This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Is a premium Alaska Visa Signature Card coming?

A few weeks ago I wrote about an online survey I took that provided the opportunity to win 10k Alaska points for taking the survey. In total the survey took maybe 10-15 minutes to complete and one of the questions I was asked was in regards to my interest in upgrading to a new Alaska Visa Signature Card. It’d have “more benefits and a higher annual fee.” I marked “very interested, number 7.” I currently have an Alaska card for each of my two businesses. If a co-branded card would come out that would provide more bennies…particularly the ability to earn Alaskan EQM for spend…I’d do it in a heartbeat.

The survey question that piqued my interest

This is certainly no indication that a new card is coming, but I’d say it does indicate that they are putting their toe in the water.

For me, the biggest incentive would be the ability to earn Elite Qualifying Miles for Alaska.

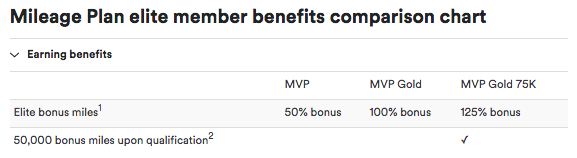

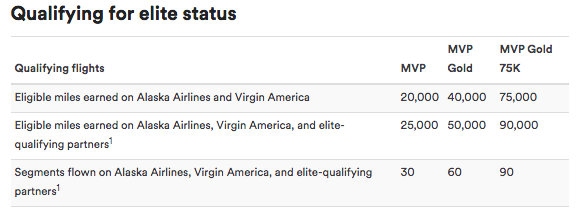

Alaska has great mileage bonuses for their elites, and I think a pretty good network of partners ( with great bonuses on them as well). Alaska’s MVP Gold and MVP75 give an amazing 100% and 125% bonus on miles flown, respectively. Inching closer to qualifying for those status levels through spend, and not having to put my butt in a seat, would be great. Additionally, MVP75 even gives a 50k point bonus when you re-qualify. Those EQMs are mega valuable not just for perks while flying, but for earning tons of bonus miles.

Since Alaska has a different qualifying structure whether the you earn your EQM through Alaska Metal or Partner metal a REALLY cool spend based perk would be stripping that differentiation. Other airlines have credit partners that eliminate the EQD requirement for their status. Instead of this EQD waiver, Alaska could offer status based off of total EQM flown regardless of how they were earned, i.e. – Earn 50k EQM and get MVP Gold, etc.

This is what I’d love to see :

- Spend $25k on an Alaska premium card and earn 5k Bonus EQMs, and so on…

- Spend $25k and the differentiation between Alaska Metal and Partner drops.

- Earn 10% back on redeemed miles

- $195 annual fee.

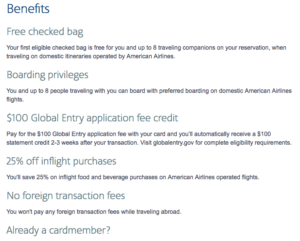

Of course, other benefits like Global Entry fee reimbursement, checked bags, priority boarding, companion certificates would all be nice too, but it’s obtaining and maintaining status that intrigues me the most.

What’s the competition offering?

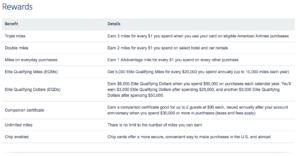

Here’s a look at the Barclay Aviator Silver ( their premium co-brand with AA) and its added benefits. Particularly the EQM

As you can see below, the card earns EQM and EQD off of spend. Alaska has no EQD requirements, but I’d gladly put spend through a credit card (think taxes) to earn very valuable EQM alongside Alaska Miles.

- 5k EQM for each $20k spend, up to 10k EQM

- 10% back up on redeemed points per year, up to 10k a year.

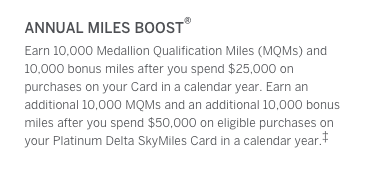

The Delta Platinum Amex gives you the opportunity to earn MQM ( their version of EQM) through spend as well.

- 10k MQM after $25k spend, an additional 10k after another $25k spend.

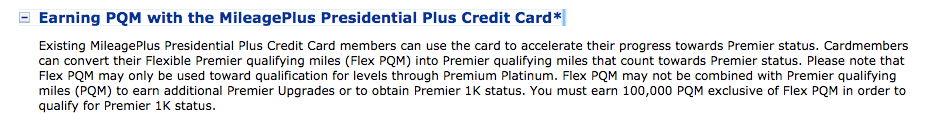

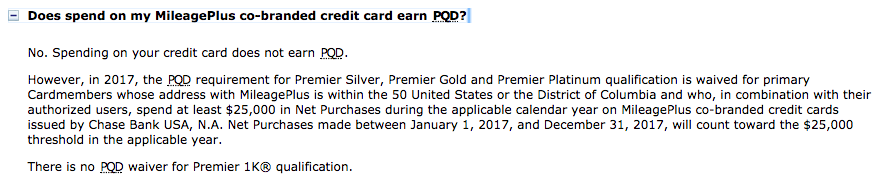

Other than the no longer publicly available United Presidential Plus card – there isn’t a United card that offers PQM. However…you can earn a PQD waiver through spend.

If Alaska were to offer a premium card, would you be interested, and what perks would be most beneficial?

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.