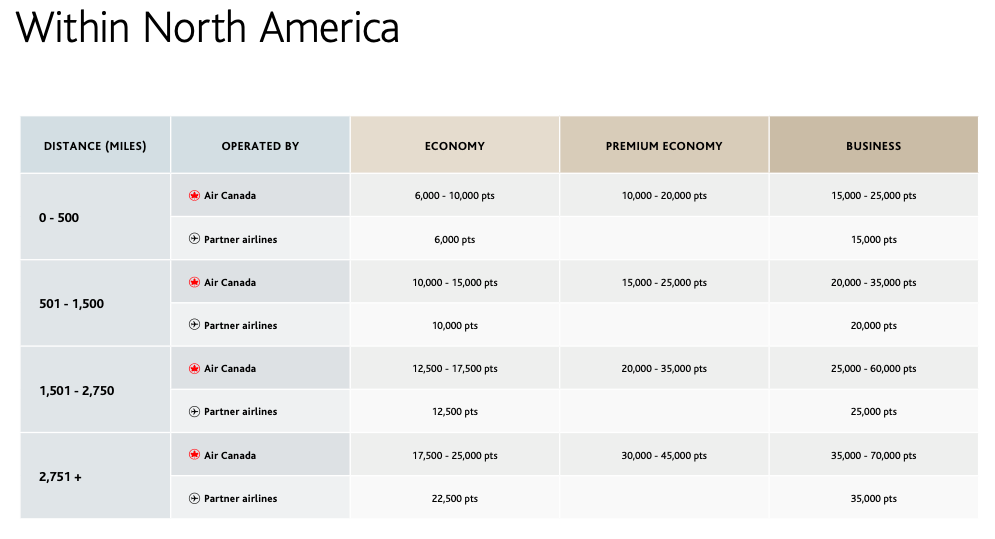

Originating in North America here are the 4 tables based on distance

Air Canada has decided to break down the 4 zones into various distanced based zones and price those independently. Let’s take the the first of those zones, North America and Atlantic, since it’s been one of the most widely hyped Aeroplan sweet spots and examine it a bit further.

In the old chart, you could fly between North American and Europe

- 55k in Business

- 70k In First Class

Now, as you can see below it will run you anywhere from 60-100k in business and 90k to 130k in first class. It’s worth noting that this folds in Africa and, remember, you can build in stopovers. So you could fly from LAX to Germany in Lufthansa First, stopover for 5k points, and continue on to South Africa for 100k points in business and 130k in first class. That’s not half bad!

Unless you are dead set on flying from the west coast, it’ll cost you 70k/100k to fly business/first from the States to Europe. 70k is pretty competitive.

The biggest advantage is the reduction in taxes and fees. It wasn’t uncommon to see fees on Lufthansa flights in the $500-600 range each way. I’d happily pay an extra 15k points to fly lufthansa business and save all those fees. Remember, you’ll still owe the partner booking fee of $39 CAD

I was able to fly on United’s Polaris business class in 2018 between Sao Paolo and Chicago – It’ll set you back just 60k points. Helluva good deal IMO.

Partners can be combined.

Aside from Air Creebec and Calm Air, you can combine airlines for redemption. This is amazing and opens up some pretty fun routing possibilities with very cool first and business class cabins.

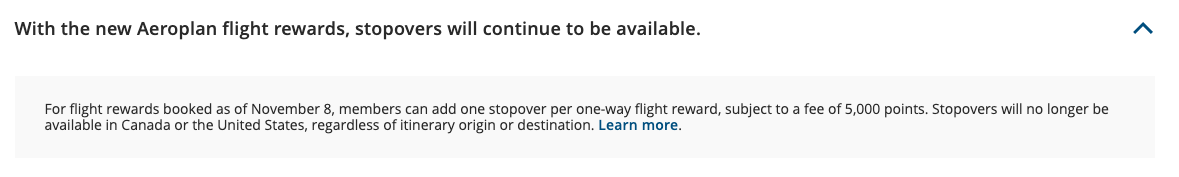

As mentioned, 5k will buy you a stopover

As long as you aren’t baking in a stopover in the US or Canada…you’re good to go. This is really very cool, and opens up all sorts of opportunities. One would be routing to a safari in Africa and stopping in Abu Dhabi for a few nights. Perhaps you even pop over to Oman and check out the Six Senses Zighy Bay for a few nights and then carry on. The options are endless.

