This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

From August 15th until September 15th, you can save 20c per gallon at Exxon & Mobile…this is double the usual 10c savings that comes with a WalMart+ membership. Remember, a perk of the The Platinum Card® from American Express is a $12.95 monthly credit which offsets the entire WalMart+ membership ( you also get Paramount+ as a perk ). Here’s how it works.

Table of Contents

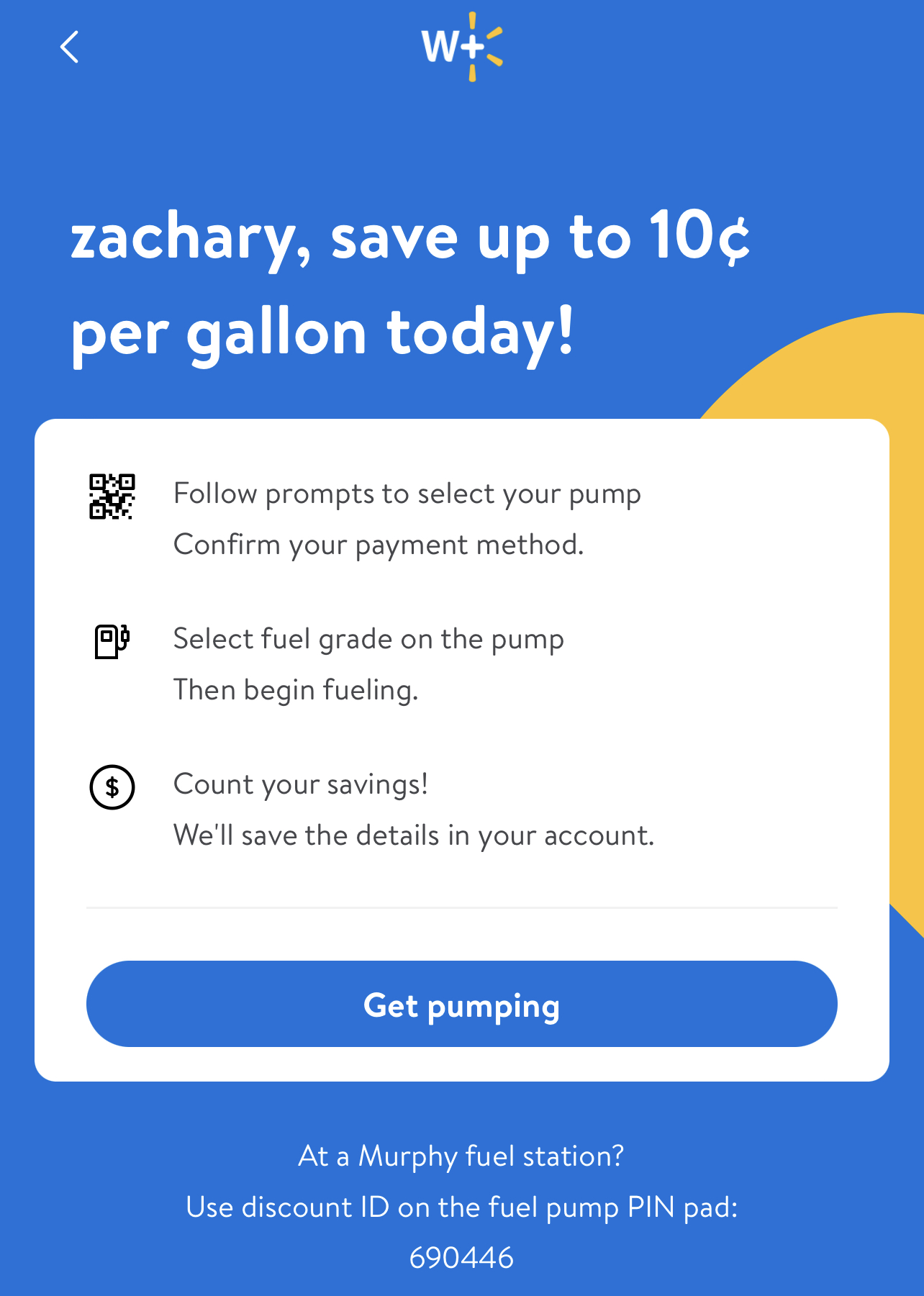

Ordinarily WalMart+ members get 10c off per gallon at:

