We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

New Members spend $30 get $30

*The biggest caveats here – you must be in the USA or Canada

I’ve written extensively about Rakuten and using how using the Rakuten shopping portal is an easy way to rack up serious amounts of Amex points. I’ve earned over 250k+ Amex Points from Rakuten alone. One of the best ways to earns loads of Rakuten points is to refer your friends and family.

Best ever is spend $40 get $40.

THIS IS USA or CANADA ONLY

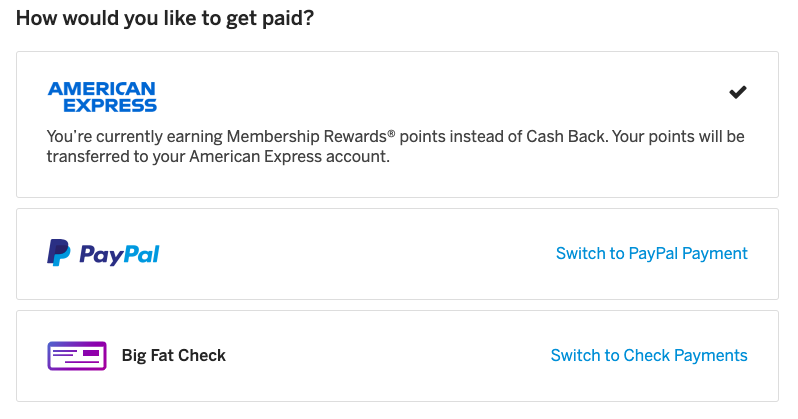

Choosing to earn Membership Rewards vs Cashback.

I would highly recommend you read our guide to using Rakuten, but essentially, Rakuten works like any other shopping portal except it gives you the option to earn your savings in the form of cashback or Amex Points. In my opinion, this is a massive leg up on competition because I value Amex Points at roughly 2 cents, meaning I’m getting double the value by choosing Amex points vs cashback. Now, you should take into consideration I also travel a lot, and I’m quite adept at using Amex points, but at the very minimum Amex points are worth 1.5 cents.

Does Rakuten work like any other portal?

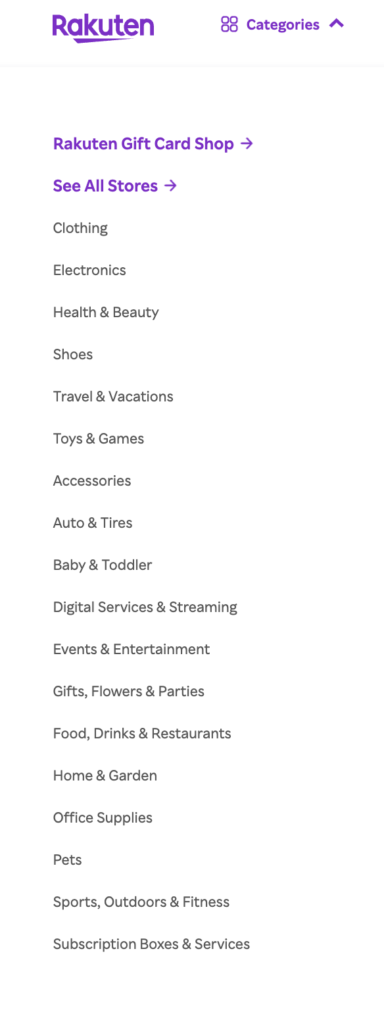

Yep. After you sign up via Rakuten, you’ll be taken to their portal. The portal is filled with various retailers and when you click on one, you will generate a link to your desired merchant, and the rest is all behind the scenes. In fact, I just used Rakuten last week to make some amazing purchases at J. Crew. It looks like my deal of 50% off already reduced prices is now 40%, but I was able to get many items at 70-80% off retail. J Crew’s debt has dropped to junk and who knows what the future holds with retailers being closed for such a long time, but the deals are insane. I got a few t-shirts for $8 a piece. Nuts.

What’s a quick way to take advantage of Rakuten?

