We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Since the lows on March 23rd, the stock market has experienced an astounding run – the SP500 closed yesterday above 3000. But like many of you, I’m also wondering, is it for real? I’m not a financial advisor, but I have some major doubts. Billionaires like Cuban, Icahn, and Tepper have all publicly said the market is overvalued. We listened to Berkshires annual meeting and learned that Buffett sold all his airline positions and is sitting on $150 Billion in cash. He just didn’t see anything worth buying. We know banks have been shoring up loan loss reserves, 14% of Americans have tapped retirement funds, yet the market still keeps going up?

Who exactly is driving the market upward? Well…there is a lot of speculation that it’s the retail investor that is moving the market on low volume and high beta investments. That’s basically you and I, the small investor, making trades of several to a few hundred shares on average. The so called “smart money” or those who are trading on behalf of large institutions or funds have largely remained on the sidelines. This low volume Is contributing to some pretty big swings In the market. So who is making all these trades?

The total market cap to gdp ratio is currently over 143% – a fair priced market is 75-90%. You may have heard about this ratio as the Buffett rule…and it’s currently screaming over valuation.

One place to look to see what the retail investor is up to, is Robinhood. Robinhood is a millenial favorite brokerage house that started the trend of commission free trades. In fact…you don’t even need enough money to buy a whole share, you can buy fractional shares and etfs. There is a website called Robintrack.com and it’s pretty insane to see the number of accounts that are trading names that are arguably zombie companies. For goodness sakes…Hertz declared bankruptcy and it’s trading volume on Robinhood shot up over 25%.

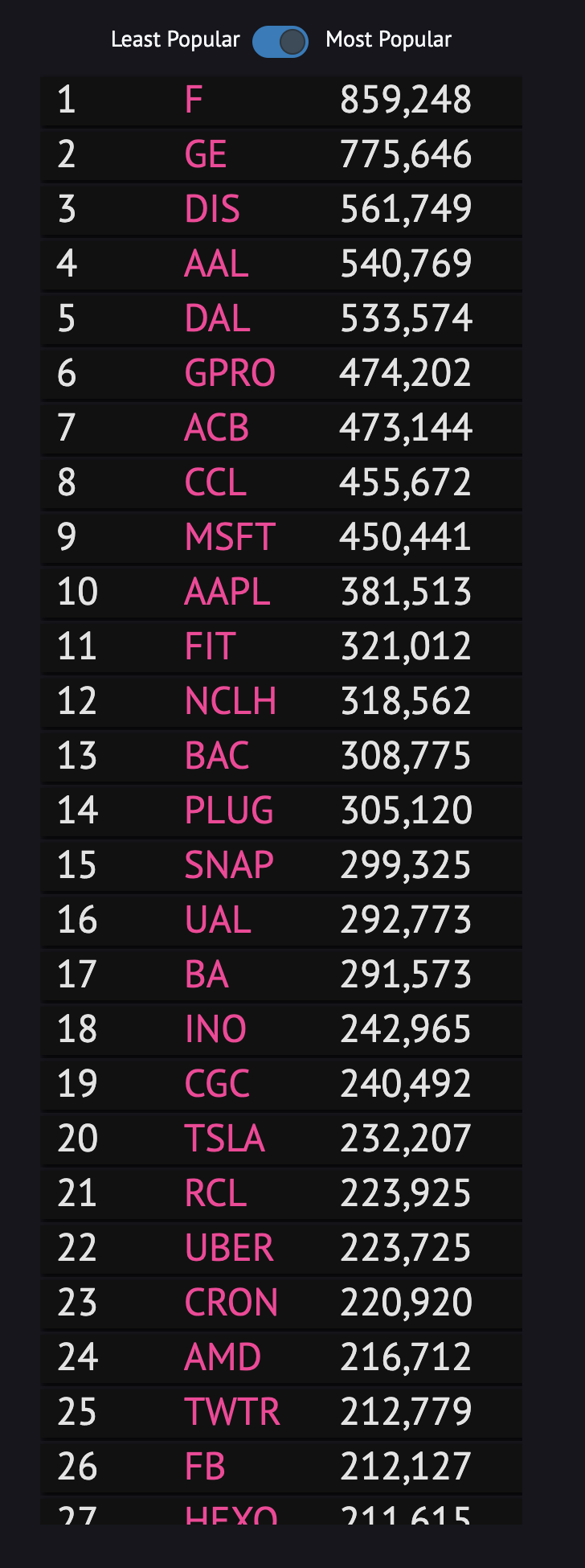

Here is a look at the Robinhood leaderboard

These are the most widely held names of companies Robinhood investors sunk their money into. Out of the top 20… American, Delta, Carnival, Norwegian, United, and Boeing are all listed. These are names that are literally facing existential crises…and perhaps Boeing is the best bet because we know that they won’t be allowed to fail. The others…well, their fate remains to be seen and could be facing insolvency.

Sure, the FED is pumping and liquidity is pushing the market higher, but liquidity doesn’t save a company from bankruptcy. We just witnessed that from Hertz. If you’re unfamiliar, liquidity basically means you don’t have enough cash to pay your bills, but your assets are greater than your liabilities. Insolvency happens when your liabilities are larger than your assets and you can’t even service the debts you owe and are forced to restructure through bankruptcy. This means equity holders could wind up with $0 valuations – that is the risk you bear. It’s why Hertz is looking to potentially liquidate almost 500k cars – it’s selling assets.

The total market cap to gdp ratio is currently over 143% – a fair priced market is 75-90%. You may have heard about this ratio as the Buffett rule…and it’s currently screaming over valuation. To do the math: we’re at roughly 3000 on the sp…90% would put us at 1900.

Does that mean the market is headed down? Who knows, but buyers are paying high premiums in the face of the worst global economic crisis we’ve ever known. And what are those buyers stocking up on?

Let’s look at Robinhood

Hertz declared bankruptcy on the 22nd at $3.07 – 15k accounts have bought in since

Look at the correlation in Robinhood buyers entering the market after bankruptcy was announced and the stock spike that followed. Can we say roulette?

American Airlines – over 500k holding the stock. January? Just 11k

Delta…Over 500k now own and 16k owned in January

Carnival…450k own and in January just 5500

Norwegian Cruise…over 300k and under 1k in January

Royal Caribbean went from 1200 in January to 220k

Compare those numbers to Ford – 340k in January to 800k

Still a big spike, and one that I wouldn’t make, but not nearly as severe.

How about Amazon…120k to 175k

Amazon has gone from low 1600s in March to 2400 now – a 50% gain and arguably one of the best suited companies to flourish in a lockdown. They have roughly a 1/4 the accounts invested as does American and Delta.

Recap

I’m not a financial advisor, but this seems to be some insane risk on plays on the market. I wouldn’t be surprised to see the market continue to melt up, and certainly the FED has made every indication that they will do what they can to help. But one has to wonder, if the underlying economy isn’t V-shaped, and things don’t return back to normal…does the retail investor continue to participate, or rather, walk away from the SP Casino with a pocket full of cash, or a what happens in the market, stays in the market sore spot. Afterall…FOMO is only a thing when what you’re missing out on is positive. Sadly, I have my suspicions that this ends with the retail investor being wiped clean as the smart money cleans up from well timed short positions.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.