We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

United’s Billion Mile Giveaway

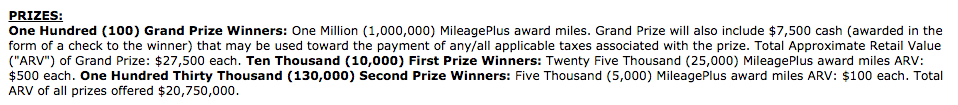

United is giving 100 grand prize winners a 1 MILLION points each. Yes that’s 1 MILLLLLLLLLION points each. Who doesn’t flipping love free Miles?! They are also giving away 10,000 prizes of 25,000 miles and 130,000 prizes of 5,000 miles each. There are a couple ways to enter this giveaway, plus the easiest is if you already have a Chase United credit card. I’ll detail the 2 options below, but I highly encourage to you enter United’s Billion Mile Giveaway.

2 ways to enter

- Spend on your Chase branded United credit card.

- every eligible purchase is an entry. That’s pretty phenom

- Read the official terms and conditions to see what some of the exclusions are

- Enter manually here

Miles and I got a United Mileage Plus Explorer card earlier this year when we were targeted for a 50k sign up and an additonal 5k for an authorized user. Not a bad grab at points, but we missed out on the HUGE 70k target. What’s annoying is that my account was targeted for it, but it was outside of the 90 days to match my sign up bonus to a better offer. Can’t win them all. I’m currently thinking of some creative ways to get multiple entries on this great offer… Remember you have until September 30th to enter in the contest.

*update* United will also give the grand prize winners cash to offset taxes

Reader Gene had some interesting thoughts on that and we had a good exchange in the comments below. Odd that United is valuing points at difference prices depending on the prize won.

- 1,000,000 valued at $27,500 or $0.0275/mile

- 25,000 valued at $500 or $0.02/mile

- 5,000 valued at $100 or $0.02/mile

Even the whole prize of 1 Billion miles is valued at $20,750,000 or $0.02075/mile. Makes me scratch my head as to why the grand prize isn’t valued at $20,000…

What would you do with 1 million Mileage Plus Miles?

I actually loved my experience in Global First last year. But I think I’d definitely spend some big Miles on partners and try out some of the International First Class products…even if they aren’t the best redemption options.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.