This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

MMMondayMemo: Activate your Chase Freedom 5x categories

Each Monday Miles has decided to drop a tip, hint, tutorial, trick that maybe you’ve missed or haven’t heard before. If you’re an expert in this field, some of these may be things you already know, but there are a lot of beginners out there who are just getting their feet wet. This week the Monkey Miles Monday Memo is making sure you earn those 5x category bonuses. It’s easy to forget they need to be activated! This week’s MMMondayMemo: Activate your Chase Freedom 5x categories.

What are Chase Freedom 5x categories?

Each quarter Chase designates certain spend categories that will earn your Chase Freedom will earn 5% back on every purchase that you make, up to $1500. If you carry another Chase card that earns Ultimate Rewards you can convert your cash back into ultimate rewards at a rate of $100 = 10,000 points. If you were to max out the quarterly bonus you could earn 5x $1500 or 7500 Ultimate Rewards. It’s a quick, easy, and straight forward way to earn lots of Ultimate Rewards on purchases you’d make anyways.

What does it mean to activate my 5x categories?

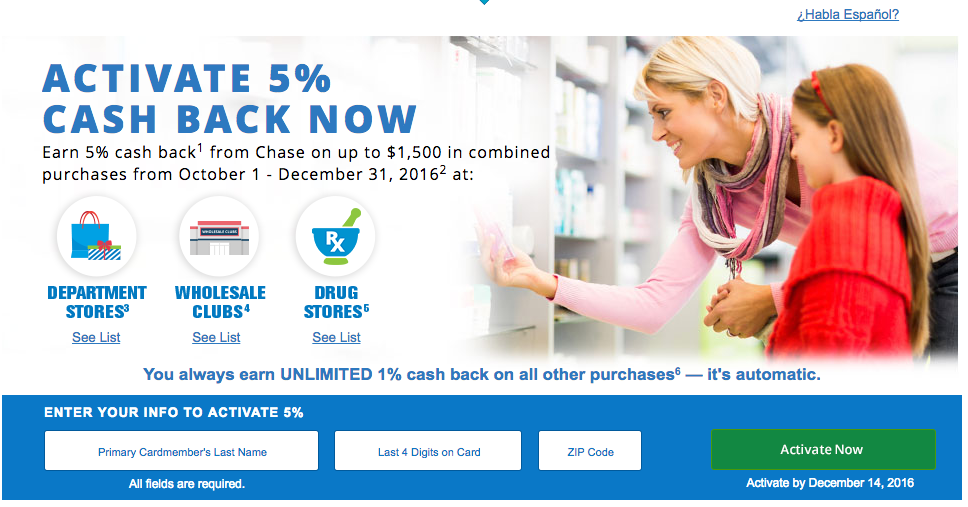

Well, here’s the thing. Chase is ultra generous in giving you 5x points on designated categories, but they require you to activate those categories to get your bonus. So you have to go here and enter your card info. Once you’ve done that you don’t need to do anything else to collect your bonus points.

What are categories for this quarter?

Great question. Chase has designated the following categories as eligible to earn 5x points. You can activate now and up until December 14th to earn 5x points on all of your purchases during the quarter.

How can I see how much I’ve already spent on my 5x categories?

I wrote an entire article on how you can easily see how much you’ve spent. You can read it here if you’re interested in learning more. Chase limits the amount of bonus you can earn at $1500. This means the most you can earn off bonus categories with your Chase Freedom in a calendar year is 30,000 Ultimate Rewards. A great and easy way to earn a bucket load of points!

What are some great uses of Ultimate Rewards points?

Well Chase has some great transfer partners. I recently flew on Lufthansa First Class from Frankfurt to Los Angeles and it was an absolutely INCREDIBLE experience. I transferred a combination of Ultimate Rewards, Citi Thank You points, and American Express Membership Rewards into Singapore Airlines’ Krisflyer program. I took an over $10,000 flight for 80k Points and roughly $300. The power of points is incredible and provides ability to achieve so many aspirational experiences like this…it’s the reason I urge you all to pay close attention to your spend so that you are maximizing every dollar you spend. When you Activate your Chase 5x Category bonuses each quarter you’re doing a very easy thing to help you max your spend.

It’s easy to forget! So make sure you Activate your Chase Freedom 5x Category bonuses!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.