This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The 4 Basics of Points.

Getting started with points and miles can be quite overwhelming, but if you’re just doing these 4 things… you’re way ahead of the game.

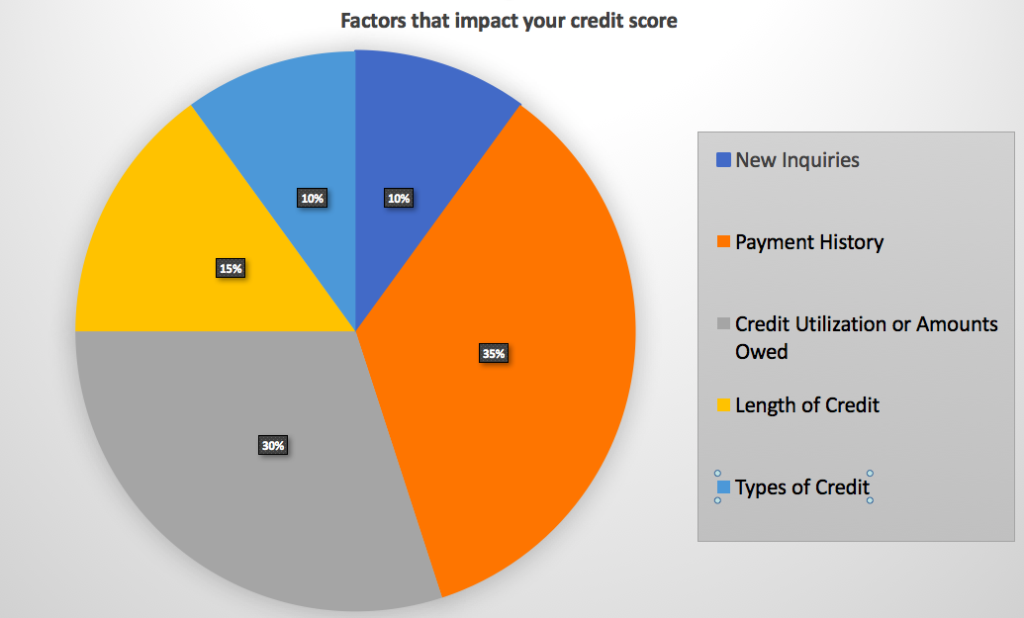

1) Pay your bills on time and in Full and maintain a creditkarma or creditsesame account to monitor your score

Keep your credit healthy and high! There aren’t any points out there worth paying interest and late fees over. Bar none. If you can’t do it…work on paying down your debts before even thinking of points.

You can read our credit score basics here.

2) Credit your travel

At the very least…join the loyalty programs of the airlines you fly, hotels you stay in, and even restaurants you frequent. Wherever there is a loyalty program…sign up for it. Use one email address that you’ve designated to receive all forms of promotional stuff from those places so you’re normal email doesn’t get bogged down.

3) Spend on the right card

Spending on cards that give you bonus points for dining, travel, cellular bills, quarterly bonuses, etc can MULTIPLY IN GREAT NUMBER the amount of points you ultimately earn come year end. Look at the cards you have and see if you don’t earn bonus points in certain categories. If you don’t…consider changing where you spend your money.

