This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Earlier today I read an article from VFTW that highlighted an article from Skift that “hints” at Alaska joining the One World Alliance via its connect program. A range of emotions instantly hit me. First, I was excited at the notion of Alaska elites walking in to some of the finest lounges in the world. Then, I immediately hit a wall when I surmised such a partnership would surely devalue their incredible award chart. Finally…I thought – wait, what the heck is One World Connect?

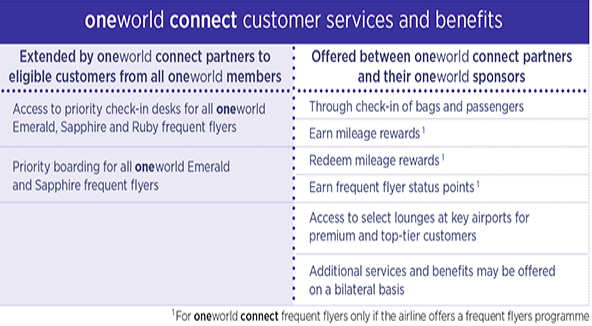

Here’s what it means straight from the horses mouth:

In order to become a One World Connect member, an airline needs to have a minimum of 3 existing One World members sponsor it. The major benefits then exist between the Connect member and its sponsors. There are some universal benefits for One World Elites, but if Cathay Pacific isn’t a sponsor, don’t expect to flash your Alaska MVPG75 membership at The Pier and get in.

Here’s a big quote from One World that describes some mutual benefits like priority boarding, interlining baggage, and lounge access.

What oneworld connect means for customers

oneworld connect partners will provide select alliance benefits to frequent flyers from any oneworld member airline travelling on their flights, with a more extensive range of benefits offered with their oneworld sponsors.

Customers with Emerald, Sapphire or Ruby status in any oneworld member airline’s frequent flyer programme will be able to use priority check-in desks, where available. Also, customers with Emerald or Sapphire status will be offered priority boarding.

The additional benefits offered by oneworld connect partners to customers from their oneworld sponsors and vice versa include:

Through check-in of passengers and their baggage for journeys including connections between a connect carrier and any of its oneworld sponsors.

The ability to earn and redeem frequent flyer rewards, and earn frequent flyer status points, for eligible flights. (For customers from oneworld connect airlines, these benefits depend on the oneworld connect partner offering a frequent flyer programme.

Access to select lounges at key airports for First or Business Class passengers or those with eligible top-tier frequent flyer status.

One World simplifies it a bit further with this chart:

Alaska is already partners with 7 of the One World Alliance Airlines ( bolded )

Alaska Airlines Partners 12/18

- Aer Lingus

- American Airlines

- British Airways

- Cathay Pacific

- Condor

- Emirates

- Fiji Airways

- Finnair

- Hainan Airlines

- Icelandair

- Japan Airlines

- Korean Air

- LATAM Airlines

- PenAir

- Qantas

- Ravn Alaska

- Singapore Airlines

With such a robust One World Partnership already in place, why take the step to join?

If you examine the benefits between sponsor and Alaska it begs the qustion…why are they joining? Many of the benefits discussed are already in place between Alaska and its 7 OW partners.

Simply put…Connecting flights.

If Alaska can sell a BA, JAL, etc flight on their website, they can attach the connecting flight to it and increase load and ease for their loyalists = make more money.

Will Alaska devalue if it joins One World Connect – they shouldn’t.

Let’s be honest, Alaska will devalue at some point, but I’m not sold that joining One World as a connect member triggers the devaluation. Sure, they could time it as such, but my knee jerk reaction that they would, was due to the massive disparity between it and AA when it comes to Cathay and Qantas redemptions. But…it’s highly unlikely that they are going to have AA as a sponsor anyways…and airlines make an absolute boatload of profit on point and mileage sales so why bend towards the status quo.

If Alaska is a Connect member with a highly advantageous chart doesn’t it best serve their bottom line to keep that chart to prompt higher sales?

Gary points out that Alaska will soon start selling partner flights on their website which means more people could utilize the Alaska site for partner fares which puts more eyeballs on their MileagePlan program = higher sales of points = more profit to AS.

Hopefully Alaska learns from the the AA/US Airways merger. AA followed Delta down the revenue based road far too soon and spoiled the relationship it had with many of its loyalists that went out of their way to fly AA because of AAdvantage.

Alaska is in a similar position, albeit smaller, post Virgin America integration. They have a wonderful program with some of the best customer service in America, and members, like myself, who are willing to go out of their way to fly them because of it.

They are looking to expand their ability to service foreign countries and profitability. Hedging that with an admittance into One World as a connect member means keeping a door open to a full fledged membership down the road.

Here’s a list of some of the best redemptions you can make with Alaska miles

Check out Cathay Biz and First to Africa and Australia – unreal deals.

- To Asia

- Cathay Biz is 50k One way

- Cathy First is 70k One way

- Japan Biz to Asia is 60k

- Japan First to Asia is 70k

- Japan Biz to S.E. Asia is 65k

- Japan First to S.E. Asia is 75k

- Europe

- AA Biz is 57.5k

- AA First is 80k

- FinnAir is 70k

- BA Biz is 60k

- BA First is 70k

- Middle East

- BA Biz is 70k

- BA First is 80k

- Cathay Business is 62.5k

- Cathay First is 70k

- Australia – 70k miles to fly First Class from the States to Australia!

- Qantas Biz is 55k

- Qantas First is 70k

- Cathay Biz is 60k

- Cathay First is 80k

- Fiji Biz is 55k

- Africa

- British Airways Biz is 70k

- British Airways First is 80k

- Cathay Biz is 62.5k

- Cathay First is 70k

Alaska has their miles on sale right now. Up to a 50% bonus. That’s less than 2 cents a pop. Best ever.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.