This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Singapore’s new Suites look next level.

This is truly an extraordinary time to be an avid points and miles collector. Not only are the opportunities to collect points the best they’ve ever been, but the redemption options keep getting better and better. In the past few months we’ve seen both Singapore Airlines, and Emirates, release new first class suites that push the envelope in luxury, design, and space. So how do we use points to fly them? With Emirates, it’s just not an option…yet. But, with Singapore Airlines it’s not a question of “if” you can use points, because you already can, but how many is the real question.

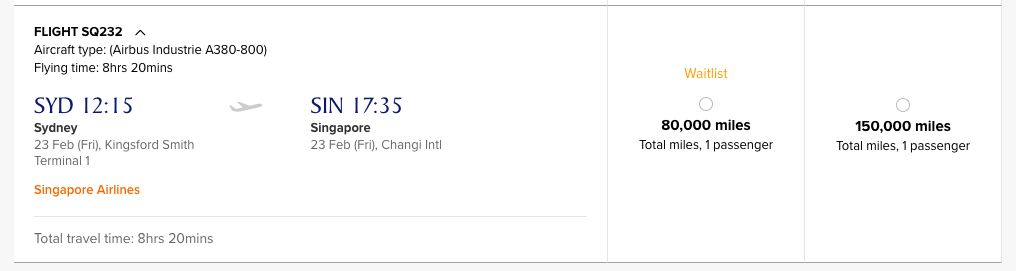

Here you can see it’s available at “standard” level.

I’ve worked with award clients that have several million points and would drop the 150k in a heartbeat if it meant flying in the world’s most luxurious first class. I’m not one of those people…I want it for 80k.

Utilize Singapore’s “waitlist” policy.

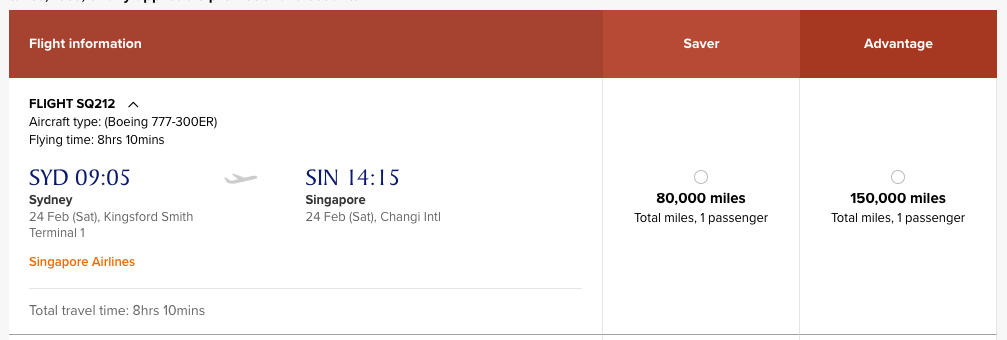

Since you only have to have the miles in the account at the time you “waitlist” a flight, as long as you have 80k Krisflyer miles in your account, you can technically waitlist as many times as you want. Personally, I’m looking at flying from Sydney to Bangkok later in the year, and one very attractive routing would take me via Singapore.

In this situation, I could waitlist myself on SQ232 and hope that I clear into the new Suites, but also flat out book my flight either on the 777-300ER First, or check out the new A380 business class on SQ232.

Book on 77W in First while I waitlist the new Suites:

Or book into the new business class on SQ232 and waitlist on first.

Either way…you’ll be assuring yourself a great ride and giving yourself a shot at clearing the waitlist.

It’s a good sign that these flights are even waitlisted. When Singapore debuted their Suites long ago, they didn’t allow point redemptions for years. Now, at least, if you’re willing drop the “standard” level price you can snag one, but I’d guess once more of these A380s are in service, we will start seeing some Saver level flights become available. Fingers crossed on the waitlist.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.