4) Take advantage of shopping portals and dining programs

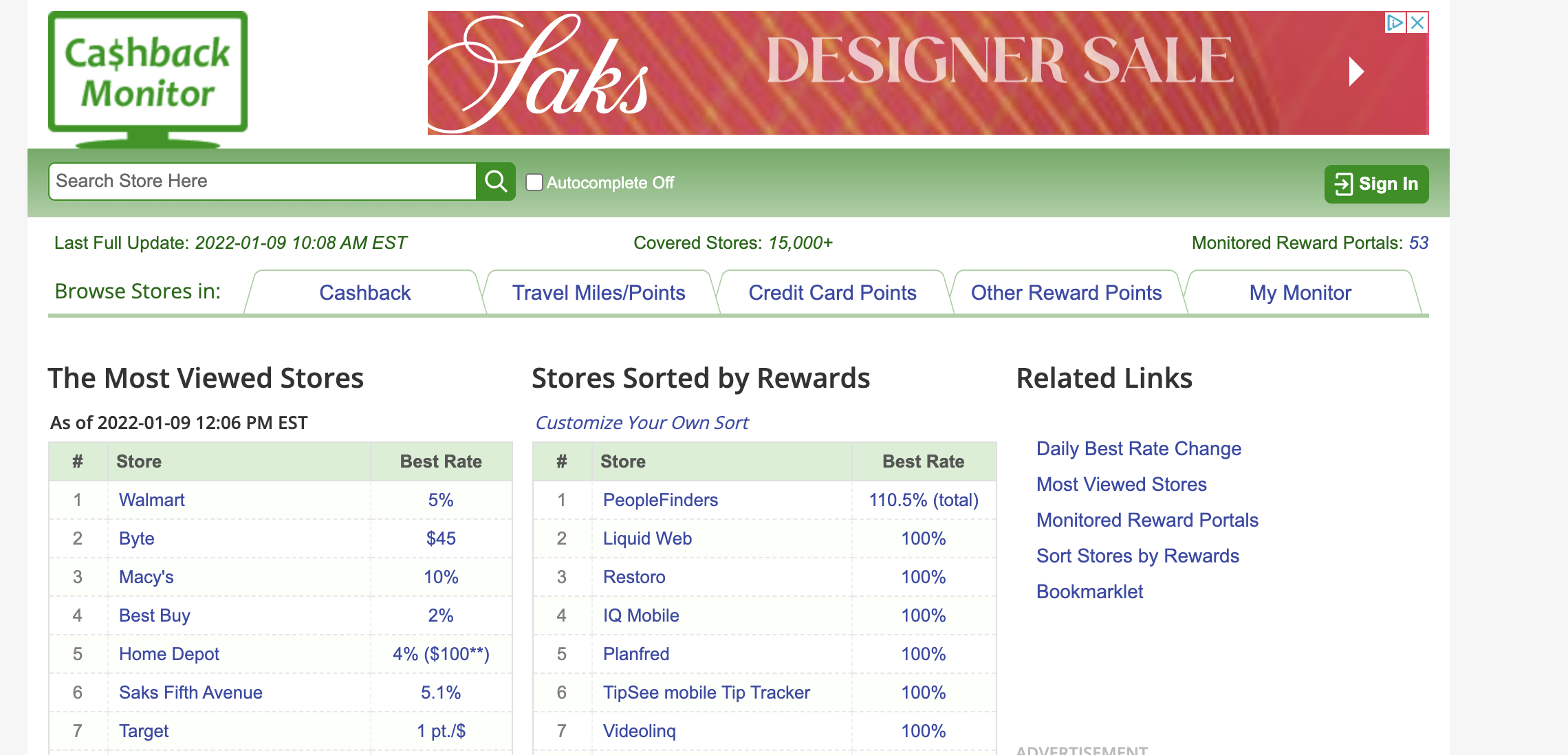

If you’re unfamiliar with shopping portals they are online portals whereby using their links to code your order you can earn a ton of bonus points. They are partnered with 100s of the most popular brands you already shop at like Gap, Saks 5th Avenue, Amazon, WalMart, the list goes on and on and one. You can choose to earn credit card points by using portals that earn Chase, Citi, Cap1, Amex points or your favorite airline miles. There are cashback portals if that’s your cup of tea as well. Regardless of what you choose…you’re missing on out earning a lot of points by not using a shopping portal.

The very best place to find which program is offering the most points is cashbackmonitor:

Dining programs are constructed in a way that you simply add your credit card to a dining program and whenever you dine at affiliated restaurants, you earn extra points/miles on your purchases. Here’s a list of dining programs you should be using to earn bonus points.

- Alaska Airlines

- United Airlines

- American Airlines

- Delta SkyMiles

- JetBlue

- Spirit

- Southwest

- Hilton

- Marriott

- IHG

There are many ways to get the most Power from your Points, but if you do these 3 things…you’ll be in a much better situation than most.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.