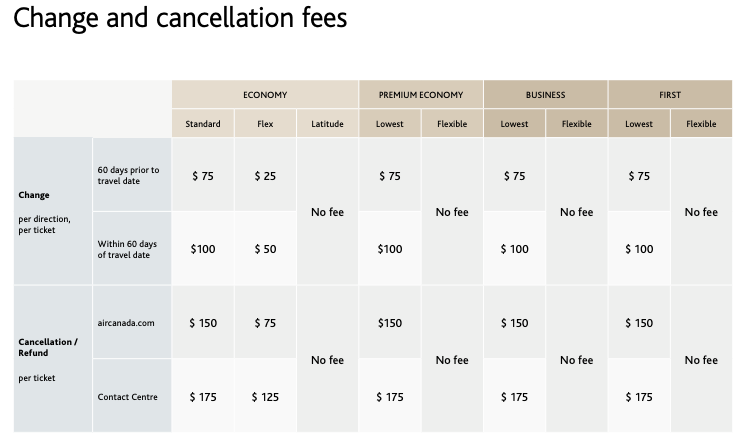

Change and Cancellation fees

The biggest thing to keep an eye on here is when you’re planning on changing or cancelling. If you change outside of 60 days you’re looking at an industry competitive $75 fee vs $100 if within 60 days. Additionally, changes are per direction – so you may be better off cancelling your ticket in full if you’re within 60 days of departure. Note these prices are in CAD.

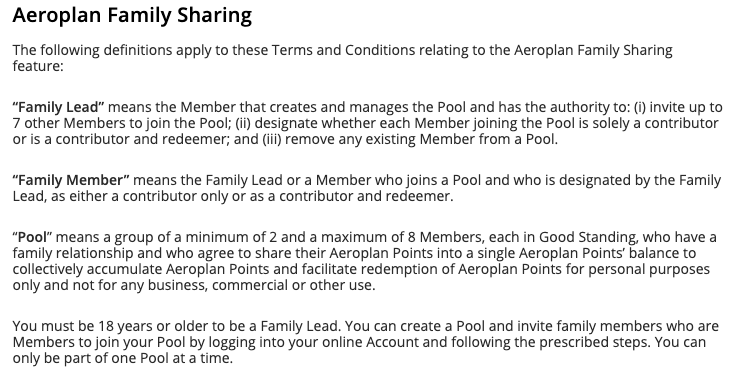

Pool points with 8 accounts

This is kind of an overview, but there are two things to really keep in mind

- Family Lead + poolers in family = only family lead can redeem points in the pool

- Family Lead + poolers but lead is only contributer = can not redeem anyones points only the specified redeemer can do that

The second option is really the easiest for situations where parents may earn a ton of points and create a pool where dad or mom is Family Lead, but the kids or inlaw really knows a lot about points. Then dad could designate daughter as the redeemer, etc.

Overall

It’s been over a week since this was all announced and overall I believe it’s the best we could have possibly hoped for – there are some other options like Cash + Points that allow points to be purchased at reasonably attractive rates, but the big draw of the program for me is transferring in from Amex. While it’s sad to see US to Europe redemptions go up from 55k/70k, the new rates are fairly in line with competitors. In fact, it’s been almost 5 years since we saw a deval from Aeroplan and hopefully it’ll be that long before we see another. Given the current state of travel, it wouldn’t surprise me to see promotions run to encourage redemptions moving forward that may even make these rates even more competitive.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.