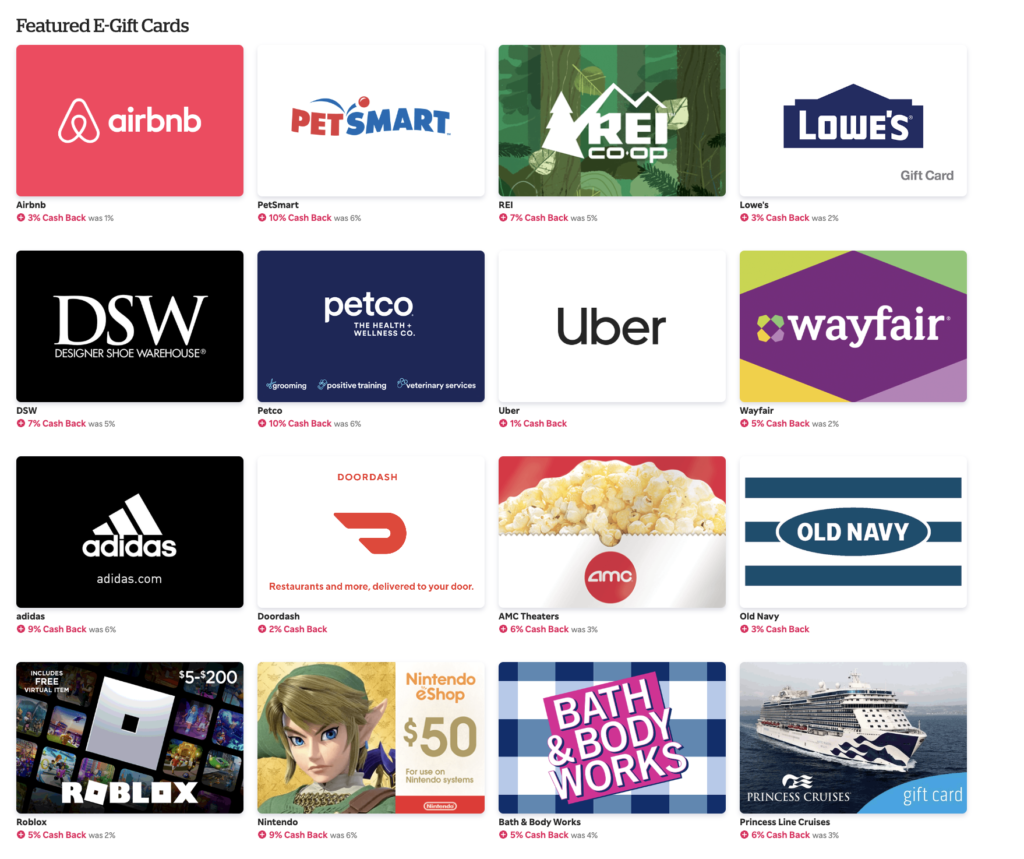

The Rakuten Gift Card shop is a great way to quickly get your points: buy a gift card for $40+ and get your bonus immediately.

Additionally, I think it’s pretty hard to beat stacking a Rakuten referral, or new member bonus with the Amex Platinum Saks 5th Avenue $100 credit statement credit which is split into 2, $50 statement credits, January through June, and July through December.

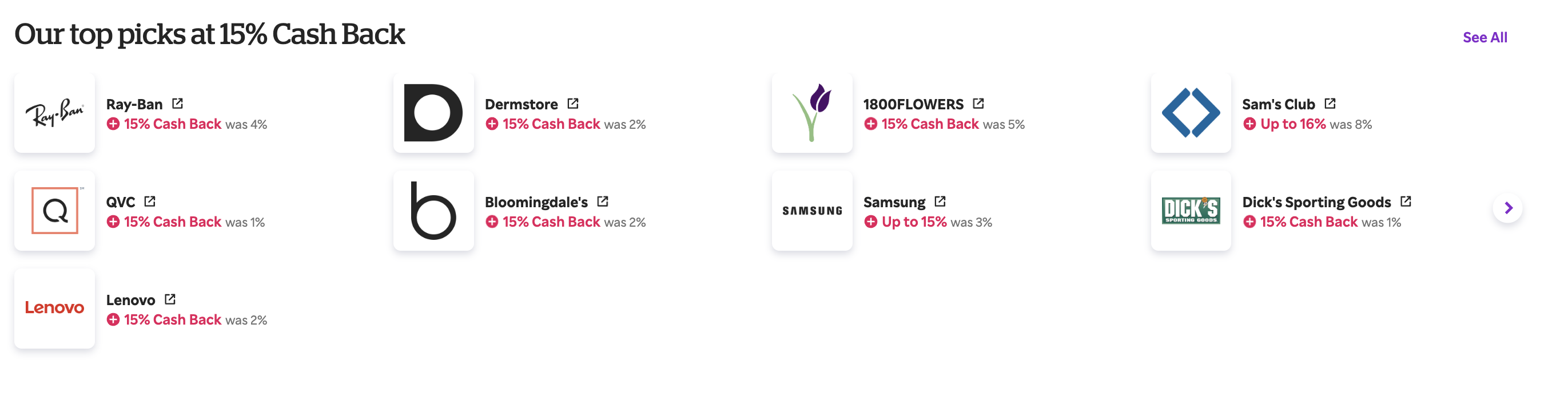

That means if you buy anything with those cards ( don’t forget you can split payment ) you’ll earn those statement credits alongside the Rakuten new member bonus AND you’ll also earn your normal Rakuten cashback. Keep an eye out for promotional weeks where bonuses will crack 15% or 15x.

Leaving Referrals in the comments section

Obviously, we’d love it if you’d use our referral since there is no limit to how many you can earn, but we also like to share the love. Earning points this way is how we are able keep in the air, but it’s also how you can take the trips of your dreams. So leave them below if you’d like.

How we use Referrals…

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.