- Exxon or Mobile gas stations

- WalMart

- Murphy or Murphy Express

- Sam’s Club

Details of 20c savings

- Must use the Walmart app

- Run between 8/15/23 and 9/15/23

- Valid at participating Exxon and Mobile locations

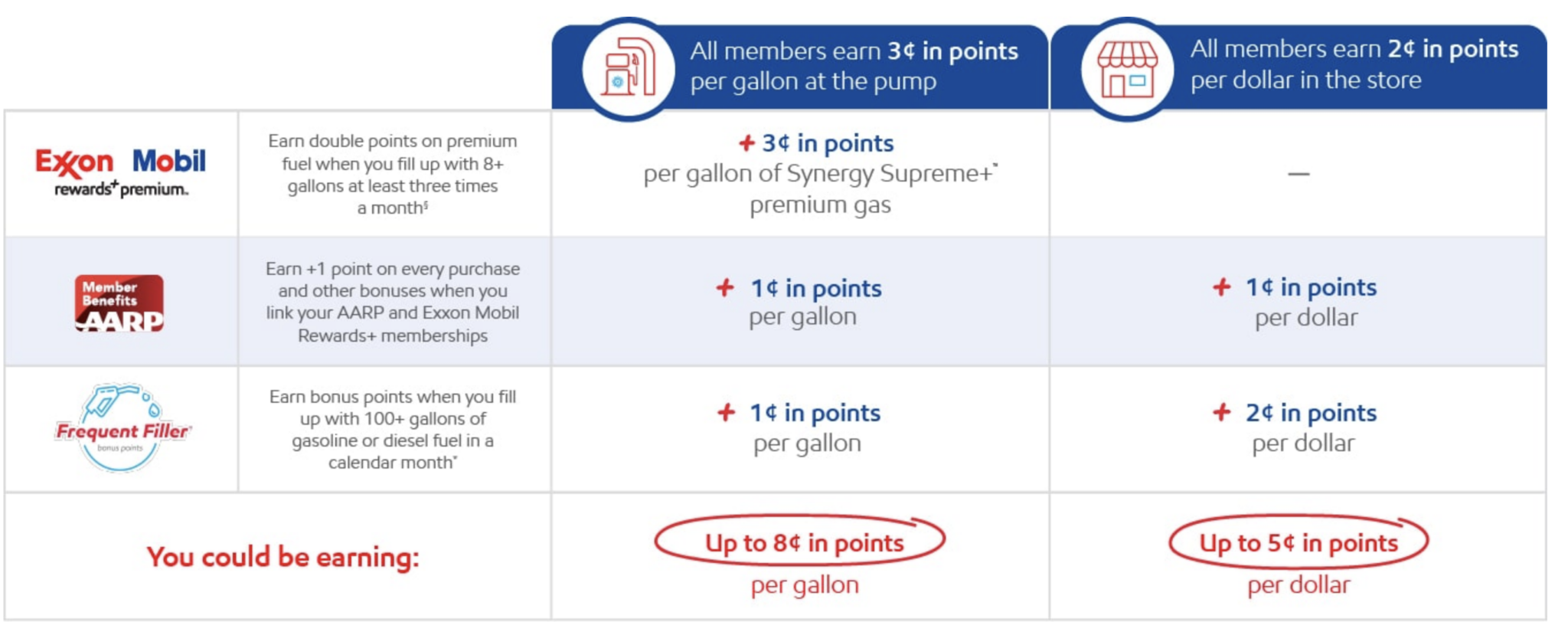

Sign up for Exxon Mobile Fuel Rewards

You can stack this deal, meaning, you can get 20cents savings at the pump, but an additional 2x points on normal fuel and 3x points on premium fuel via the Exxon Mobile Fuel Rewards program…so effectively you’re getting 22 or 23 cents per gallon back, and normally, without this promo, 12 or 13 cents per gallon back.

Don’t forget to link your AARP membership and Exxon Mobile Fuel Pump Rewards

If you’re an AARP member, you can link your accounts to earn an extra point per dollar every time you fill up. Instead of 3points per dollar = 3 cents, you could be earning 4 cents per dollar. So you’d not only get 20 cents per gallon back at the pump, but you’d get earning an extra point per dollar as well. So you could be getting 24 cents per dollar back on premium fuel. This is pretty awesome.

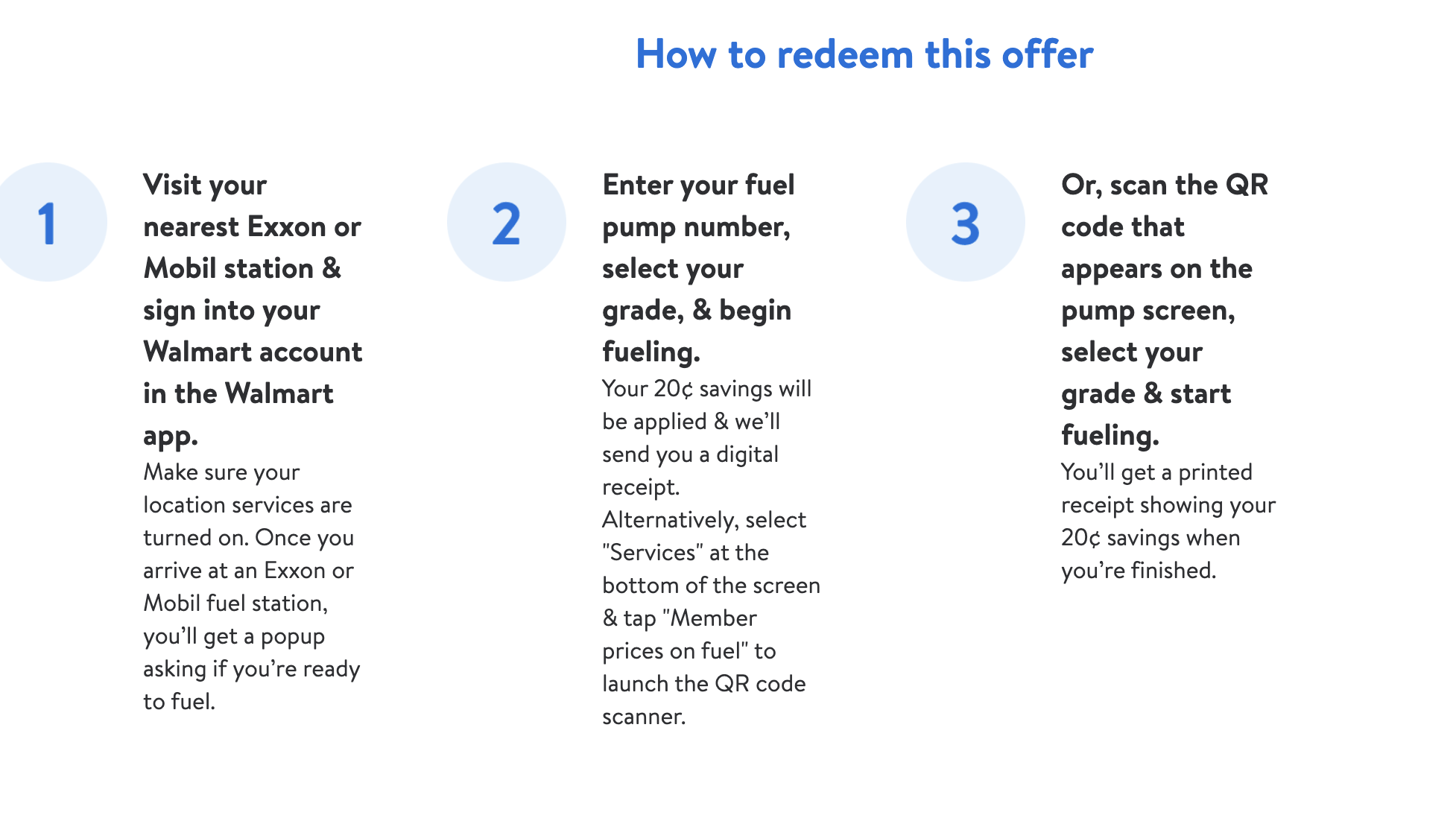

When you get to Exxon/Mobile here’s what you do to get the 20 cents off.

Happy Savings!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.